Question: Reply all Delete Junk Block - Presentation Auditing reevaluate established materiality levels? (1) The materiality level was established based on preliminary financial statement amounts that

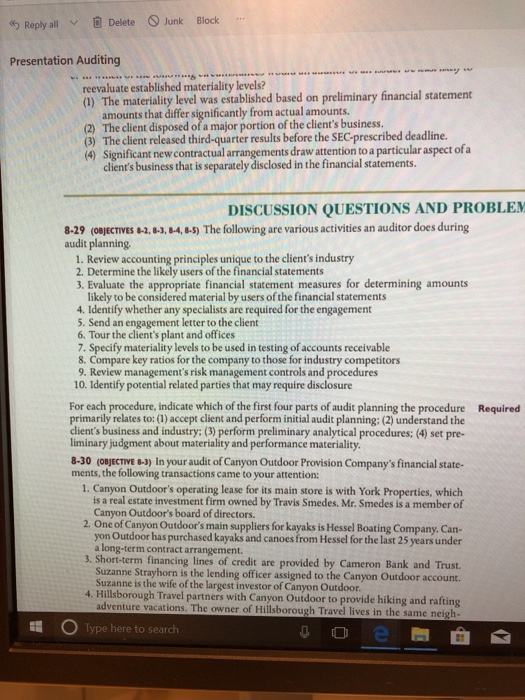

Reply all Delete Junk Block - Presentation Auditing reevaluate established materiality levels? (1) The materiality level was established based on preliminary financial statement amounts that differ significantly from actual amounts. (2) The client disposed of a major portion of the client's business. (3) The client released third-quarter results before the SEC-prescribed deadline. (4) Significant new contractual arrangements draw attention to a particular aspect of a client's business that is separately disclosed in the financial statements. DISCUSSION QUESTIONS AND PROBLEM 8-29 (OBJECTIVES 6-2, 6-3, 6-4, 6-5) The following are various activities an auditor does during audit planning 1. Review accounting principles unique to the client's industry 2. Determine the likely users of the financial statements 3. Evaluate the appropriate financial statement measures for determining amounts likely to be considered material by users of the financial statements 4. Identify whether any specialists are required for the engagement 5. Send an engagement letter to the client 6. Tour the client's plant and offices 7. Specify materiality levels to be used in testing of accounts receivable 8. Compare key ratios for the company to those for industry competitors 9. Review management's risk management controls and procedures 10. Identify potential related parties that may require disclosure Required For each procedure, indicate which of the first four parts of audit planning the procedure primarily relates to: (1) accept client and perform initial audit planning: (2) understand the client's business and industry: (3) perform preliminary analytical procedures: (4) set pre- liminary judgment about materiality and performance materiality. 8-30 (OBJECTIVE 6-3) In your audit of Canyon Outdoor Provision Company's financial state- ments, the following transactions came to your attention: 1. Canyon Outdoor's operating lease for its main store is with York Properties, which is a real estate investment firm owned by Travis Smedes. Mr. Smedes is a member of Canyon Outdoor's board of directors. 2. One of Canyon Outdoor's main suppliers for kayaksis Hessel Boating Company. Can yon Outdoor has purchased kayaks and canoes from Hessel for the last 25 years under a long-term contract arrangement. 3. Short-term financing lines of credit are provided by Cameron Bank and Trust. Suzanne Strayhorn is the lending officer assigned to the Canyon Outdoor account. Suzanne is the wife of the largest investor of Canyon Outdoor 4. Hillsborough Travel partners with Canyon Outdoor to provide hiking and rafting adventure vacations. The owner of Hillsborough Travel lives in the same neigh- O Type here to search E Reply all Delete Junk Block - Presentation Auditing reevaluate established materiality levels? (1) The materiality level was established based on preliminary financial statement amounts that differ significantly from actual amounts. (2) The client disposed of a major portion of the client's business. (3) The client released third-quarter results before the SEC-prescribed deadline. (4) Significant new contractual arrangements draw attention to a particular aspect of a client's business that is separately disclosed in the financial statements. DISCUSSION QUESTIONS AND PROBLEM 8-29 (OBJECTIVES 6-2, 6-3, 6-4, 6-5) The following are various activities an auditor does during audit planning 1. Review accounting principles unique to the client's industry 2. Determine the likely users of the financial statements 3. Evaluate the appropriate financial statement measures for determining amounts likely to be considered material by users of the financial statements 4. Identify whether any specialists are required for the engagement 5. Send an engagement letter to the client 6. Tour the client's plant and offices 7. Specify materiality levels to be used in testing of accounts receivable 8. Compare key ratios for the company to those for industry competitors 9. Review management's risk management controls and procedures 10. Identify potential related parties that may require disclosure Required For each procedure, indicate which of the first four parts of audit planning the procedure primarily relates to: (1) accept client and perform initial audit planning: (2) understand the client's business and industry: (3) perform preliminary analytical procedures: (4) set pre- liminary judgment about materiality and performance materiality. 8-30 (OBJECTIVE 6-3) In your audit of Canyon Outdoor Provision Company's financial state- ments, the following transactions came to your attention: 1. Canyon Outdoor's operating lease for its main store is with York Properties, which is a real estate investment firm owned by Travis Smedes. Mr. Smedes is a member of Canyon Outdoor's board of directors. 2. One of Canyon Outdoor's main suppliers for kayaksis Hessel Boating Company. Can yon Outdoor has purchased kayaks and canoes from Hessel for the last 25 years under a long-term contract arrangement. 3. Short-term financing lines of credit are provided by Cameron Bank and Trust. Suzanne Strayhorn is the lending officer assigned to the Canyon Outdoor account. Suzanne is the wife of the largest investor of Canyon Outdoor 4. Hillsborough Travel partners with Canyon Outdoor to provide hiking and rafting adventure vacations. The owner of Hillsborough Travel lives in the same neigh- O Type here to search E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts