Question: Reporting Amounts on the Four Basic Financial Statements and Evaluating Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions displayed below.]

![Statements [LO 1-2, LO 1-3] [The following information applies to the questions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd60b3d54c8_39566fd60b376648.jpg)

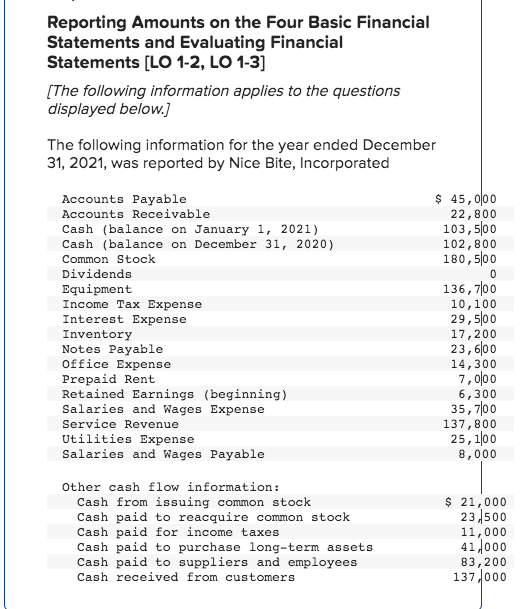

Reporting Amounts on the Four Basic Financial Statements and Evaluating Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions displayed below.] The following information for the year ended December 31, 2021, was reported by Nice Bite, Incorporated Accounts Payable Accounts Receivable Cash (balance on January 1, 2021) Cash (balance on December 31, 2020) Common Stock Dividends Equipment Income Tax Expense Interest Expense Inventory Notes Payable Office Expense Prepaid Rent Retained Earnings (beginning) Salaries and Wages Expense Service Revenue Utilities Expense Salaries and Wages Payable $ 45, 0100 22,800 103,500 102,800 180,500 0 136,700 10,100 29,5100 17,200 23, 6100 14,300 7, 0100 6,300 35,700 137,800 25, 1100 8,000 Other cash flow information: Cash from issuing common stock Cash paid to reacquire common stock Cash paid for income taxes Cash paid to purchase long-term assets Cash paid to suppliers and employees Cash received from customers $ 21,000 23,500 11,000 41,000 83,200 137,000 4. Prepare a statement of cash flows for 2021. (Cash outflows should be entered as negative amounts.) NICE BITE Incorporated Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities $ 0 Cash Flows from Investing Activities 0 Cash Flows from Financing Activities 0 $ $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts