Question: Replicate problem 8-6 with these new inputs. The current price of a stock is $48. In 1 year, the price will be either $55 or

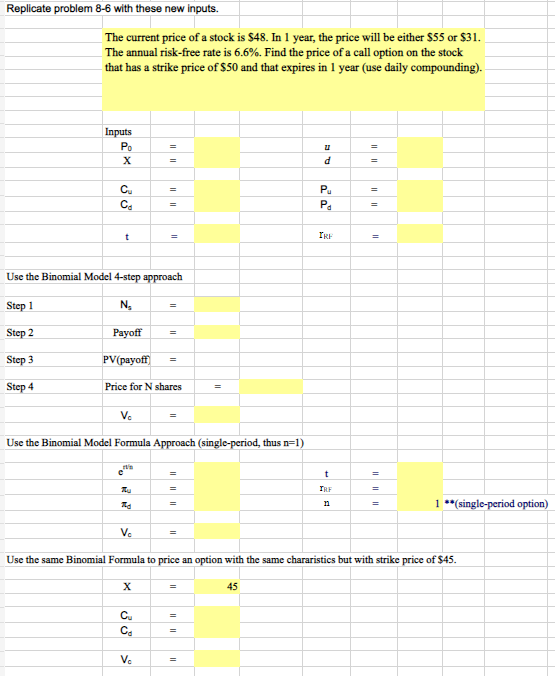

Replicate problem 8-6 with these new inputs. The current price of a stock is $48. In 1 year, the price will be either $55 or $31. The annual risk-free rate is 6.6%. Find the price of a call option on the stock that has a strike price of $50 and that expires in 1 year (use daily compounding). Inputs Po X d Cu = Pu = = t = IRF = Use the Binomial Model 4-step approach Step 1 N. Step 2 Payoff = Step 3 PV (payoff] = Step 4 Price for N shares Use the Binomial Model Formula Approach (single-period, thus n=1) = t 1I 1 (single-period option) = Use the same Binomial Formula to price an option with the same chararistics but with strike price of $45. X = 45 Cu = = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts