Question: Remark: all the dollar value below should be considered fair ( true ) market values - i . e . any prospective buyer / seller

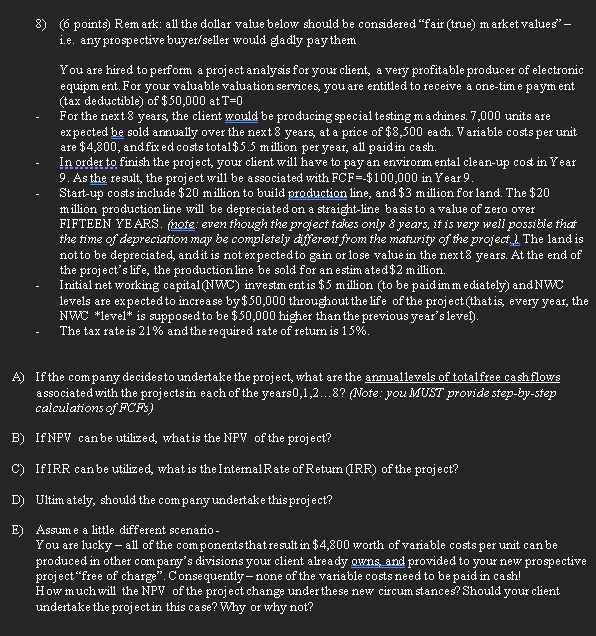

Remark: all the dollar value below should be considered "fair true market values" ie any prospective buyerseller would gadly pay them You are hired to perform a project analysis for your client, a very profitable producer of electronic equipm ent. For your valuable valuation services, you are entitled to receive a onetime paym ent tax deductible of $ at T For the next years, the client would be producing special testing machines. units are expected be sold anmually over the next years, at a price of $ each. Wariable costs per unit are $ and fix ed costs total $ million per year, all paid in cash. In order to finish the project, your client will have to pay an envirorm ental cleanup cost in Year As the result, the project will be associated with FCF$ in Year Startup costs include $ million to build production line, and $ million for land. The $ million productionline will be depreciated on a straightline basis to a value of zero over FIFTEEN YEARS. hote: even though the project tahes only years, it is very well possible that the time of depreciation may be completely different from the maturity of the project, The land is not to be depreciated, andit is not expected to gain or lose value in the next years. At the end of the project's life, the production line be sold for an estim ated $ million. Initial net working capitalNWC investm ent is $ million to be paidimmediately andNWW levels are expected to increase by $ throughout the life of the project that is every year, the NWC level is supposed to be $ higher than the previous year's level The tax rate is and the required rate of retumis is A If the company decides to undertake the project, what are the annuallevels of totalfree cashflows associated with the projectsin each of the years dotsNote: you MUST provide stepbystep calculations of FCF B If NPV canbe utilized, what is the NPV of the project? C If IRR can be utilized, what is the IntemalRate of Retum IRR of the project? D Ultim ately, should the company undertake thisproject? E Assume a little different scenario You are lucky all of the components thatresult in $ worth of variable costs per unit can be produced in other company's divisions your client already owns, and provided to your new prospective project "free of charge". C onsequently none of the variable costs need to be paid in cash! How much will the NPV of the project change under the se new circum stances? Should your client undertake the project in this case? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock