Question: Rent Roll Tenant Name/Unit Type CVS Sherwin Williams Keller Williams Domino's Nail Salon Total Occupied/Avg 5% market vacancy 5.50% Investor's ROE SF 7,500 Questions:

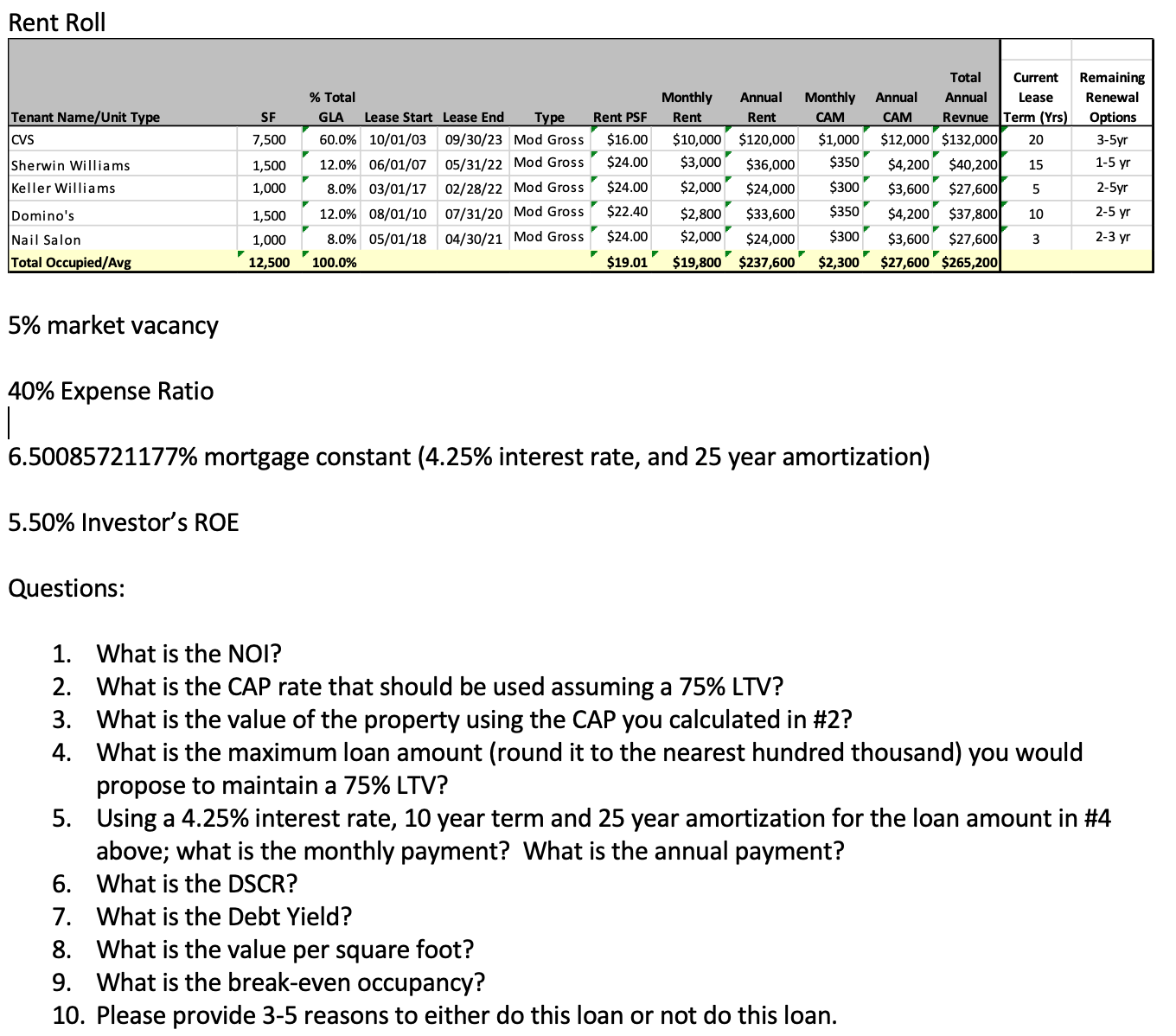

Rent Roll Tenant Name/Unit Type CVS Sherwin Williams Keller Williams Domino's Nail Salon Total Occupied/Avg 5% market vacancy 5.50% Investor's ROE SF 7,500 Questions: 1,500 1,000 % Total GLA Lease Start 60.0% 10/01/03 12.0% 06/01/07 8.0% 03/01/17 12.0% 08/01/10 8.0% 05/01/18 1,500 1,000 12,500 100.0% Lease End Type 09/30/23 Mod Gross 05/31/22 Mod Gross 02/28/22 Mod Gross 07/31/20 Mod Gross 04/30/21 Mod Gross 40% Expense Ratio T 6.50085721177% mortgage constant (4.25% interest rate, and 25 year amortization) Renewal Options 3-5yr Total Current Remaining Monthly Annual Monthly Annual Annual Lease Rent PSF Rent Rent CAM CAM Revnue Term (Yrs) $16.00 $10,000 $120,000 $1,000 $12,000 $132,000 20 $24.00 $3,000 $36,000 $350 $4,200 $40,200 15 $24.00 $2,000 $24,000 $300 $3,600 $27,600 5 $22.40 $2,800 $33,600 $350 $4,200 $37,800 10 $24.00 $2,000 $24,000 $300 $3,600 $27,600 3 $19.01 $19,800 $237,600 $2,300 $27,600 $265,200 1-5 yr 2-5yr 2-5 yr 2-3 yr 1. What is the NOI? 2. What is the CAP rate that should be used assuming a 75% LTV? 3. What is the value of the property using the CAP you calculated in #2? 4. What is the maximum loan amount (round it to the nearest hundred thousand) you would propose to maintain a 75% LTV? 5. Using a 4.25% interest rate, 10 year term and 25 year amortization for the loan amount in #4 above; what is the monthly payment? What is the annual payment? 6. What is the DSCR? 7. What is the Debt Yield? 8. What is the value per square foot? 9. What is the break-even occupancy? 10. Please provide 3-5 reasons to either do this loan or not do this loan.

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

To answer the questions well first need to calculate some intermediate values based on the provided data 1 Net Operating Income NOI NOI Total Annual Revenue Total Operating Expenses From the provided ... View full answer

Get step-by-step solutions from verified subject matter experts