Question: Replace an existing asset: You have a 2003 Nissan that is expected to run for another three years, but you are considering buying a new

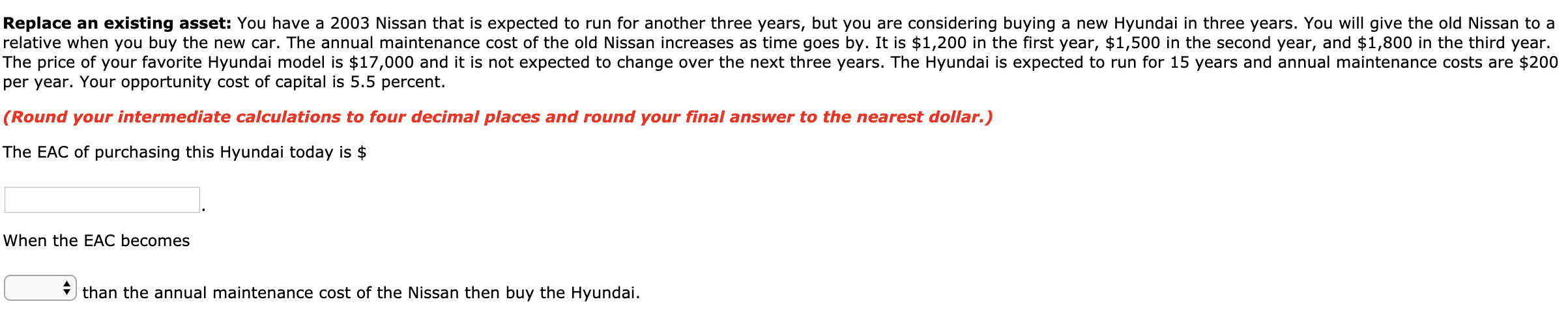

Replace an existing asset: You have a 2003 Nissan that is expected to run for another three years, but you are considering buying a new Hyundai in three years. You will give the old Nissan to a relative when you buy the new car. The annual maintenance cost of the old Nissan increases as time goes by. It is $1,200 in the first year, $1,500 in the second year, and $1,800 in the third year. The price of your favorite Hyundai model is $17,000 and it is not expected to change over the next three years. The Hyundai is expected to run for 15 years and annual maintenance costs are $200 per year. Your opportunity cost of capital is 5.5 percent. (Round your intermediate calculations to four decimal places and round your final answer to the nearest dollar.) The EAC of purchasing this Hyundai today is $ When the EAC becomes than the annual maintenance cost of the Nissan then buy the Hyundai

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts