Question: reposting this question as the original answer without explanation appears incorrect. Please provide computations. Birch Corp. is a real estate developer with its headquarters in

reposting this question as the original answer without explanation appears incorrect. Please provide computations.

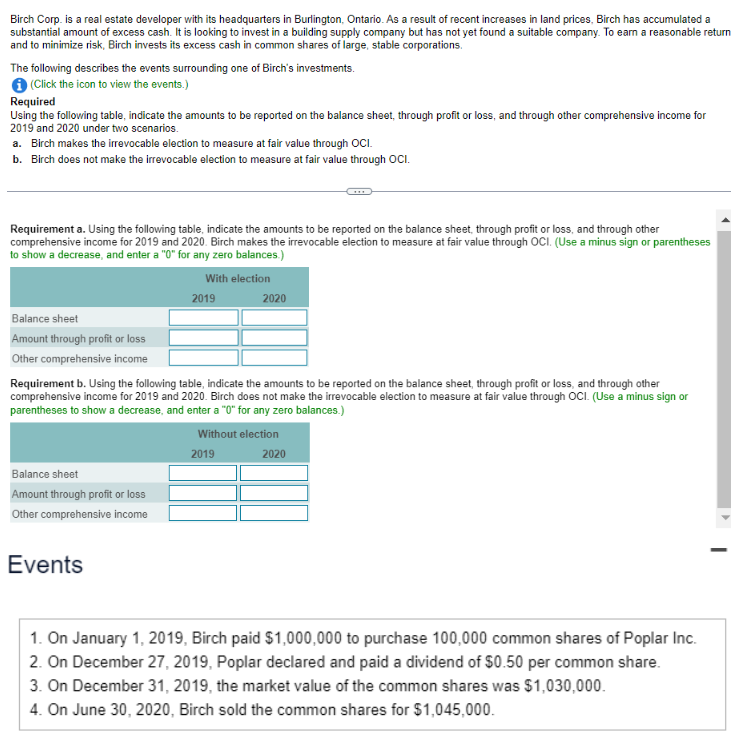

Birch Corp. is a real estate developer with its headquarters in Burlington, Ontario. As a result of recent increases in land prices, Birch has accumulated a substantial amount of excess cash. It is looking to invest in a building supply company but has not yet found a suitable company. To earn a reasonable retur and to minimize risk, Birch invests its excess cash in common shares of large, stable corporations. The following describes the events surrounding one of Birch's investments. (Click the icon to view the events.) Required Using the following table, indicate the amounts to be reported on the balance sheet, through profit or loss, and through other comprehensive income for 2019 and 2020 under two scenarios. a. Birch makes the irrevocable election to measure at fair value through OCl. b. Birch does not make the irrevocable election to measure at fair value through OCl. Requirement a. Using the following table, indicate the amounts to be reported on the balance sheet, through profit or loss, and through other comprehensive income for 2019 and 2020 . Birch makes the irrevocable election to measure at fair value through OCl. (Use a minus sign or parentheses to show a decrease, and enter a "0" for any zero balances.) Requirement b. Using the following table, indicate the amounts to be reported on the balance sheet, through profit or loss, and through other comprehensive income for 2019 and 2020 . Birch does not make the irrevocable election to measure at fair value through OCl. (Use a minus sign or parentheses to show a decrease, and enter a "0" for any zero balances.) Events 1. On January 1, 2019, Birch paid $1,000,000 to purchase 100,000 common shares of Poplar Inc. 2. On December 27, 2019, Poplar declared and paid a dividend of $0.50 per common share. 3. On December 31,2019 , the market value of the common shares was $1,030,000. 4. On June 30,2020 , Birch sold the common shares for $1,045,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts