Question: Remaining Time: 2 hours, 23 minutes, 16 seconds. Question Completion Status: 10 11 12 13 14 15 16 17 18 19 20 21 22 QUESTION

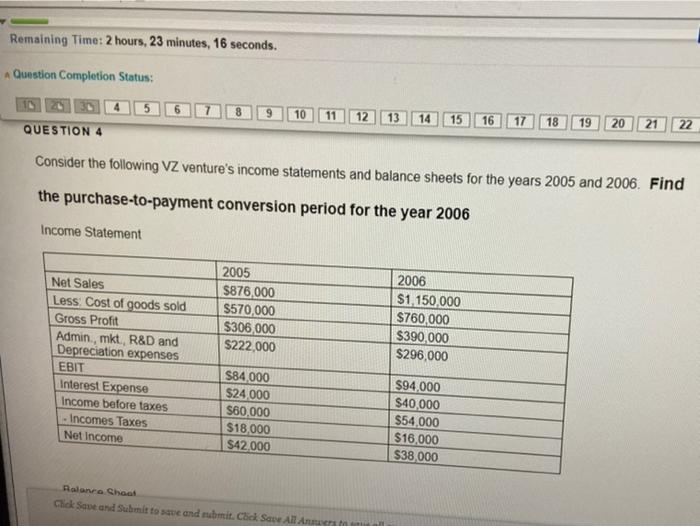

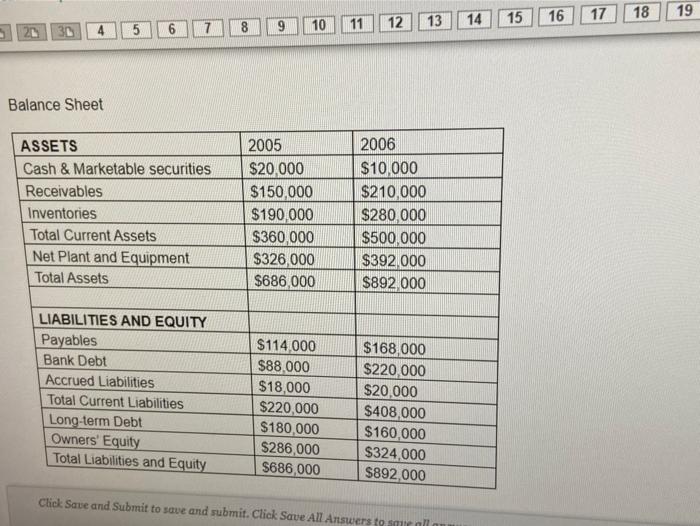

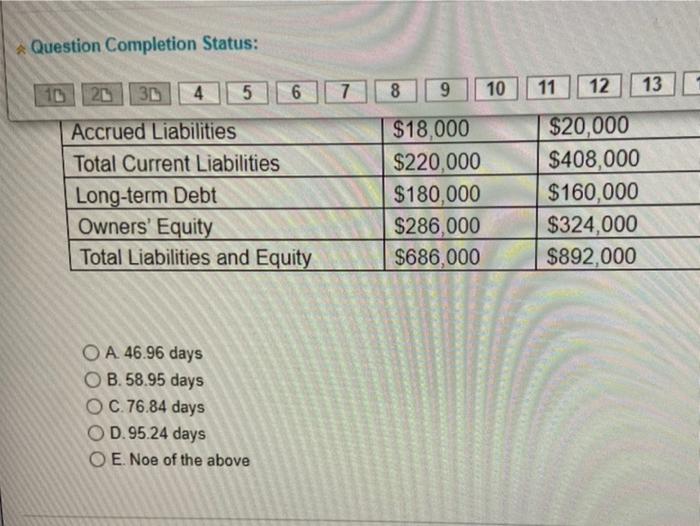

Remaining Time: 2 hours, 23 minutes, 16 seconds. Question Completion Status: 10 11 12 13 14 15 16 17 18 19 20 21 22 QUESTION 4 Consider the following VZ venture's income statements and balance sheets for the years 2005 and 2006. Find the purchase-to-payment conversion period for the year 2006 Income Statement 2005 $876,000 $570,000 $306 000 $222,000 Net Sales Less Cost of goods sold Gross Profit Admin., mkt., R&D and Depreciation expenses EBIT Interest Expense Income before taxes Incomes Taxes Net Income 2006 $1,150,000 $760,000 $390,000 $296,000 $84,000 $24.000 $60.000 $18.000 $42.000 $94.000 $40,000 $54,000 $16,000 $38.000 Balance Choo Click Save and Submit to save and mubmit Chick Save All Antall 19 16 17 18 15 12 13 14 11 8 4 5 10 6 Balance Sheet ASSETS Cash & Marketable securities Receivables Inventories Total Current Assets Net Plant and Equipment Total Assets 2005 $20,000 $150,000 $190,000 $360,000 $326,000 $686,000 2006 $10,000 $210,000 $280,000 $500,000 $392,000 $892.000 LIABILITIES AND EQUITY Payables Bank Debt Accrued Liabilities Total Current Liabilities Long-term Debt Owners' Equity Total Liabilities and Equity $114.000 $88.000 $18,000 $220,000 $180,000 $286,000 $686,000 $168,000 $220,000 $20,000 $408,000 $160,000 $324,000 $892,000 Click Save and Submit to save and submit. Click Save All Answers to sur all Question Completion Status: 7 8 9 10 11 12 13 10 20 3D 4 5 6 Accrued Liabilities Total Current Liabilities Long-term Debt Owners' Equity Total Liabilities and Equity $18,000 $220,000 $180,000 $286,000 $686,000 $20,000 $408,000 $160,000 $324,000 $892,000 O A 46.96 days OB.58.95 days O C.76.84 days OD.95.24 days O E. Noe of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts