Question: Remaining Time: 2 hours, 53 minutes, 40 seconds. Question Completion Status: QUESTION 2 4 points Save Ansy Publishing Firm P/E Pricel Enterprise Book Value/ Sales

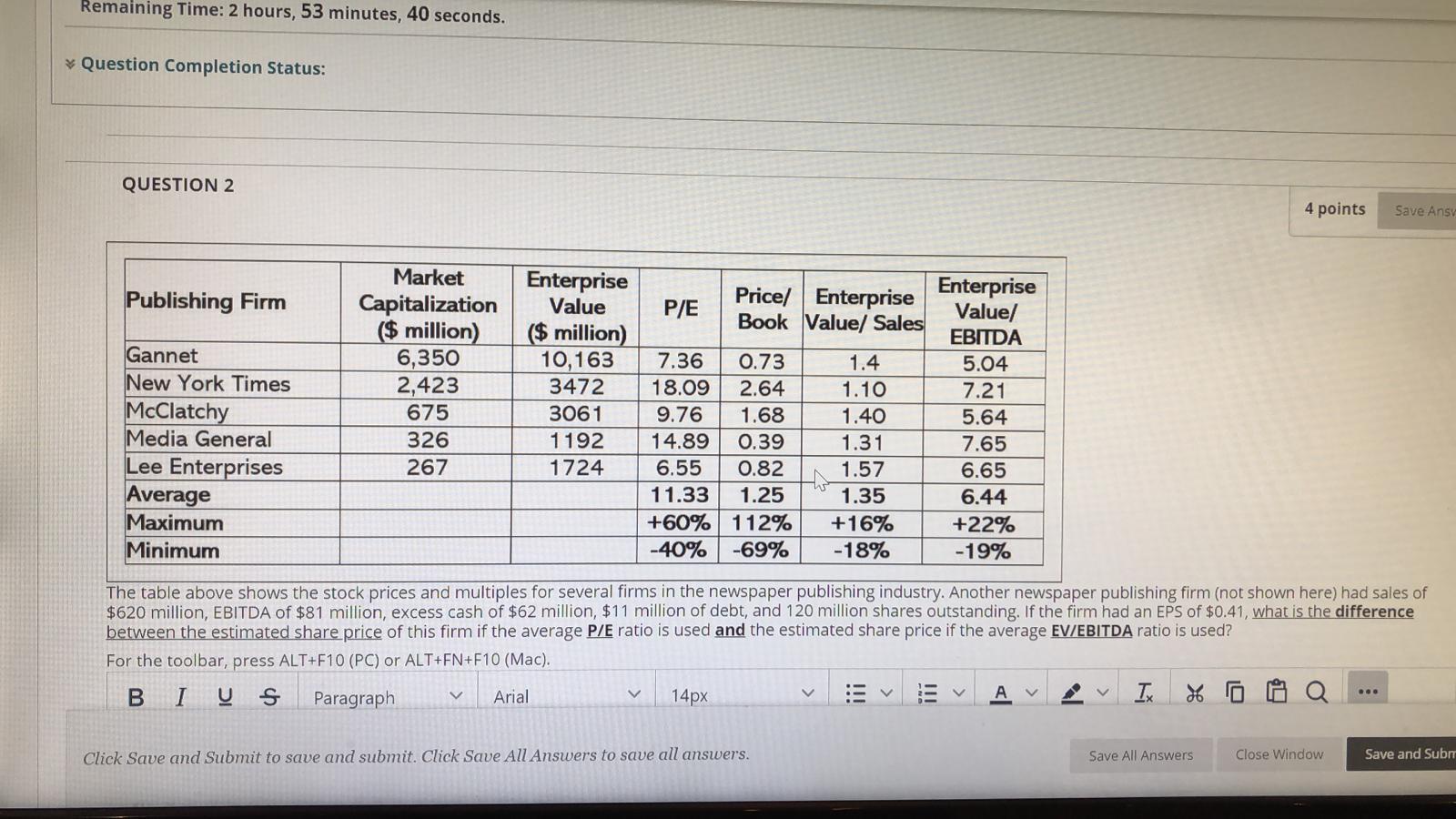

Remaining Time: 2 hours, 53 minutes, 40 seconds. Question Completion Status: QUESTION 2 4 points Save Ansy Publishing Firm P/E Pricel Enterprise Book Value/ Sales Enterprise Value ($ million) 10,163 3472 3061 1192 Market Capitalization ($ million) 6,350 2,423 675 326 267 Enterprise Value/ EBITDA 5.04 7.21 5.64 1.4 1.10 1.40 1.31 Gannet New York Times McClatchy Media General Lee Enterprises Average Maximum Minimum 7.65 7.36 0.73 18.09 2.64 9.76 1.68 14.89 0.39 6.55 0.82 11.33 1.25 +60% 112% -40% -69% 1724 1.57 to 1.35 +16% -18% 6.65 6.44 +22% -19% The table above shows the stock prices and multiples for several firms in the newspaper publishing industry. Another newspaper publishing firm (not shown here) had sales of $620 million, EBITDA of $81 million, excess cash of $62 million, $11 million of debt, and 120 million shares outstanding. If the firm had an EPS of $0.41, what is the difference between the estimated share price of this firm if the average P/E ratio is used and the estimated share price if the average EV/EBITDA ratio is used? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px : Ix 46 V V A V .. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save and Sub

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts