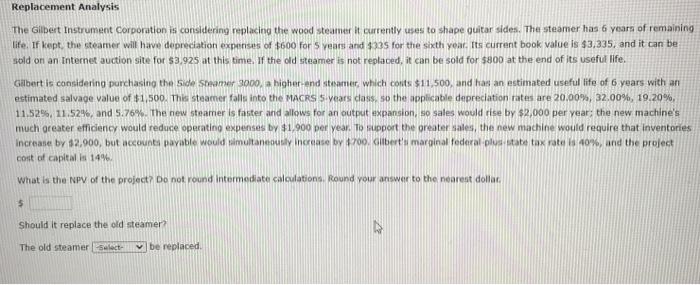

Question: Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamerit currently uses to shape quitar sides. The steamer has 6 years of remaining

Replacement Analysis The Gilbert Instrument Corporation is considering replacing the wood steamerit currently uses to shape quitar sides. The steamer has 6 years of remaining life. If kept the steamer will have depreciation expenses of $600 for years and $335 for the sixth year. Its current book value is $3.335, and it can be sold on an Internet auction site for $3.925 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is considering purchasing the Side Steamer 3000, a higher and steamer, which corts $11,500, and has an estimated useful life of 6 years with an estimated salvage value of $1,500. This steamer falls into the MACRS 5 years class, so the applicable depreciation rates are 20.00%, 32.00%, 19.20% 11.529, 11.52%, and 5.76%. The new steamer is faster and allows for an output expansion, so sales would rise by $2,000 per year; the new machine's much greater efficiency would reduce operating expenses by $1,900 per year. To support the greater sales, the new machine would require that inventories Increase by 12.900, but accounts payable would simultaneously increase by 1700. ibert's marginal federal plus state tax rate 40%, and the project cost of capital is 14% What is the NPV of the project? Do not round Intermediate calculations, Round your answer to the nearest dolor $ Should it replace the old steamer? The old steamer select- be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts