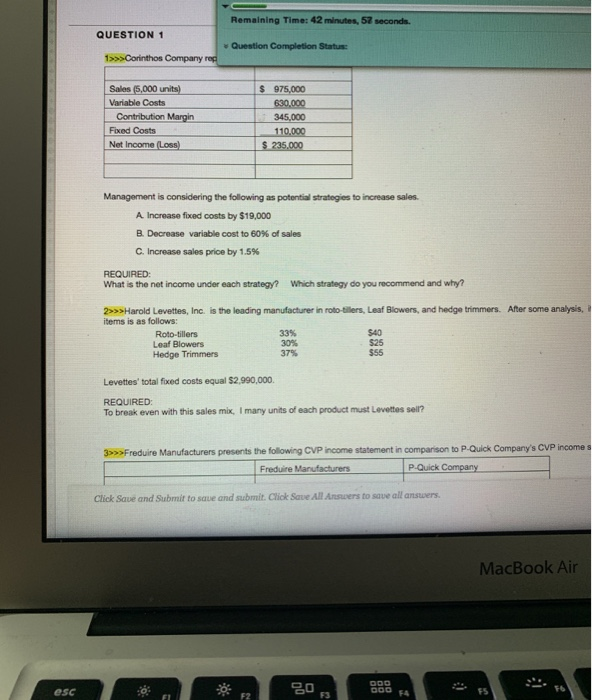

Question: Remaining Time: 42 minutes, 52 seconds. QUESTION 1 Question Completion Status: 1>Corinthos Company rep S 975.000 Sales (5.000 units) 630,000 Variable Costs Contribution Margin 345,000

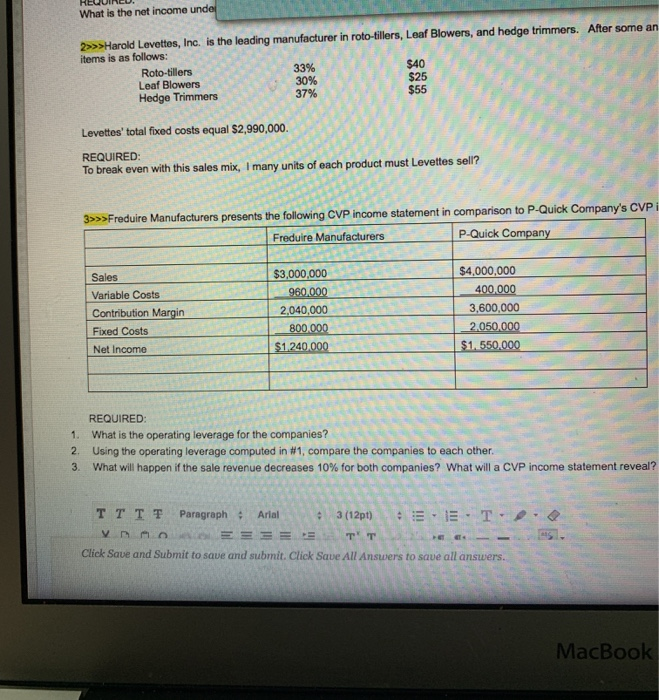

Remaining Time: 42 minutes, 52 seconds. QUESTION 1 Question Completion Status: 1>Corinthos Company rep S 975.000 Sales (5.000 units) 630,000 Variable Costs Contribution Margin 345,000 Fixed Costs 110,000 $ 235,000 Net Income (Loss) Management is considering the following as potential strategies to increase sales. A Increase fixed costs by $19,000 B. Decrease variable cost to 60 % of sales C. Increase sales price by 1.5 % REQUIRED: What is the net income under each strategy? Which strategy do you recommend and why? 2>>>Harold Levettes, Inc. is the leading manufacturer in roto-tillers, Leaf Blowers, and hedge trimmers. After some analysis, items is as follows: 33% 30% 37% $40 $25 $55 Roto-tillers Leaf Blowers Hedge Trimmers Levettes' total fixed costs equal $2,990,000. REQUIRED To break even with this sales mix, I many units of each product must Levettes sell? 3>Freduire Manufacturers presents the following CVP income statement in comparison to P-Quick Company's CVP income s Freduire Manufacturers P-Quick Company Click Saue and Submit to saue and submit. Click Save All Answers to save all answers. MacBook Air 20 F3 esc F2 What is the net income unde 2>>>Harold Levettes, Inc. is the leading manufacturer in roto-tillers, Leaf Blowers, and hedge trimmers. items is as follows: After some am $40 $25 33% 30% 37% Roto-tillers. Leaf Blowers Hedge Trimmers $55 Levettes' total fixed costs equal $2,990,000. REQUIRED: To break even with this sales mix, I many units of each product must Levettes sell? 3>>>Freduire Manufacturers presents the following CVP income statement in comparison to P-Quick Company's CVP i P-Quick Company Freduire Manufacturers $4,000,000 $3,000,000 Sales 400,000 960.000 Variable Costs 3,600,000 2,040,000 Contribution Margin 2,050,000 800,000 Fixed Costs $1,550,000 $1.240,000 Net Income REQUIRED: What is the operating leverage for the companies? Using the operating leverage computed in #1 , compare the companies to each other. What will happen if the sale revenue decreases 10 % for both companies? What will a CVP income statement reveal? 2. 3 T T T T Arial Paragraph ET 3 (12pt) T T Click Save and Submit to saue and submit. Click Save All Answers to save all answers. MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts