Question: Remaining Time: 2 hours, 06 minutes, 05 seconds. Question Completion Status: QUESTION 16 Charles wants to relocate to Florida. He decided to sell his rental

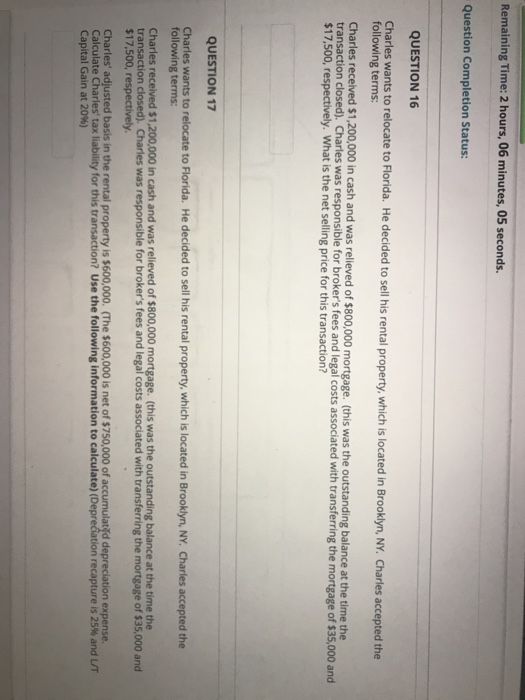

Remaining Time: 2 hours, 06 minutes, 05 seconds. Question Completion Status: QUESTION 16 Charles wants to relocate to Florida. He decided to sell his rental property, which is located in Brooklyn, NY. Charles accepted the following terms: Charles received $1,200,000 in cash and was relieved of $800,000 mortgage (this was the outstanding balance at the time the transaction closed). Charles was responsible for broker's fees and legal costs associated with transferring the mortgage of $35,000 and $17,500, respectively. What is the net selling price for this transaction? QUESTION 17 Charles wants to relocate to Florida. He decided to sell his rental property, which is located in Brooklyn, NY. Charles accepted the following terms: Charles received 51,200,000 in cash and was relieved of $800,000 mortgage (this was the outstanding balance at the time the transaction closed). Charles was responsible for broker's fees and legal costs associated with transferring the mortgage of $35,000 and $17.500, respectively. Charles' adjusted basis in the rental property is $600,000. (The $600,000 is net of $750,000 of accumulatid depreciation expense. Calculate Charles tax liability for this transaction? Use the following information to calculate) (Depreciation recapture is 25% and Capital Gain at 20%) Remaining Time: 2 hours, 06 minutes, 05 seconds. Question Completion Status: QUESTION 16 Charles wants to relocate to Florida. He decided to sell his rental property, which is located in Brooklyn, NY. Charles accepted the following terms: Charles received $1,200,000 in cash and was relieved of $800,000 mortgage (this was the outstanding balance at the time the transaction closed). Charles was responsible for broker's fees and legal costs associated with transferring the mortgage of $35,000 and $17,500, respectively. What is the net selling price for this transaction? QUESTION 17 Charles wants to relocate to Florida. He decided to sell his rental property, which is located in Brooklyn, NY. Charles accepted the following terms: Charles received 51,200,000 in cash and was relieved of $800,000 mortgage (this was the outstanding balance at the time the transaction closed). Charles was responsible for broker's fees and legal costs associated with transferring the mortgage of $35,000 and $17.500, respectively. Charles' adjusted basis in the rental property is $600,000. (The $600,000 is net of $750,000 of accumulatid depreciation expense. Calculate Charles tax liability for this transaction? Use the following information to calculate) (Depreciation recapture is 25% and Capital Gain at 20%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts