Question: REPORTABLE SEGMENTS, ALLOCATING AMOUNTS TO SEGMENTS ** Company A is a listed diversified retail company. Its stores are located mainly in Australia. It has three

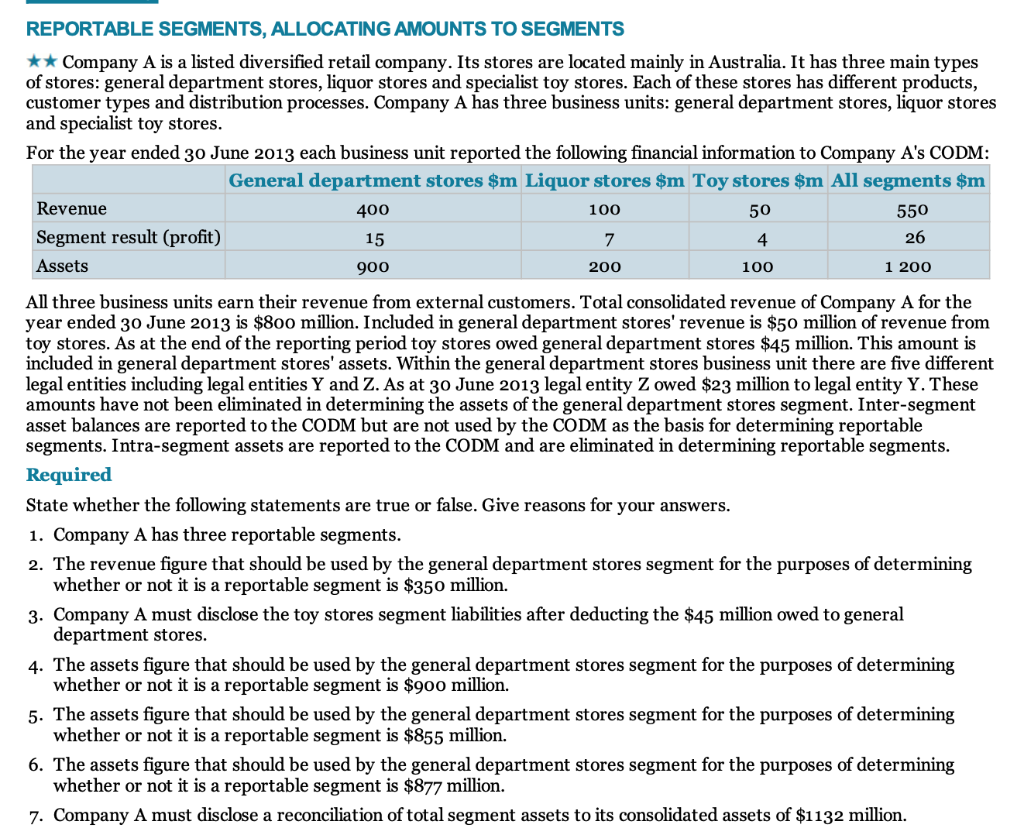

REPORTABLE SEGMENTS, ALLOCATING AMOUNTS TO SEGMENTS ** Company A is a listed diversified retail company. Its stores are located mainly in Australia. It has three main types of stores: general department stores, liquor stores and specialist toy stores. Each of these stores has different products, customer types and distribution processes. Company A has three business units: general department stores, liquor stores and specialist toy stores. For the year ended 30 June 2013 each business unit reported the following financial information to Company A's CODM: General department stores $m Liquor stores $m Toy stores $m All segments $m Revenue 400 100 50 550 Segment result (profit) 15 7 4. 26 Assets 900 200 1 200 100 All three business units earn their revenue from external customers. Total consolidated revenue of Company A for the year ended 30 June 2013 is $800 million. Included in general department stores' revenue is $50 million of revenue from toy stores. As at the end of the reporting period toy stores owed general department stores $45 million. This amount is included in general department stores' assets. Within the general department stores business unit there are five different legal entities including legal entities Y and Z. As at 30 June 2013 legal entity Z owed $23 million to legal entity Y. These amounts have not been eliminated in determining the assets of the general department stores segment. Inter-segment asset balances are reported to the CODM but are not used by the CODM as the basis for determining reportable segments. Intra-segment assets are reported to the CODM and are eliminated in determining reportable segments. Required State whether the following statements are true or false. Give reasons for your answers. 1. Company A has three reportable segments. 2. The revenue figure that should be used by the general department stores segment for the purposes of determining whether or not it is a reportable segment is $350 million. 3. Company A must disclose the toy stores segment liabilities after deducting the $45 million owed to general department stores. 4. The assets figure that should be used by the general department stores segment for the purposes of determining whether or not it is a reportable segment is $900 million. 5. The assets figure that should be used by the general department stores segment for the purposes of determining whether or not it is a reportable segment is $855 million. 6. The assets figure that should be used by the general department stores segment for the purposes of determining whether or not it is a reportable segment is $877 million. 7. Company A must disclose a reconciliation of total segment assets to its consolidated assets of $1132 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts