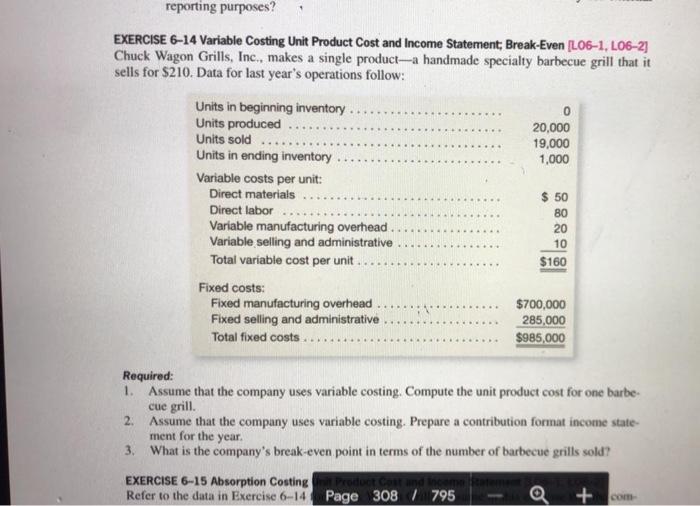

Question: reporting purposes? EXERCISE 6-14 Variable Costing Unit Product Cost and Income Statement: Break-Even |L06-1, L06-2] Chuck Wagon Grills, Inc., makes a single product-a handmade specialty

reporting purposes? EXERCISE 6-14 Variable Costing Unit Product Cost and Income Statement: Break-Even |L06-1, L06-2] Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow: Units in beginning inventory 0 Units produced 20,000 Units sold 19,000 Units in ending inventory 1,000 Variable costs per unit: Direct materials $ 50 Direct labor Variable manufacturing overhead 20 Variable selling and administrative Total variable cost per unit.... $160 Fixed costs: Fixed manufacturing overhead $700,000 Fixed selling and administrative 285,000 Total fixed costs $985,000 80 10 2. Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbe cue grill. Assume that the company uses variable costing. Prepare a contribution format income state- ment for the year. 3. What is the company's break-even point in terms of the number of barbecue grills sold? EXERCISE 6-15 Absorption Costing Refer to the data in Exercise 6-14 Page 308 795 Q +com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts