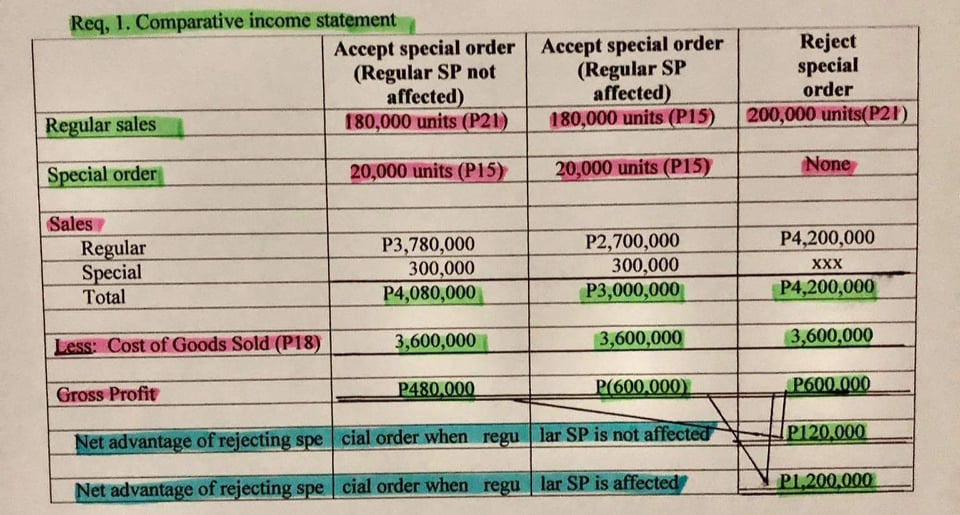

Question: Req, 1. Comparative income statement Regular sales Accept special order (Regular SP not affected) 180,000 units (P21) Accept special order (Regular SP Reject special

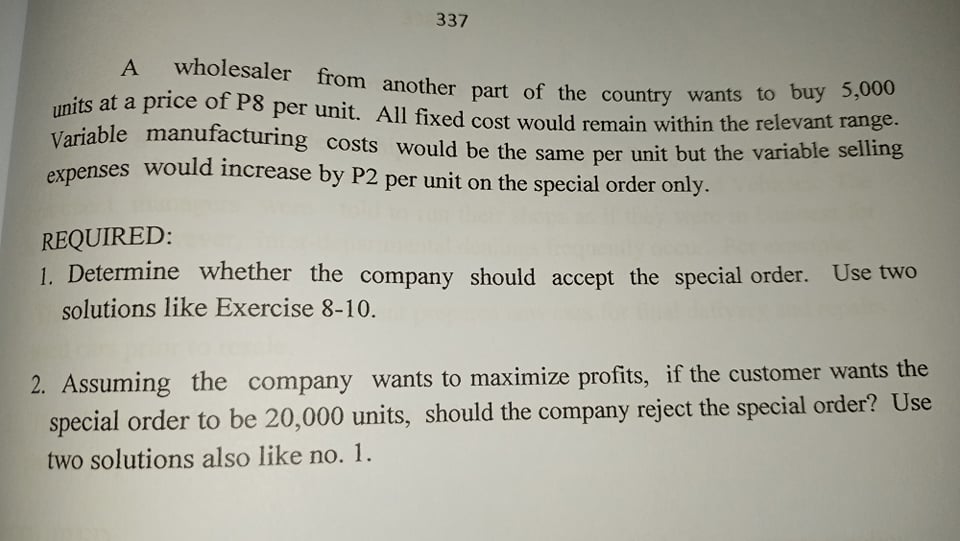

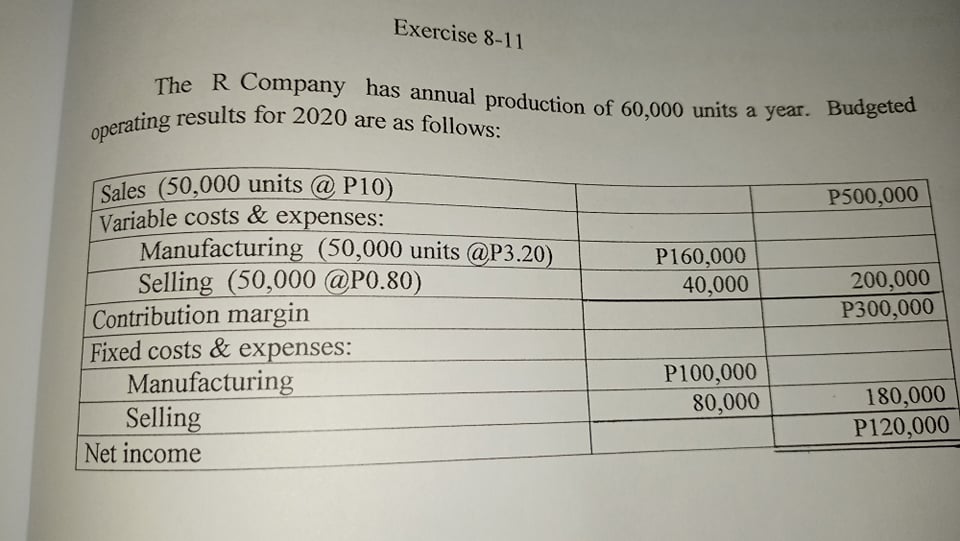

Req, 1. Comparative income statement Regular sales Accept special order (Regular SP not affected) 180,000 units (P21) Accept special order (Regular SP Reject special affected) order 180,000 units (P15) 200,000 units(P21) Special order 20,000 units (P15) 20,000 units (P15) None Sales Regular Special Total P3,780,000 P2,700,000 P4,200,000 300,000 300,000 XXX P4,080,000 P3,000,000 P4,200,000 Less: Cost of Goods Sold (P18) 3,600,000 3,600,000 3,600,000 Gross Profit P480,000 P(600.000) P600.000 Net advantage of rejecting special order when regular SP is not affected P120,000 Net advantage of rejecting special order when regu lar SP is affected P1,200,000 A 337 wholesaler from another part of the country wants to buy 5,000 units at a price of P8 per unit. All fixed cost would remain within the relevant range. Variable manufacturing costs would be the same per unit but the variable selling expenses would increase by P2 per unit on the special order only. REQUIRED: 1. Determine whether the company should accept the special order. Use two solutions like Exercise 8-10. 2. Assuming the company wants to maximize profits, if the customer wants the special order to be 20,000 units, should the company reject the special order? Use two solutions also like no. 1. Exercise 8-11 The R Company has annual production of 60,000 units a year. Budgeted operating results for 2020 are as follows: Sales (50,000 units @ P10) Variable costs & expenses: P500,000 Manufacturing (50,000 units @P3.20) P160,000 Selling (50,000 @P0.80) 40,000 Contribution margin 200,000 P300,000 Fixed costs & expenses: Manufacturing Selling Net income P100,000 80,000 180,000 P120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts