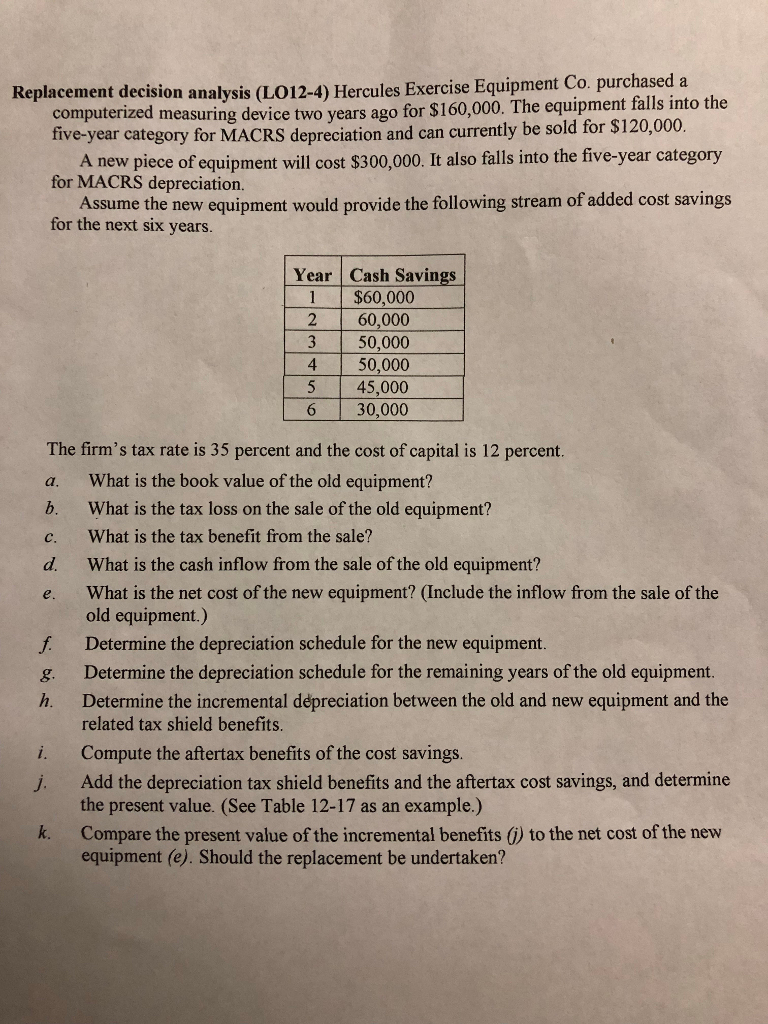

Question: Replacement decision analysis (LO12-4) Hercules Exercise Equipment Co. purchased a 120,000. the computerized measuring device two years ago for $160,000. The equipment falls into five-year

Replacement decision analysis (LO12-4) Hercules Exercise Equipment Co. purchased a 120,000. the computerized measuring device two years ago for $160,000. The equipment falls into five-year category for MACRS depreciation and can currently be sold for $ A new piece of equipment will cost $300,000. It also falls into the five-year category Assume the new equipment would provide the following stream of added cost savings for MACRS depreciation. for the next six years. Year Cash Savings 1 $60,000 60,000 50,000 50,000 5 45,000 30,000 4 The firm's tax rate is 35 percent and the cost of capital is 12 percent a. What is the book value of the old equipment? b. What is the tax loss on the sale of the old equipment? c. What is the tax benefit from the sale? d. What is the cash inflow from the sale of the old equipment? e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) Determine the depreciation schedule for the new equipment. Determine the depreciation schedule for the remaining years of the old equipment. Determine the incremental dpreciation between the old and new equipment and the related tax shield benefits. Compute the aftertax benefits of the cost savings. Add the depreciation tax shield benefits and the aftertax cost savings, and determine the present value. (See Table 12-17 as an example.) Compare the present value of the incremental benefits to the net cost of the new equipment (e). Should the replacement be undertaken? f. g. h. i. j. k

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts