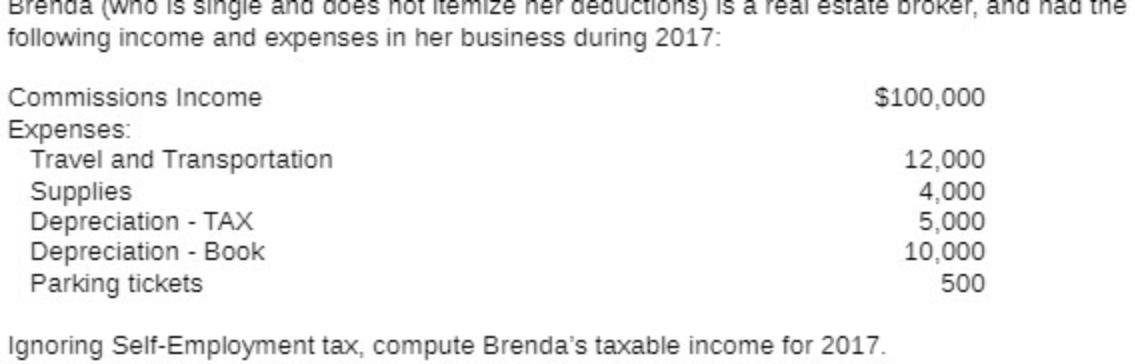

Question: renda (who is single and does not itemize her deductions) is a real estate broker, and had the following income and expenses in her

renda (who is single and does not itemize her deductions) is a real estate broker, and had the following income and expenses in her business during 2017: Commissions Income Expenses: Travel and Transportation Supplies $100,000 Depreciation - TAX Depreciation - Book Parking tickets Ignoring Self-Employment tax, compute Brenda's taxable income for 2017. 12,000 4,000 5,000 10,000 500

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

To compute Brendas taxable income for 2017 we need to subtract ... View full answer

Get step-by-step solutions from verified subject matter experts