Question: Remaining Time: 39 minutes, 49 seconds. Question Completion Status: 4 5 MARS Moving to another question will save this response Question 4 of 24 Question

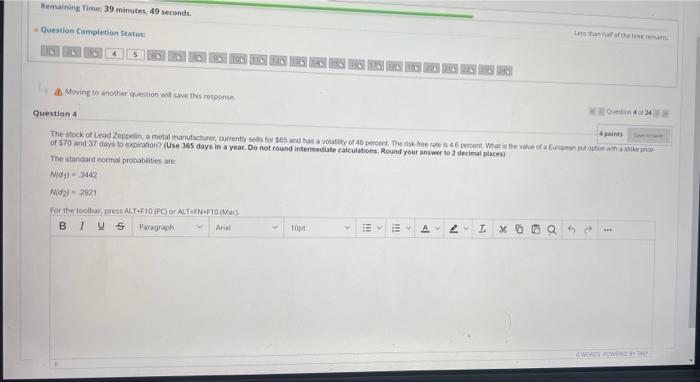

Remaining Time: 39 minutes, 49 seconds. Question Completion Status: 4 5 MARS Moving to another question will save this response Question 4 of 24 Question 4 4 points Seve The stock of Lead Zeppelin, a metal manufacturer, currently sells for $65 and has a volatility of 46 percent. The risk-hee rate is 46 percent What is the value of a European put option with a siker p of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places) The standard normal probabilities are: Nid) 3442 Nid) 2921 For the toolbar, press ALT+F10 (PC) or ALT-FN-F10 (Mac) A 52 V E- 10pt 21 x 0 Arial V BIVS Paragraph WORDS W 4 0 o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts