Question: Remaining Time: 58 minutes, 40 seconds. Question Completion Status: Moving to another question will save this response Question 1 of 12 Question 1 3 points

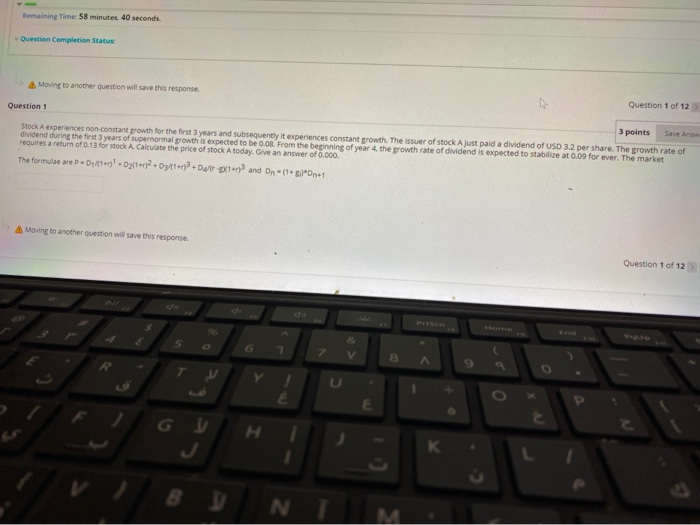

Remaining Time: 58 minutes, 40 seconds. Question Completion Status: Moving to another question will save this response Question 1 of 12 Question 1 3 points Save Answ Stock A experiences non constant growth for the first 3 years and subsequently it experiences constant growth. The issuer of stock A just paid a dividend of USD 3.2 per share. The growth rate of dividend during the first 3 years of supernormal growth is expected to be 0.08. From the beginning of year 4. the growth rate of dividend is expected to stabilize at 0.09 for ever. The market requires a return of 0.13 for stock A. Calculate the price of stock A today. Give an answer of 6.000 The formulae are P-D14+002114772 +0311+73) Dell 300m2 and On - (1 + $]+On+1 Moving to another question will save this response. Question 1 of 12 5 O V 8 9 Y H . N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts