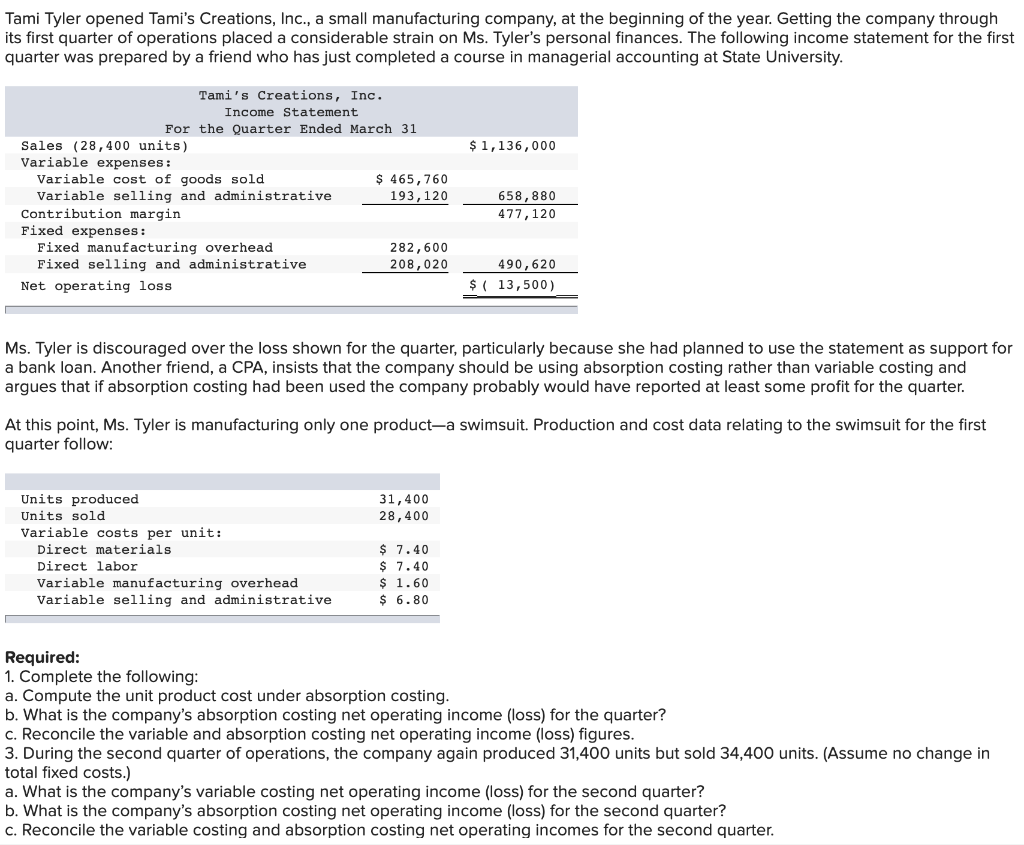

Question: Req 1A Req 1B Req 1C Req Req 3B Req 3C During the second quarter of operations, the company again produced 31,400 units but sold

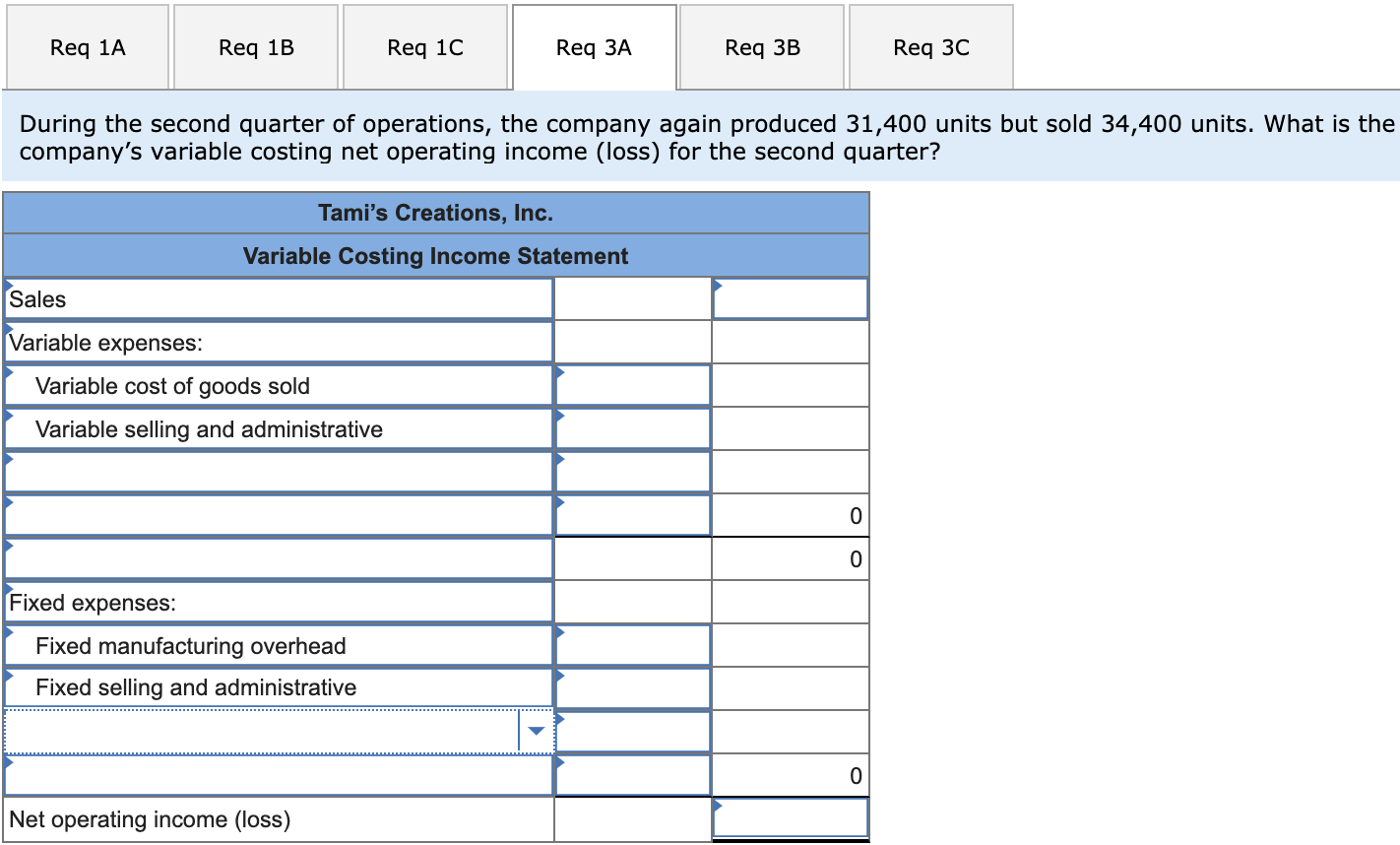

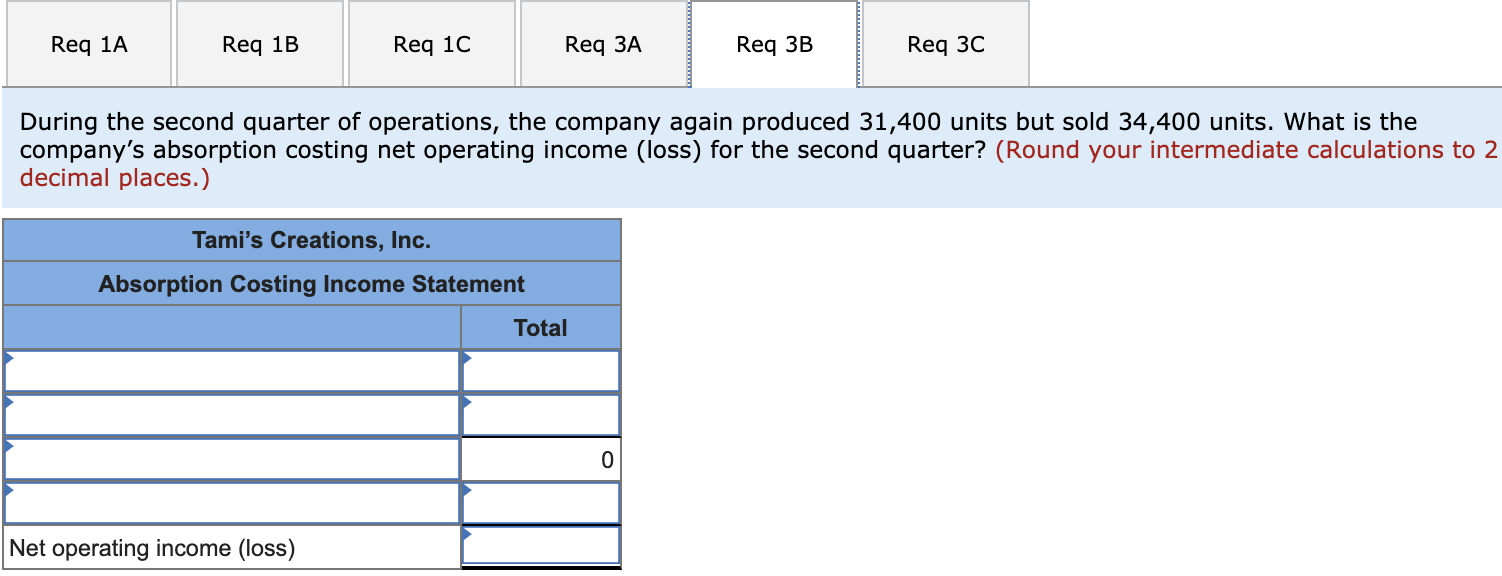

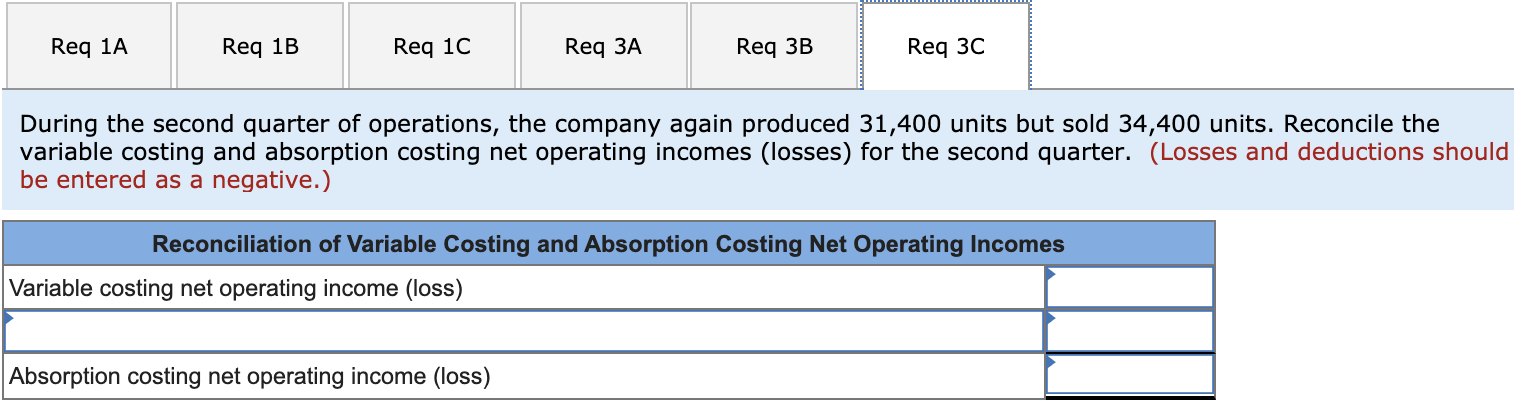

Req 1A Req 1B Req 1C Req Req 3B Req 3C During the second quarter of operations, the company again produced 31,400 units but sold 34,400 units. What is the company's variable costing net operating income (loss) for the second quarter? Tami's Creations, Inc. Variable Costing Income Statement Sales Variable expenses: Variable cost of goods sold Variable selling and administrative 0 0 Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative 0 Net operating income (loss) Reg 1A Reg 1B Reg 1c Req Req 3B Reg 3C During the second quarter of operations, the company again produced 31,400 units but sold 34,400 units. What is the company's absorption costing net operating income (loss) for the second quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Absorption Costing Income Statement Total 0 Net operating income (loss) Req 1A Req 1B Req 1c Req Req 3B Req 3C During the second quarter of operations, the company again produced 31,400 units but sold 34,400 units. Reconcile the variable costing and absorption costing net operating incomes (losses) for the second quarter. (Losses and deductions should be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts