Question: Report the numerical result rounded to the nearest dollar without a $ sign and without a + or sign. A $1,000 bond has a coupon

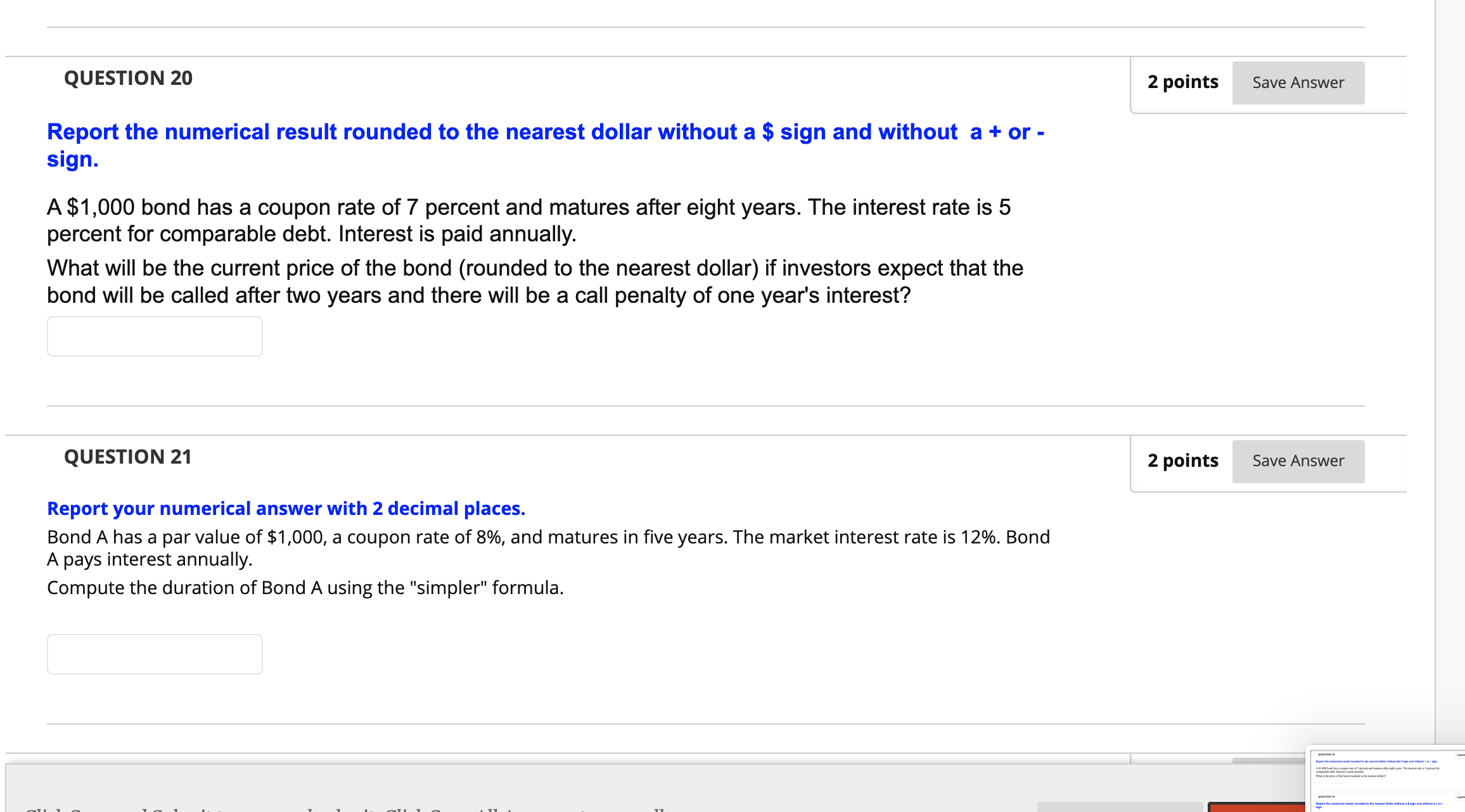

Report the numerical result rounded to the nearest dollar without a $ sign and without a + or sign. A $1,000 bond has a coupon rate of 7 percent and matures after eight years. The interest rate is 5 percent for comparable debt. Interest is paid annually. What will be the current price of the bond (rounded to the nearest dollar) if investors expect that the bond will be called after two years and there will be a call penalty of one year's interest? QUESTION 21 Report your numerical answer with 2 decimal places. Bond A has a par value of $1,000, a coupon rate of 8%, and matures in five years. The market interest rate is 12%. Bond A pays interest annually. Compute the duration of Bond A using the "simpler" formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts