Question: Replacing old equipment at an immediate cost of $80,000 and an additional outlay of $10,000 four years from now will result in savings of

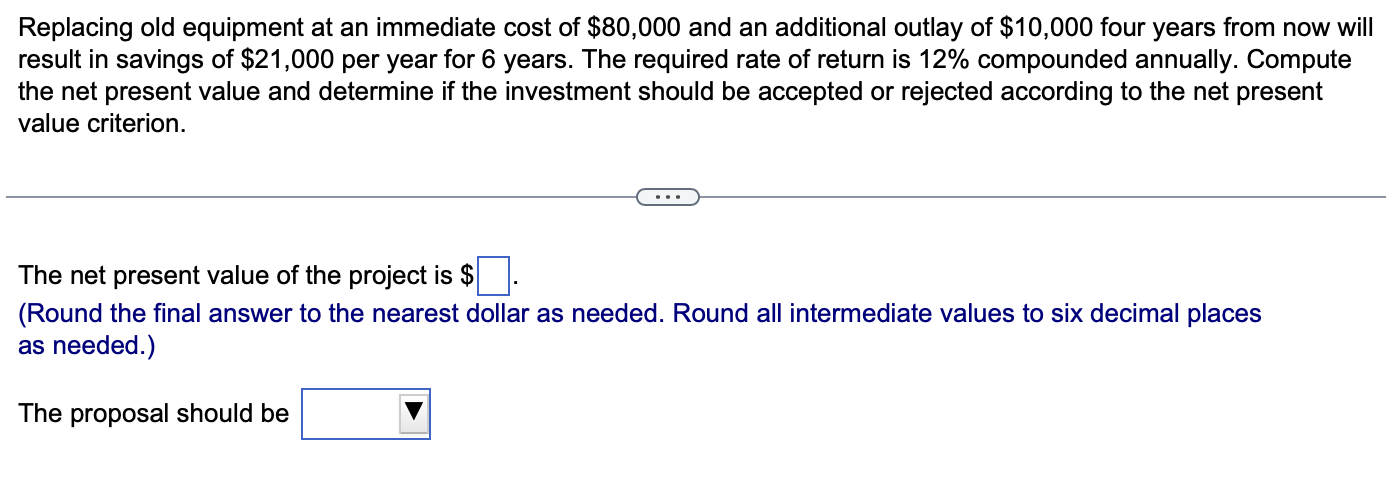

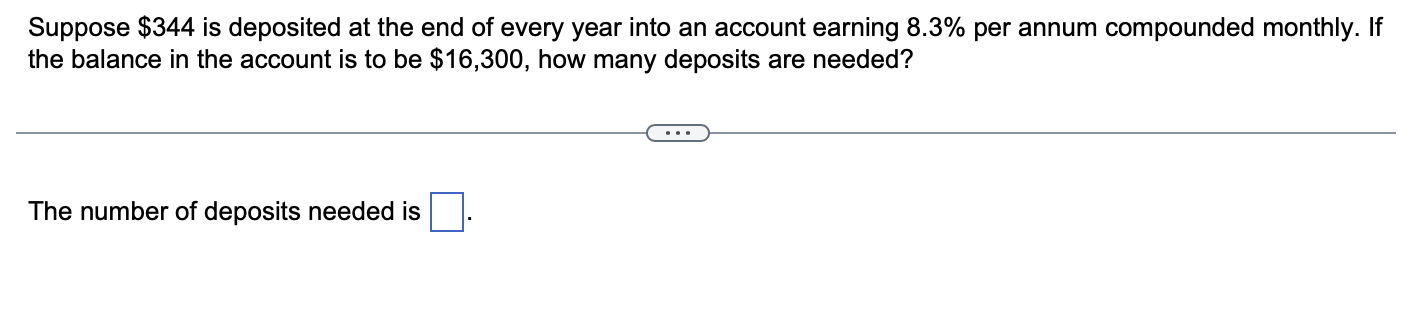

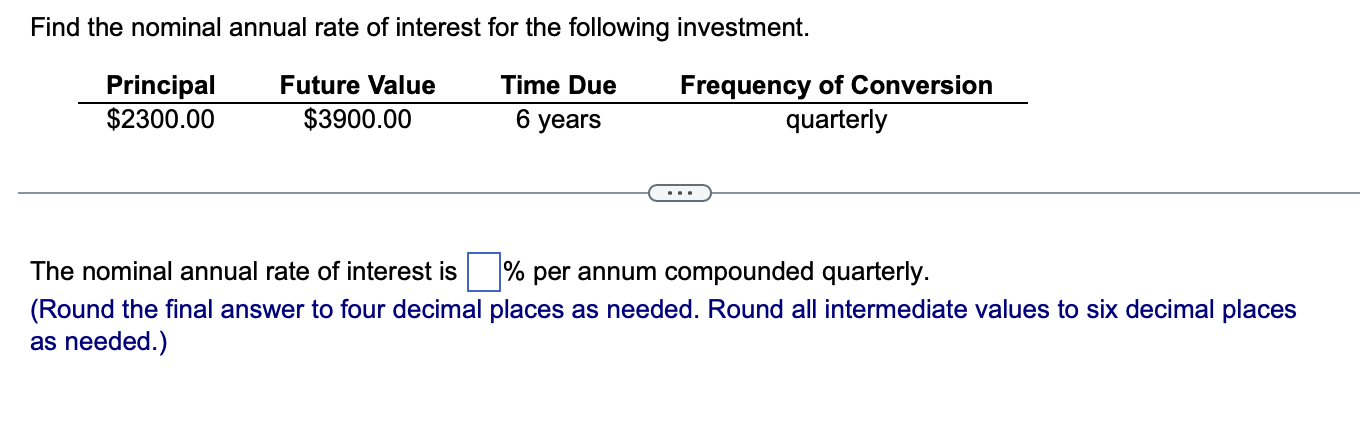

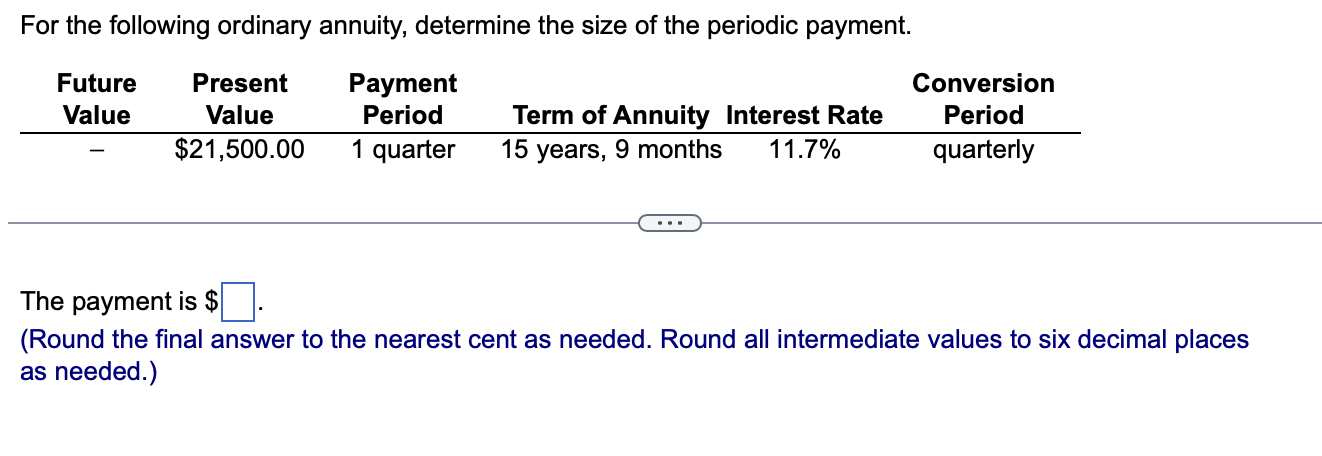

Replacing old equipment at an immediate cost of $80,000 and an additional outlay of $10,000 four years from now will result in savings of $21,000 per year for 6 years. The required rate of return is 12% compounded annually. Compute the net present value and determine if the investment should be accepted or rejected according to the net present value criterion. The net present value of the project is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The proposal should be Suppose $344 is deposited at the end of every year into an account earning 8.3% per annum compounded monthly. If the balance in the account is to be $16,300, how many deposits are needed? The number of deposits needed is Find the nominal annual rate of interest for the following investment. Principal $2300.00 Future Value $3900.00 Time Due 6 years Frequency of Conversion quarterly The nominal annual rate of interest is % per annum compounded quarterly. (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.) For the following ordinary annuity, determine the size of the periodic payment. Payment Period Conversion Period Future Value Present Value $21,500.00 1 quarter Term of Annuity Interest Rate 15 years, 9 months 11.7% quarterly The payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts