Question: Reposting because the first time it was incorrect. A new project involves the purchase of a $9000 food processing machine. The machine would be depreciated

Reposting because the first time it was incorrect.

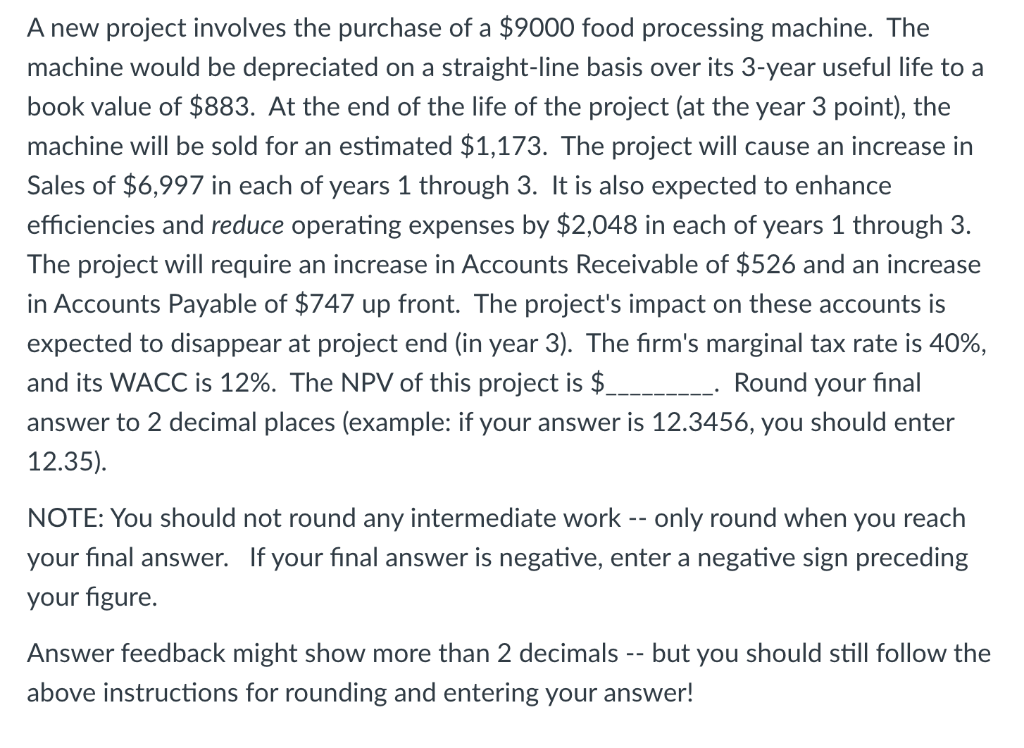

A new project involves the purchase of a $9000 food processing machine. The machine would be depreciated on a straight-line basis over its 3-year useful life to a book value of $883. At the end of the life of the project (at the year 3 point), the machine will be sold for an estimated $1,173. The project will cause an increase in Sales of $6,997 in each of years 1 through 3. It is also expected to enhance efficiencies and reduce operating expenses by $2,048 in each of years 1 through 3. The project will require an increase in Accounts Receivable of $526 and an increase in Accounts Payable of $747 up front. The project's impact on these accounts is expected to disappear at project end (in year 3). The firm's marginal tax rate is 40%, and its WACC is 12%. The NPV of this project is $. Round your final answer to 2 decimal places (example: if your answer is 12.3456, you should enter 12.35). NOTE: You should not round any intermediate work -- only round when you reach your final answer. If your final answer is negative, enter a negative sign preceding your figure. Answer feedback might show more than 2 decimals -- but you should still follow the above instructions for rounding and entering your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts