Question: Remaining Time: 2 hours, 14 minutes, 41 seconds. Question Completion Status: You are employed by CGT, a Fortune 500 firm that is a major producer

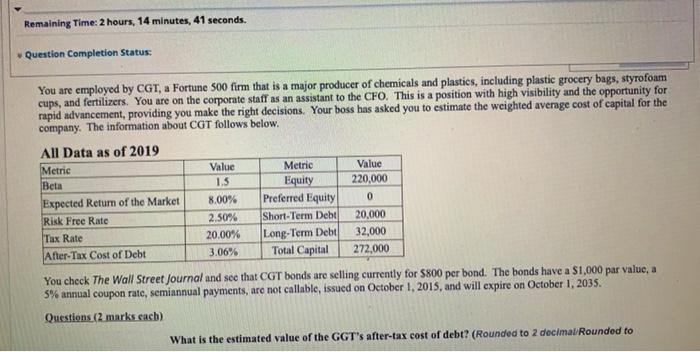

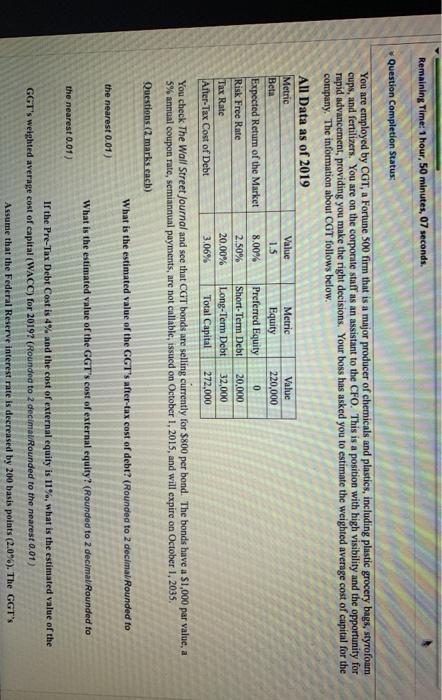

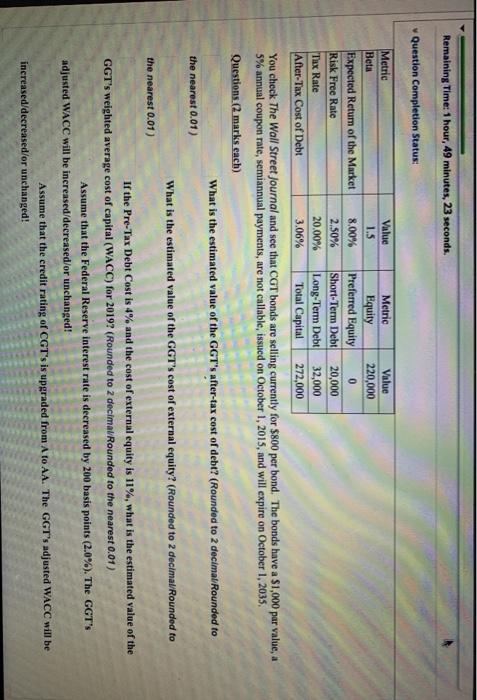

Remaining Time: 2 hours, 14 minutes, 41 seconds. Question Completion Status: You are employed by CGT, a Fortune 500 firm that is a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers. You are on the corporate staff as an assistant to the CFO. This is a position with high visibility and the opportunity for rapid advancement, providing you make the right decisions. Your boss has asked you to estimate the weighted average cost of capital for the company. The information about CGT follows below. All Data as of 2019 Metric Value Metric Value Beta 1.5 Equity 220,000 Expected Return of the Market 8.00% Preferred Equity 0 Risk Free Rate 2.50% Short-Term Debt 20.000 Tax Rate 20.00% Long-Term Debt 32,000 After-Tax Cost of Debt 3.06% Total Capital 272.000 You check The Wall Street Journal and see that CGT bonds are selling currently for $800 per bond. The bonds have a $1,000 par value, a 5% annual coupon rate, semiannual payments, are not callable, issued on October 1, 2015, and will expire on October 1, 2035. Questions. (2 marks each) What is the estimated value of the GGT's after-tax cost of debt? (Rounded to 2 decimal Rounded to Remaining Time: 1 hour, 50 minutes, 07 seconds. Question Completion Status 0 You are employed by COT, a Fortune 500 firm that is a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers. You are on the corporate staff as an assistant to the CFO. This is a position with high visibility and the opportunity for rapid advancement , providing you make the right decisions. Your boss has asked you to estimate the weighted average cost of capital for the company. The information about CGT follows below. All Data as of 2019 Metric Value Metric Value Beta 1.5 Equity 220,000 Expected Return of the Market 8.00% Preferred Equity Risk Free Rate 2.50% Short-Term Debt 20.000 Tax Rate 20.00% Long-Term Debt 32,000 After-Tax Cost of Debt 3.06% Total Capital 272.000 You check The Wall Street Journal and see that CGT bonds are selling currently for $800 per bond. The bonds have a $1,000 par value, a 5% annual coupon rate, semiannual payments are not callable, issued on October 1, 2015, and will expire on October 1, 2035, Questions (2 marks each) What is the estimated value of the GGT's after-tax cost of debt? (Rounded to 2 decimal Rounded to the nearest 0.01) What is the estimated value of the GGT's cost of external equity? (Rounded to 2 decimal Rounded to the nearest 0.01) If the Pre-Tax Debt Cost is 4% and the cost of external equity is 11%, what is the estimated value of the GGT's weighted average cost of capital (WACC) for 2019? (Roundea to 2 decimal Rounded to the nearest 0.01) Assume that the Federal Reserve interest rate is decreased by 200 basis points (2.096). The GGT's Remaining Time: 1 hour, 49 minutes, 23 seconds. Question Completion Status: Metric Value Metric Value Beta 1.5 Equity 220,000 Expected Return of the Market 8.00% Preferred Equity 0 Risk Free Rate 2.50% Short-Term Debt 20,000 Tax Rate 20.00% Long-Term Debt 32,000 After-Tax Cost of Debt 3.06% Total Capital 272,000 You check The Wall Street Journal and see that CGT bonds are selling currently for $800 per bond. The bonds have a $1,000 par value, a 5% annual coupon rate, semiannual payments, are not callable, issued on October 1, 2015, and will expire on October 1, 2035, Questions (2 marks each) What is the estimated value of the GGT's after-tax cost of debt? (Rounded to 2 decimal Rounded to the nearest 0.01) What is the estimated value of the GGT's cost of external equity? (Rounded to 2 decimal Rounded to the nearest 0.01) If the Pre-Tax Debt Cost is 4% and the cost of external equity is 11%, what is the estimated value of the GGT's weighted average cost of capital (WACC) for 2019? (Rounded to 2 decimav Rounded to the nearest 0.01) Assume that the Federal Reserve interest rate is decreased by 200 basis points (2.0%). The GGT'S adjusted WACC will be increased/decreased/or unchanged! Assume that the credit rating of CGT's is upgraded from A to AA. The GGT's adjusted WACC will be increased/decreased/or unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts