Question: Remaining Time: 20 minutes, 51 seconds. * Question Completion Status: Moving to the next question prevents changes to this answer. Question 18 of 25 >

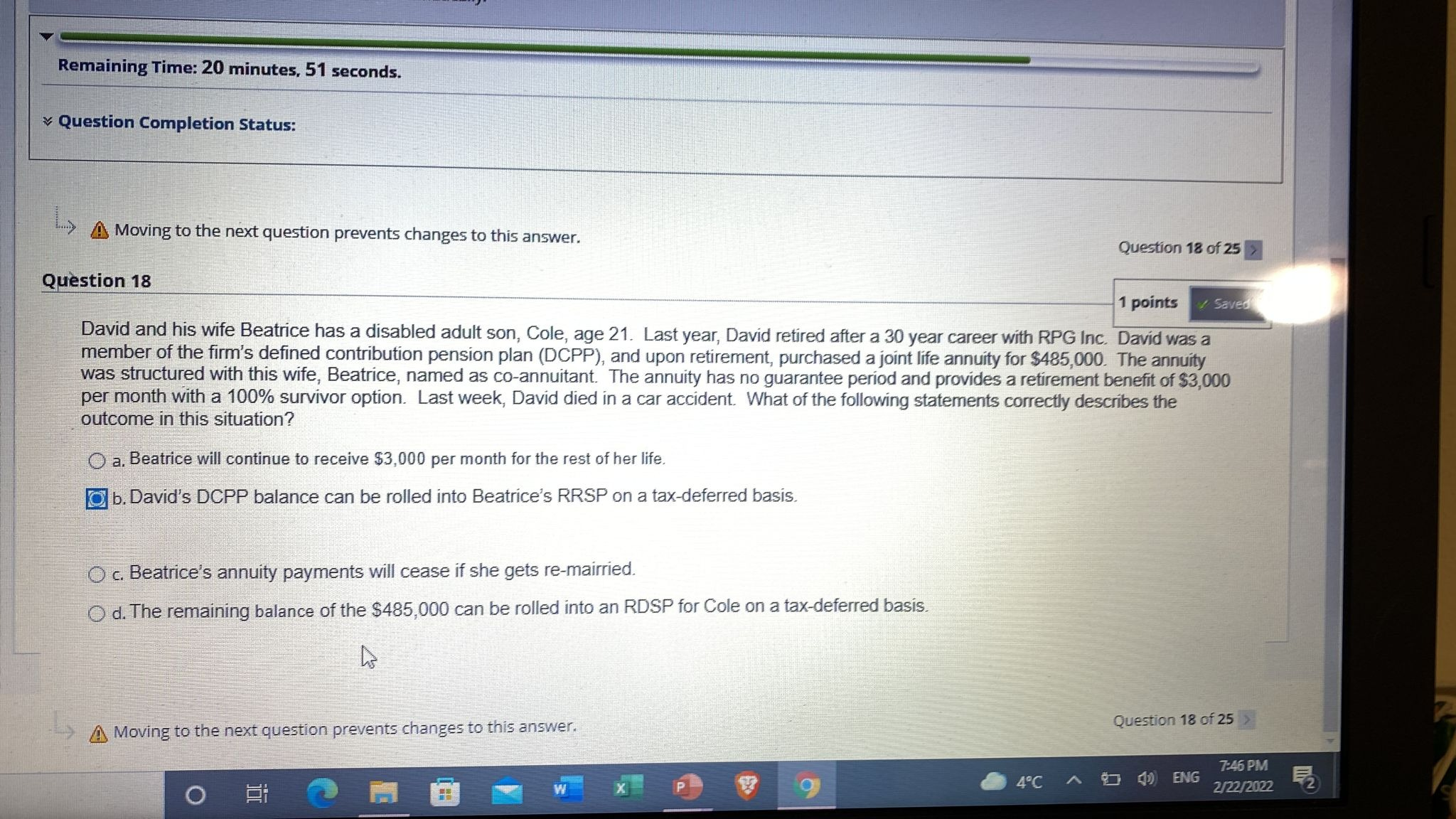

Remaining Time: 20 minutes, 51 seconds. * Question Completion Status: Moving to the next question prevents changes to this answer. Question 18 of 25 > Question 18 1 points Saved David and his wife Beatrice has a disabled adult son, Cole, age 21. Last year, David retired after a 30 year career with RPG Inc. David was a member of the firm's defined contribution pension plan (DCPP), and upon retirement, purchased a joint life annuity for $485,000. The annuity was structured with this wife, Beatrice, named as co-annuitant. The annuity has no guarantee period and provides a retirement benefit of $3,000 per month with a 100% survivor option. Last week, David died in a car accident. What of the following statements correctly describes the outcome in this situation? O a. Beatrice will continue to receive $3,000 per month for the rest of her life. b. David's DCPP balance can be rolled into Beatrice's RRSP on a tax-deferred basis. O c. Beatrice's annuity payments will cease if she gets re-mairried. O d. The remaining balance of the $485,000 can be rolled into an RDSP for Cole on a tax-deferred basis. A Moving to the next question prevents changes to this answer. Question 18 of 25 > 7:46 PM O Eli M 9 4.C A ( ENG 2/22/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts