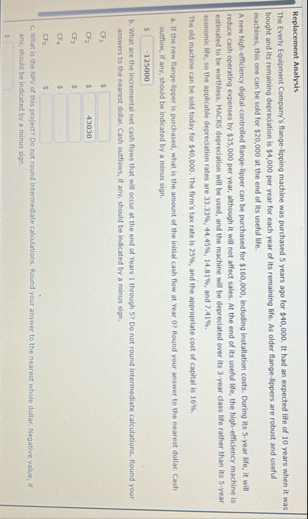

Question: Replacement Analysis The Everly Equipment Compamy's flange - lipping machine was purchased 5 years ago for $ 4 0 , 0 0 0 . It

Replacement Analysis

The Everly Equipment Compamy's flangelipping machine was purchased years ago for $ It had an expected life of years when it was bought and its remaining depredation is $ per year for each year of its remaining life. As older flangelippers are robust and useful machines, this one can be sold for $ at the end of its useful life.

A new higheffidency digitalcontrolled flangelipper can be purchased for $ induding installation costs. During its year life, it will reduce cash operating expenses by $ per year, although it will not affect sales. At the end of its useful life, the highefficiency machine is estimated to be worthless. MACRS depredation will be used, and the machine will be depreciated over its year dass life rather than its year economic life, so the applicable depredation rates are and

The old machine can be sold today for $ The firm's tax rate is and the appropriate cost of capital is

a If the new fanpelipper is purchased, what is the amount of the Initlat cash flow at Year Round your answer to the nearest dollar. Cash outflow, if any, should be indicated by a minus sign.

$

b What are the incremental net cash flows that will occur at the end of Years through Do not round intermediate calculations. Round your answers to the nearest dollar. Cash outflows, if ary, should be indicated by a minus sign.

$

$

c What is the NPV of this profect? Do not round intermediate calculations. Round your answer to the nearest whole dollar. Negative value, if arny, whould be indicated by a minus sign.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock