Question: Remember to show all your work. 1. (Slides 8-9, 13 and Example 11.2 from the textbook are helpful) A pension fund has a duration (D)

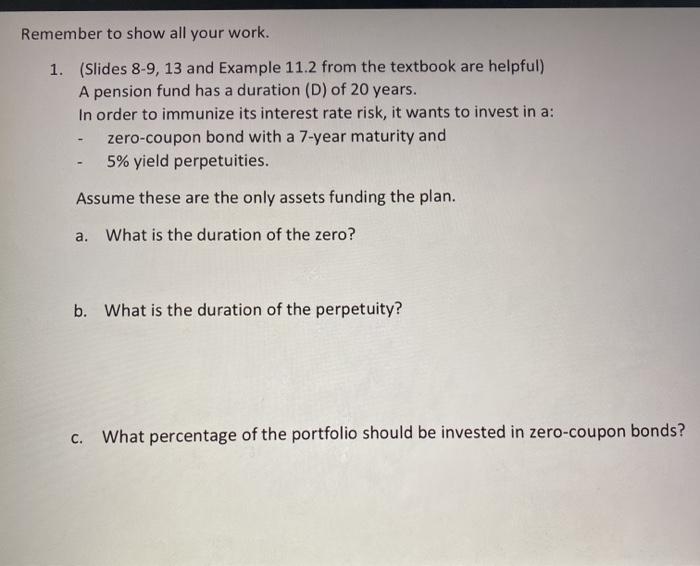

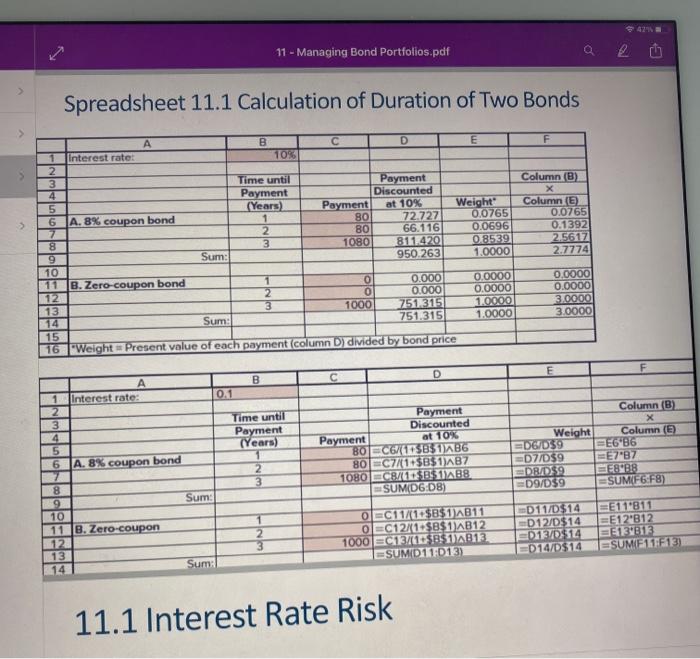

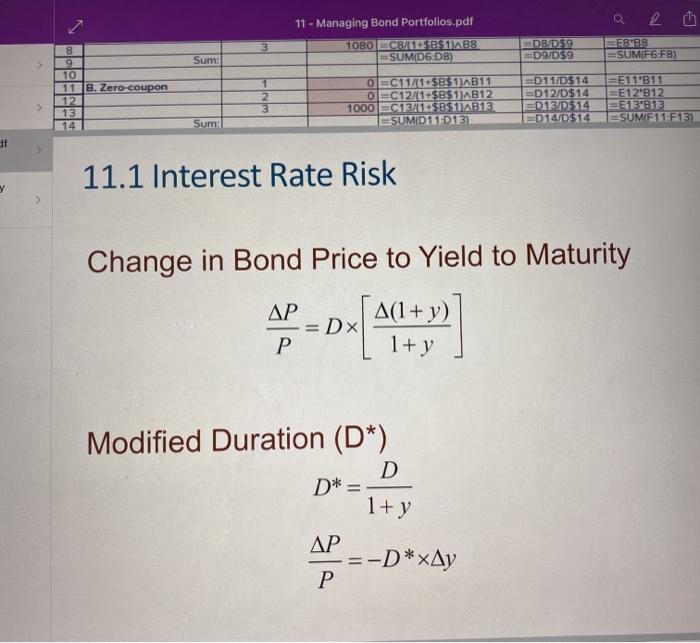

Remember to show all your work. 1. (Slides 8-9, 13 and Example 11.2 from the textbook are helpful) A pension fund has a duration (D) of 20 years. In order to immunize its interest rate risk, it wants to invest in a: zero-coupon bond with a 7-year maturity and 5% yield perpetuities. Assume these are the only assets funding the plan. a. What is the duration of the zero? b. What is the duration of the perpetuity? C. What percentage of the portfolio should be invested in zero-coupon bonds? 11 - Managing Bond Portfolios.pdf Spreadsheet 11.1 Calculation of Duration of Two Bonds F B D E 1 Interest rate 10% 2 3 Time until Payment 4 Payment Discounted 5 (Years) Payment at 10% Weight 6 A. 8% coupon bond 1 80 72.727 0.0765 7 2 BO 66.116 0.0696 8 3 1080 811.420 0.8539 9 Sum: 950.263 1.0000 10 11 B. Zero-coupon bond 1 0 0.000 0.0000 12 2 0 0.000 0.0000 13 3 1000 75123115 1.0000 14 Sum: 751.3151 1.0000 15 16 Weight : Present value of each payment column D divided by bond price Column (B) X Column E) 0.0765 0.1392 2.5617 2.7774 0.0000 0.0000 3.0000 3.0000 F D B 0.1 1 Interest rate: 2 3 4 5 6 A. 8% coupon bond Time until Payment (Years) Payment Discounted Payment at 10% BO C6/(17383186 80 C7/(1+$B$1AB7 1080 ECB/C5351/AB8 SUMD6:08) Column (B) x Weight Column (E) 06/0$9 E6B6 D7/D$9 E7"B7 DRD$9 EEBB8 DS/D$9 SUMF6:48) 2 3 Sum: 8 9 10 11 B. Zero-coupon O EC11/1:$B$ DAB11 O EC12/1:$B$ 1AB12 1000 EC1058511AB113 SUMD11 D13) 2 3 011/D$14 012/D$14 D1370$24 D14/D$14 E11'811 E12812 BE1313 ESUMF11 F113 12 13 14 Sum: 11.1 Interest Rate Risk 11 - Managing Bond Portfolios.pdf 1080 ECBIB$ABB SUMD6:08) DB/D$9 -D9/D$9 FB'B8 SUMIF6:F8) Sum: 8 9 10 11 B. Zero-coupon 12 13 14 1 2 3 011/D$14 012/D$14 2013/0$14 ED14/D$14 O C11/1:$B$1AB11 0 C12/1+$B$1 AB12 1000 C13/1$B$1) AB13 SUMID 11D 137 EE111811 E12312 BE131313 ESUMF11 F131 > Sum: St 11.1 Interest Rate Risk Change in Bond Price to Yield to Maturity AP DX ox[00:+ A(1+y) 1+ y Modified Duration (D*) D D* = 1+ y AP -=-D*xAy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts