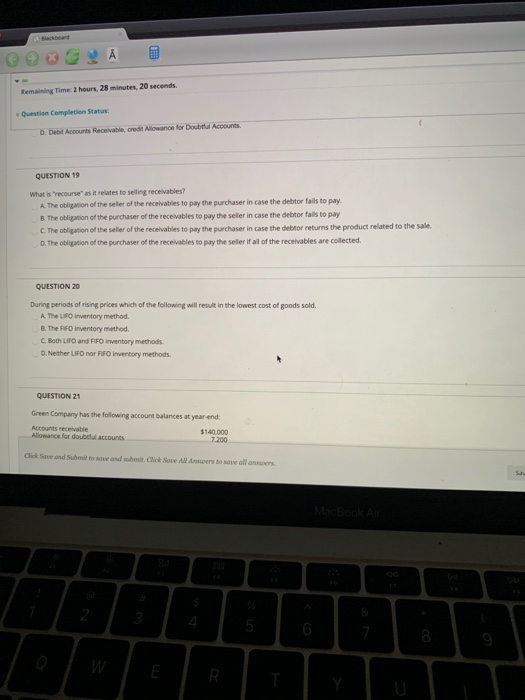

Question: Remaining Time: 2 hours, 28 minutes, 20 seconds. Question Completion Status: D. Debit Accounts Receivable, credit Allowance for Double Accounts QUESTION 19 What is recourse

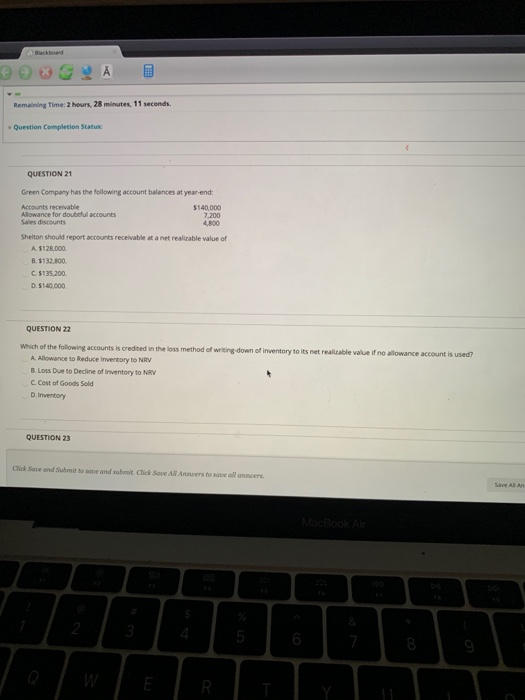

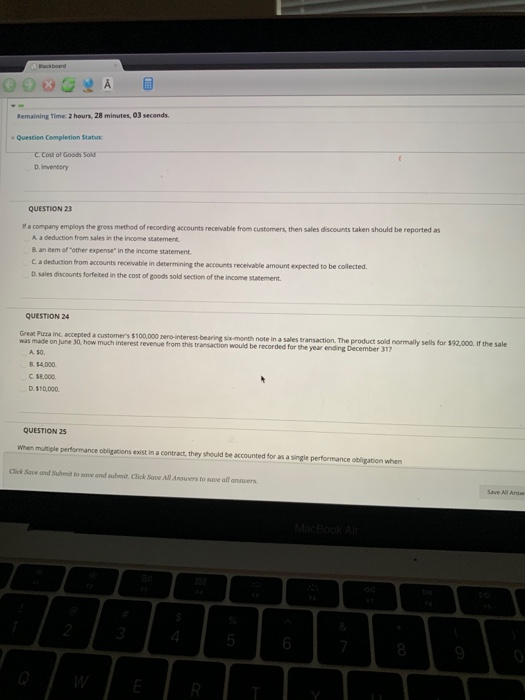

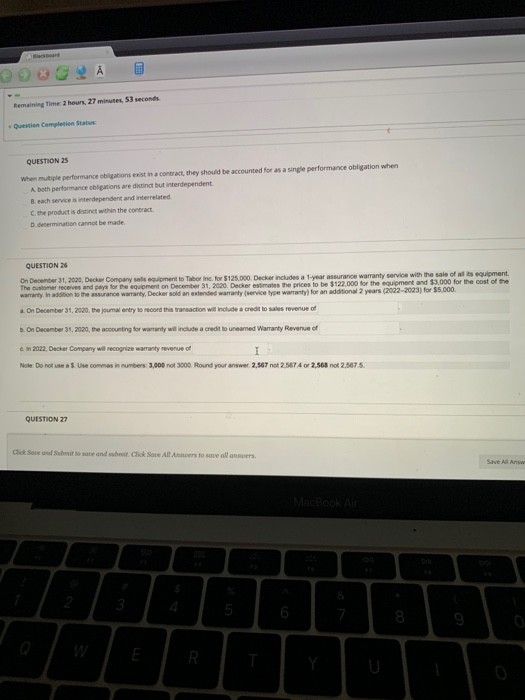

Remaining Time: 2 hours, 28 minutes, 20 seconds. Question Completion Status: D. Debit Accounts Receivable, credit Allowance for Double Accounts QUESTION 19 What is recourse" as it relates to seling receivables? A The obligation of the seler of the receivables to pay the purchaser in case the debtor fails to pay. B. The obligation of the purchaser of the recevables to pay the seller in case the debtor fails to pay C. The obligation of the seller of the receivables to pay the purchaser in case the debtor returns the product related to the sale D. The obligation of the purchaser of the receivables to pay the seller if all of the receivables are collected QUESTION 20 During periods of rising prices which of the following will result in the lowest cost of goods sold A. The UFO Inventory method. B. The FIFO inventory method C. Both UFO and FIFO inventory methods D. Neither LIFO nor FIFO inventory methods. QUESTION 21 Green Company has the following account balances at year-end: Accounts receivable $140.000 Allowance for doubt accounts 7.200 Click Save and submit to sow and bit. Click Savellers to see all 2 3 5 7 8 9 R Bahad BED Remaining Time: 2 hours, 28 minutes, 11 seconds. Question Completion Status: QUESTION 21 Green Company has the following account balances at year-end: Accounts receivable $140,000 Allowance for doublul accounts 7,200 Sales discounts 4,800 Shelton should report accounts receivable at a net realizable value of A $128.000 R$132.800 C. 5135,200 D. $140,000 QUESTION 22 Which of the following accounts is credited in the loss method of writing down of inventory to its net realizable value if no allowance account is used? A. Allowance to Reduce Inventory to NRV B. Loss Due to Decline of Inventory to NRV Cost of Goods Sold D. Inventory QUESTION 23 Chick Save and submit to me and sub Chick Save All Antall ans Save AB 3 4 6 8 R Mackboard Remaining Time: 2 hours, 28 minutes, 03 seconds. Question Completion Status Cost of Good Sold D. Inventory QUESTION 23 a company employs the gross method of recording accounts receivable from customers, then sales discounts taken should be reported as A a deduction from sales in the income statement. B. an item of other expense" in the income statement Ca deduction from accounts receivable in determining the accounts receivable amount expected to be collected D. sales discounts forfebed in the cost of goods sold section of the income statement QUESTION 24 Great Pura Inc. accepted a customer's $100,000 ero interest bearing six-month note in a sales transaction. The product sold normally sells for $92,000. If the sale was made on June 30, how much interest revenue from this transaction would be recorded for the year ending December 317 A. 50 B. 54,000 C 58,000 D. 110,000 QUESTION 25 When multiple performance obligations exist in a contract, they should be accounted for as a single performance obligation when Click Save and to sow and submit. Click Save All Stallones Save Allan 3 6 Remaining Time 2 hours, 27 minutes, 53 seconds Question Completion Status QUESTION 2 When mutiple performance obligations exist in a contract, they should be accounted for as a single performance obligation when A both performance obligations are distinct but interdependent Beach service is interdependent and interrelated the product is distinct within the contract. Determination cannot be made. QUESTION 26 On December 31, 2020, Ducher Company els equipment to Toborine.for $125.000. Decker includes a 1-year assurance warranty service with the sale of all equipment The customer receives and pay for the equipment on December 31, 2020. Decker estimates the prices to be $122.000 for the equipment and $3,000 for the cost of the warranty. In addition to the assurance warranty, Deckersold an extended warranty service type warranty for an additional 2 years (2002-2023) for $5.000 On December 31, 2020, the journal entry to record this transaction will include a credit to sales revenue of D.On December 31, 2000, the counting for warranty will include a credit to uneared Warranty Revenue of in 2022, Decker Company will recognize warranty revenue of 1 Note: Do not use a 5. Use commas in numbers: 3,000 not3000. Round your answer. 2.567 not 2.5674 or 2.568 not 2,567.5. QUESTION 27 Click Save and Sub to save and what click Save All Acto se alla Save All An MacBook Air 4 5 6 7 8. R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts