Question: Repulse Bay Corporation is trying to choose between two mutually exclusive projects. Project A has a 5 year expected life while project B has a

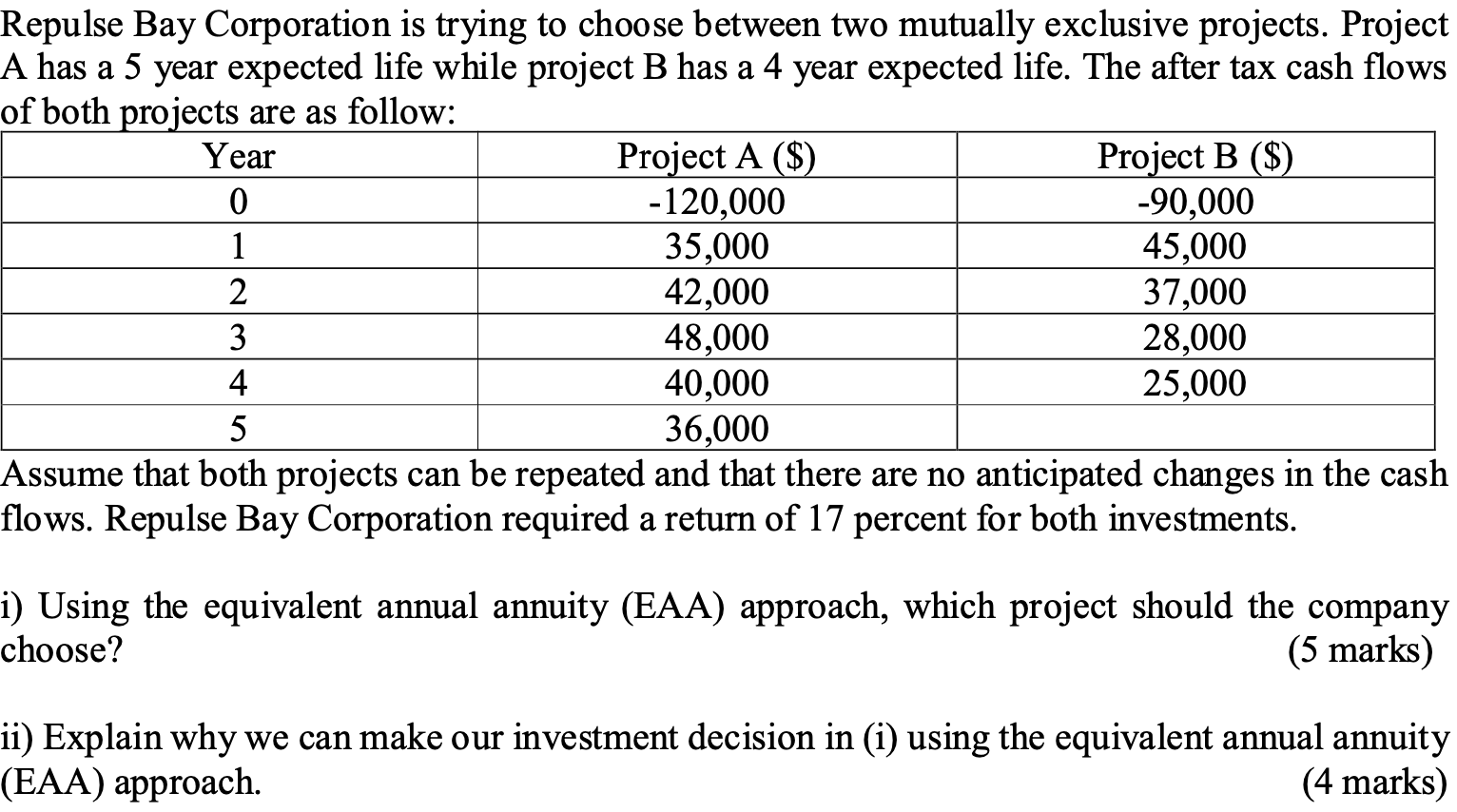

Repulse Bay Corporation is trying to choose between two mutually exclusive projects. Project A has a 5 year expected life while project B has a 4 year expected life. The after tax cash flows of both projects are as follow: Year Project A ($) Project B ($) 0 -120,000 -90,000 1 35,000 45,000 2 42,000 37,000 3 48,000 28,000 4 40,000 25,000 5 36,000 Assume that both projects can be repeated and that there are no anticipated changes in the cash flows. Repulse Bay Corporation required a return of 17 percent for both investments. i) Using the equivalent annual annuity (EAA) approach, which project should the company choose? (5 marks) ii) Explain why we can make our investment decision in (i) using the equivalent annual annuity (EAA) approach. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts