Question: Remember, a bond's coupon rate partially determines the interest-based return that a bond pay, and a bondhalder's required return refiects the return that a bondholder

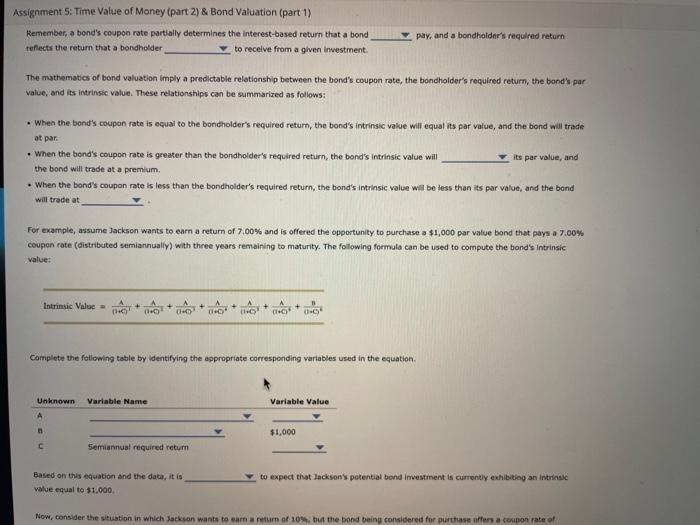

Remember, a bond's coupon rate partially determines the interest-based return that a bond pay, and a bondhalder's required return refiects the return that a bondholder to receive from a given investment. The mathematics of bond valuation imply a predictable relationship between the bond's coupon rate, the bondholder's required return, the band's par value. and its intrinsic value. These relationships can be summarized as follows: - When the bond's coupon rate is equal to the bondholder's required return, the bond's intrinsic value will equal its par value, and the bond nill trade at par. - When the bond's coupon rate is greater than the bondholder's required return, the bond's intrinsic value will the bond will trade at a premium. - When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at For example, assume Jackson wants to earn a retum of 7,00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 7.00% coupon rate (distributed semiannually) with three years rembining to maturity. The following formula can be used to compute the bond's intrinsic value: IntrinsicValue=(1+0)A+(1+02A+(1+0)2A+(1+)2A+(1+C2A+(1+94A+(1+02B Complete the following table by identifying the appropriate conresponding variables used in the equation. Based on this equation and the data, it is to expect that Jackson's petential bond imvestment is currontly exhibuting an intrinsic value equal to $1,000 Now, conslder the sitiabtion in which Jacksan wasts to earn a return of a w, but the bond being considered for puruhase affers a coupon rate of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts