Question: Replicement Project KFUPM is planning to replace it heavy duty printing machine with a newer model that is faster and better quality. The existing machine

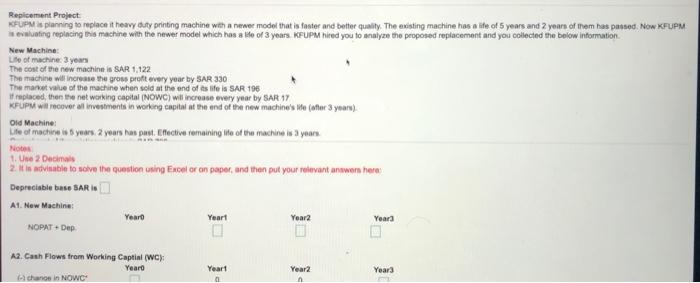

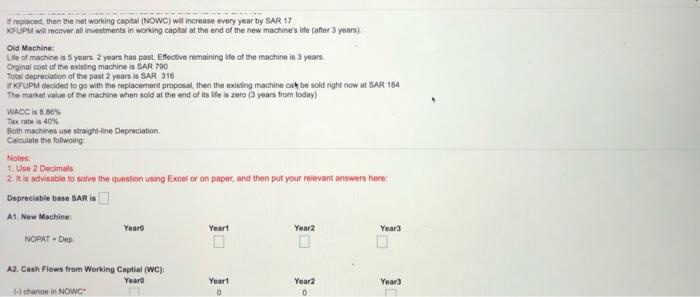

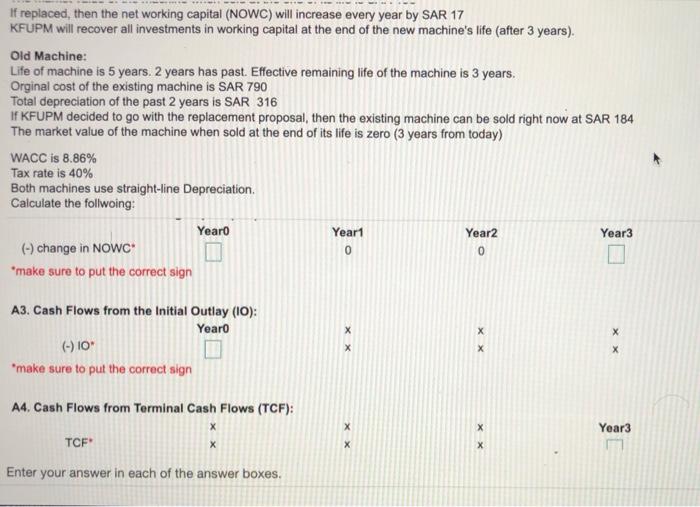

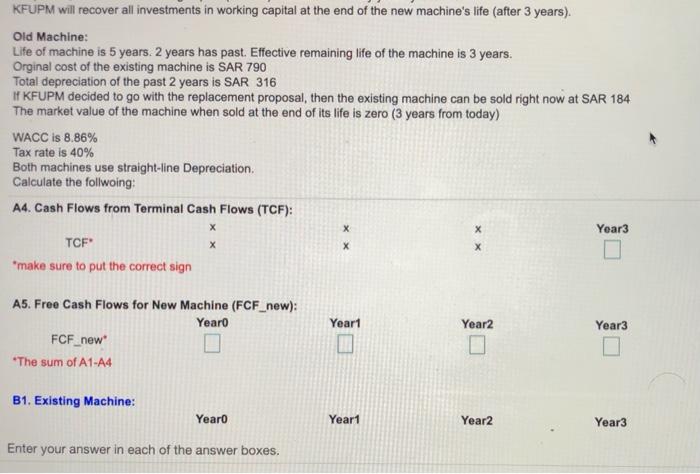

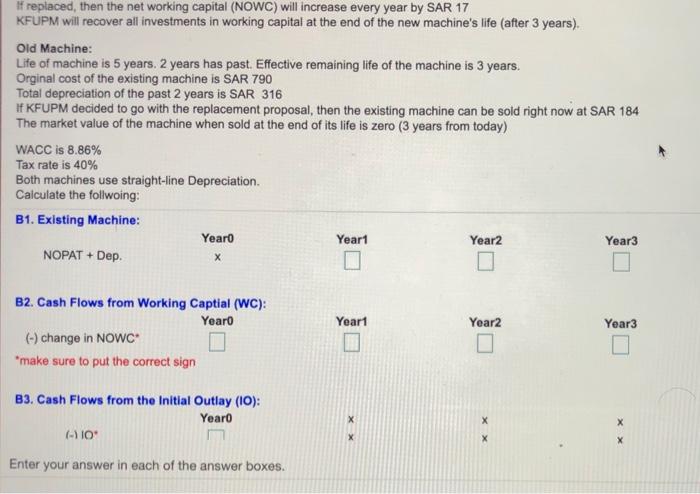

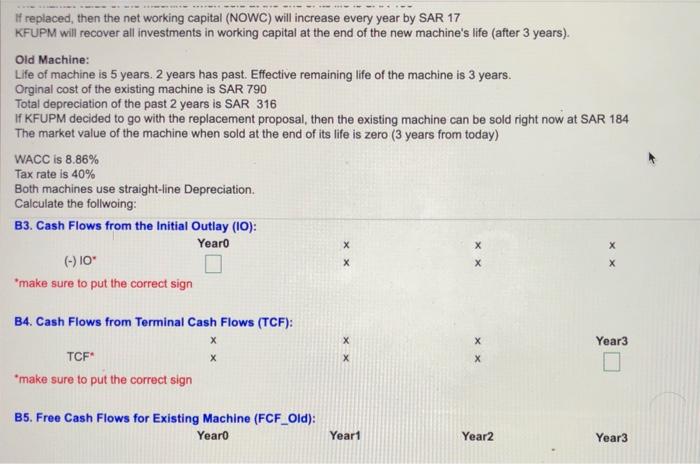

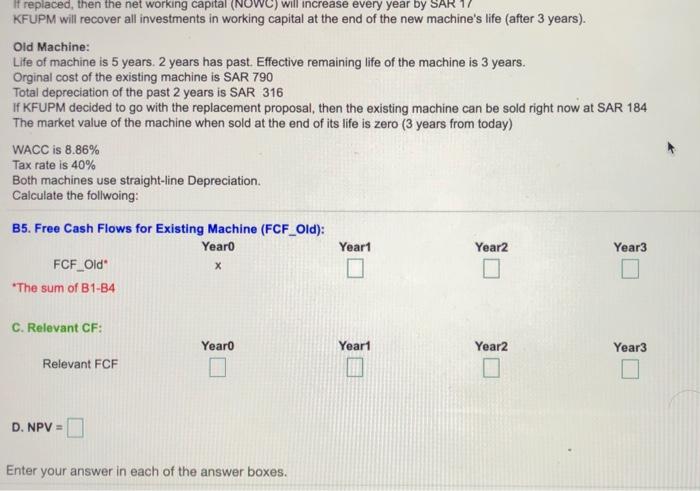

Replicement Project KFUPM is planning to replace it heavy duty printing machine with a newer model that is faster and better quality. The existing machine has a life of 5 years and 2 years of them has passed. Now KFUPM evaluating replacing this machine with the newer model which has a life of 3 years, KFUPM hired you to analyze the proposed replacement and you collected the below information New Machine: Lite of machine: 3 years The cost of the new machines SAR 1,122 The machine will increase the gross profit every year by SAR 330 The marvet value of the machine when sold at the end of sife is SAR 196 replaced, then the networking capital (NOWC) will increase every year by SAR 17 KPUPM will cover al Investments in working capital at the end of the new machine's Ite (ofter 3 years) Old Machine Life of machine is 5 years. 2 years has past. Effective remaining the of the machine is 3 years Notes 1. Une 2 Decimals 2. it is advisable to solve the question using Excel or on paper, and then put your relevant answer here Depreciable base SAR IN A1. New Machine Yeard Yeart Year2 Years N ENT + Dep A2. Cash Flows from Working Captial (WC): Yeard change in NOWC Yeart Year2 Year3 replaced, then the networking capital (NOWC) will increase every year by SAR 17 KFUPM will cover all investments in working capital at the end of the new machine's life after 3 years) Old Machine Life of machine is 5 years 2 years has past. Effective remaining ife of the machine in 3 years Orginal cost of the existing machine is SAR 790 Tots depreciation of the past 2 years is SAR 316 KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero 3 years from today) WACC 8.50% Tax rate is 40% Both machines use straight-line Depreciation Calculate the follwing: Notes: 1. Use 2 Decimals 2. It's advisable to solve the question using Excel or on paper, and then put your relevant answers here: Depreciable buse SAR IS A1 New Machine Yearo Yeart Year2 Year NOVAT + Dep A2. Cash Flows from Working Captial (WC) Yeard change in NOWC Yeart Years Year 0 If replaced, then the net working capital (NOWC) will increase every year by SAR 17 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). Old Machine: Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years. Orginal cost of the existing machine is SAR 790 Total depreciation of the past 2 years is SAR 316 If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero (3 years from today) WACC is 8.86% Tax rate is 40% Both machines use straight-line Depreciation. Calculate the follwoing: Yearo Year1 Year2 Year3 (-) change in NOWC 0 0 *make sure to put the correct sign o A3. Cash Flows from the initial Outlay (10): Yearo (-)10 *make sure to put the correct sign x x A4. Cash Flows from Terminal Cash Flows (TCF): Year3 TCF X Enter your answer in each of the answer boxes, KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). Old Machine: Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years. Orginal cost of the existing machine is SAR 790 Total depreciation of the past 2 years is SAR 316 If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero (3 years from today) WACC is 8.86% Tax rate is 40% Both machines use straight-line Depreciation Calculate the follwoing: A4. Cash Flows from Terminal Cash Flows (TCF): Year3 TCF X *make sure to put the correct sign Yeart Year2 Year3 A5. Free Cash Flows for New Machine (FCF_new): Yearo FCF_new *The sum of A1-A4 B1. Existing Machine: Yearo Year1 Year2 Year3 Enter your answer in each of the answer boxes. If replaced, then the net working capital (NOWC) will increase every year by SAR 17 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years) Old Machine: Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years. Orginal cost of the existing machine is SAR 790 Total depreciation of the past 2 years is SAR 316 If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero (3 years from today) WACC is 8.86% Tax rate is 40% Both machines use straight-line Depreciation. Calculate the follwoing: B1. Existing Machine: Yearo Year1 Year2 Year3 NOPAT + Dep. Yeart Year2 B2. Cash Flows from Working Captial (WC): Yearo (-) change in NOWC *make sure to put the correct sign Year3 B3. Cash Flows from the Initial Outlay (10): Yearo (-) 10" X X Enter your answer in each of the answer boxes. If replaced, then the networking capital (NOWC) will increase every year by SAR 17 KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). Old Machine: Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years. Orginal cost of the existing machine is SAR 790 Total depreciation of the past 2 years is SAR 316 If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero (3 years from today) WACC is 8.86% Tax rate is 40% Both machines use straight-line Depreciation. Calculate the follwoing: B3. Cash Flows from the Initial Outlay (10): Yearo x (-)10 *make sure to put the correct sign X X X X Year3 B4. Cash Flows from Terminal Cash Flows (TCF): X TCF x *make sure to put the correct sign B5. Free Cash Flows for Existing Machine (FCF_Old): Yearo Yeart Year2 Year3 If replaced, then the networking capital (NOWC) will increase every year by SA KFUPM will recover all investments in working capital at the end of the new machine's life (after 3 years). Old Machine: Life of machine is 5 years. 2 years has past. Effective remaining life of the machine is 3 years. Orginal cost of the existing machine is SAR 790 Total depreciation of the past 2 years is SAR 316 If KFUPM decided to go with the replacement proposal, then the existing machine can be sold right now at SAR 184 The market value of the machine when sold at the end of its life is zero (3 years from today) WACC is 8.86% Tax rate is 40% Both machines use straight-line Depreciation. Calculate the follwoing: B5. Free Cash Flows for Existing Machine (FCF_Old): Yearo Year2 Year3 FCF_Old *The sum of B1-B4 Year1 C. Relevant CF: Yearo Year1 Year2 Year3 Relevant FCF D. NPV = Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts