Question: Remaining Time: 2 hours, 06 minutes, 00 seconds. Question Completion Status: 2 2 150 160 V AC 12 13 1456 1617090195 QUESTION 20 Bradley has

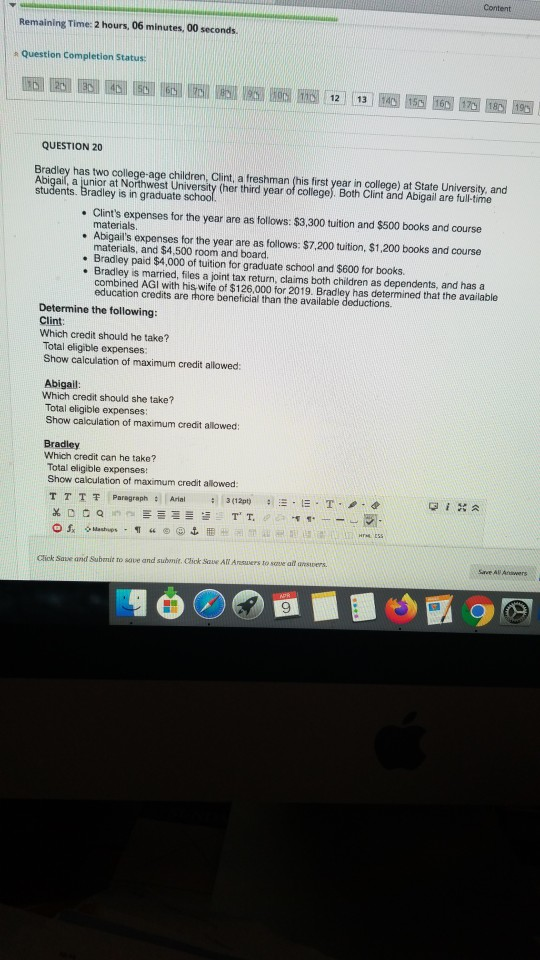

Remaining Time: 2 hours, 06 minutes, 00 seconds. Question Completion Status: 2 2 150 160 V AC 12 13 1456 1617090195 QUESTION 20 Bradley has two college-age children, Clint, a freshman (his first year in college) at State University, and Abigail, a junior at Northwest University (her third year of college). Both Clint and Abigail are full-time students. Bradley is in graduate school. Clint's expenses for the year are as follows: $3,300 tuition and $500 books and course materials. Abigail's expenses for the year are as follows: $7.200 tuition, $1,200 books and course materials, and $4,500 room and board Bradley paid $4,000 of tuition for graduate school and $600 for books. Bradley is married, files a joint tax return, claims both children as dependents, and has a combined AGI with his wife of $126,000 for 2019. Bradley has determined that the available education credits are thore beneficial than the available deductions. Determine the following: Clint Which credit should he take? Total eligible expenses: Show calculation of maximum credit allowed: Abigail: Which credit should she take? Total eligible expenses: Show calculation of maximum credit allowed: Bradley Which credit can he take? Total eligible expenses: Show calculation of maximum credit allowed TTTT Paragraph + Arial : 3 (121) %DOQE T T . OS - 14 @ E- . T- - - wes Click Save and Submit to save and stonit. Chick Save All Ars to some all unsters. Save AV Awers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts