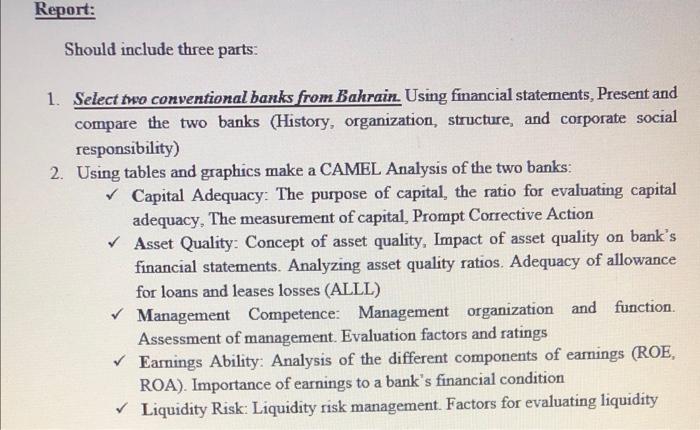

Question: Report: Should include three parts: a 1. Select to conventional banks from Bahrain. Using fiancial statements, Present and compare the two banks (History, organization, structure,

Report: Should include three parts: a 1. Select to conventional banks from Bahrain. Using fiancial statements, Present and compare the two banks (History, organization, structure, and corporate social responsibility) 2. Using tables and graphics make a CAMEL Analysis of the two banks: Capital Adequacy: The purpose of capital, the ratio for evaluating capital adequacy, The measurement of capital, Prompt Corrective Action Asset Quality: Concept of asset quality. Impact of asset quality on bank's financial statements. Analyzing asset quality ratios. Adequacy of allowance for loans and leases losses (ALLL) Management Competence: Management organization and function. Assessment of management. Evaluation factors and ratings Earnings Ability: Analysis of the different components of earnings (ROE, ROA). Importance of earnings to a bank's financial condition Liquidity Risk: Liquidity risk management. Factors for evaluating liquidity Report: Should include three parts: a 1. Select to conventional banks from Bahrain. Using fiancial statements, Present and compare the two banks (History, organization, structure, and corporate social responsibility) 2. Using tables and graphics make a CAMEL Analysis of the two banks: Capital Adequacy: The purpose of capital, the ratio for evaluating capital adequacy, The measurement of capital, Prompt Corrective Action Asset Quality: Concept of asset quality. Impact of asset quality on bank's financial statements. Analyzing asset quality ratios. Adequacy of allowance for loans and leases losses (ALLL) Management Competence: Management organization and function. Assessment of management. Evaluation factors and ratings Earnings Ability: Analysis of the different components of earnings (ROE, ROA). Importance of earnings to a bank's financial condition Liquidity Risk: Liquidity risk management. Factors for evaluating liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts