Question: Remalning Timec 3 8 minutes, 0 2 seconds. Question Completion Stacus: Moving to another question will save this response. mestion 4 5 Marie participates in

Remalning Timec minutes, seconds.

Question Completion Stacus:

Moving to another question will save this response.

mestion

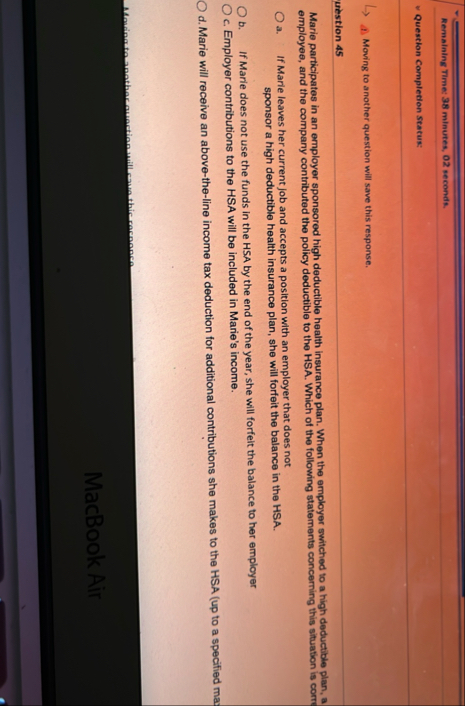

Marie participates in an employer sponsored high deductible health insurance plan. When the employer switched to a high deductible plan, a employee, and the company contributed the policy deductible to the HSA. Which of the following staternents concerning this situation is corte

a If Marie leaves her current job and accepts a position with an employer that does not

sponsor a high deductible health insurance plan, she will forfeit the balance in the HSA.

b If Marie does not use the funds in the HSA by the end of the year, she will forfelt the balance to her employer

c Employer contributions to the HSA will be included in Marie's income.

d Marie will receive an abovetheline income tax deduction for additional contributions she makes to the HSA up to a specified may

Mondingto another cowection will sane thicesocononen

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock