Question: represent Apple Inc. cash flow statement with explanation for the last 5 years i need the explanation for the cash flow statement for example; the

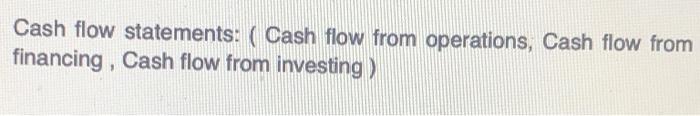

Cash flow statements: ( Cash flow from operations, Cash flow from financing , Cash flow from investing ) Year 2020 2019 2018 2017 2016 Cash Flow Statement Operations Financing $80,674 (586,820) $69,391 ($90,976) $77,434 ($87,876) $64,225 ($17,974) $66,231 ($20,890) Investing ($4,289) $45,896 $16,066 ($46,446) ($45,977) In 2016, the total sales were $ 214,226. Then, it increases in 2017 and 2018. while it decreasing in 2019. Then increases to $274,150 in 2020. .NET INCOME: In 2016, the net income were $ 45,687. Then, it increases in 2017 and 2018. while it decreasing in 2019. Then increases to $57,411 in 2020. COST OF GOODS SOLD: COST OF GOODS SOLD In 2016, the cost of goods sold were $131,506. Then, it increases in 2017 and 2018. while it decreasing in 2019. Then increases to $170,143 in 2020. DEPRECIATION DEPERECIATION: In 2016, the depreciation were $8,300. Then, it decreasing in 2017 and increases again in 2018 and 2019. Then decreasing to $11,056 in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts