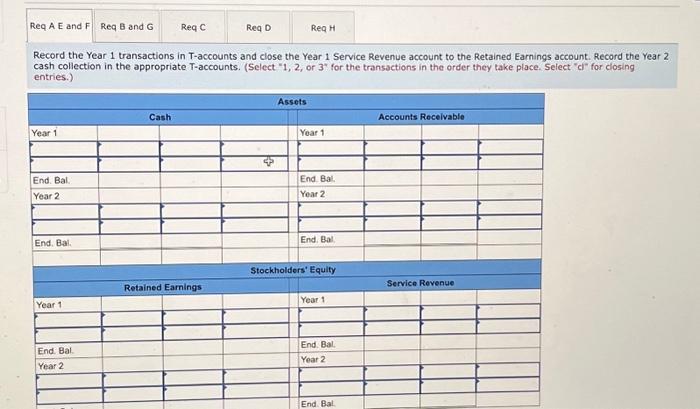

Question: Req A E and F Req B and G Year 1 End. Bal. Year 2 Record the Year 1 transactions in T-accounts and close the

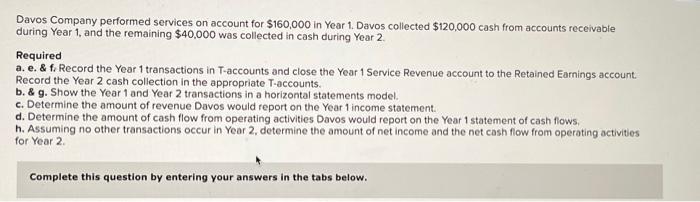

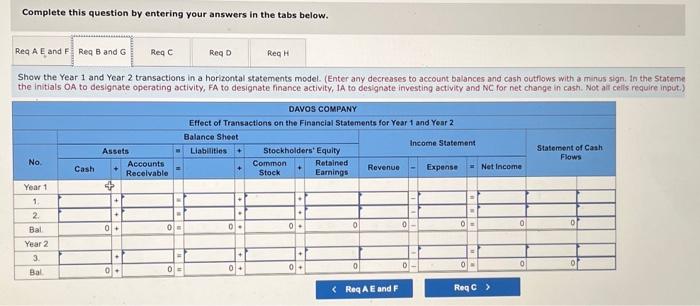

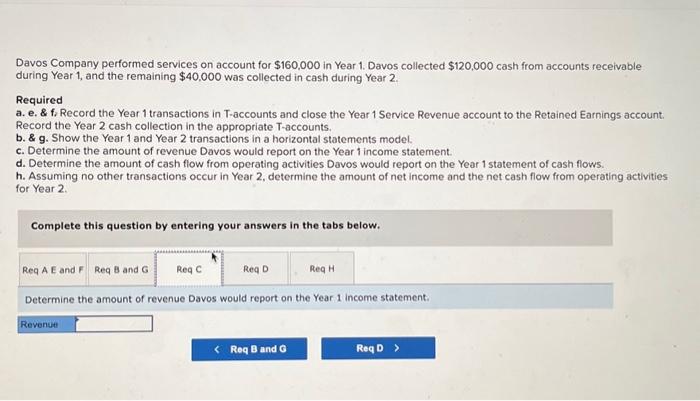

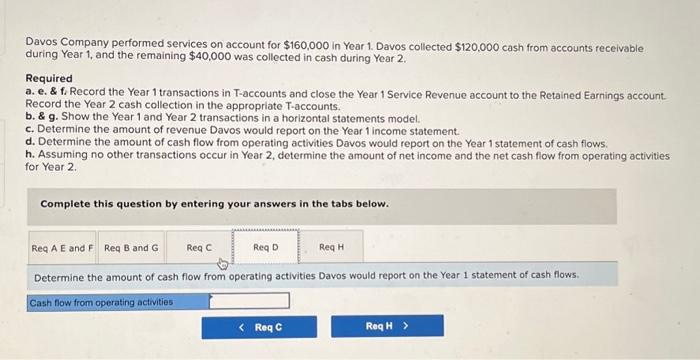

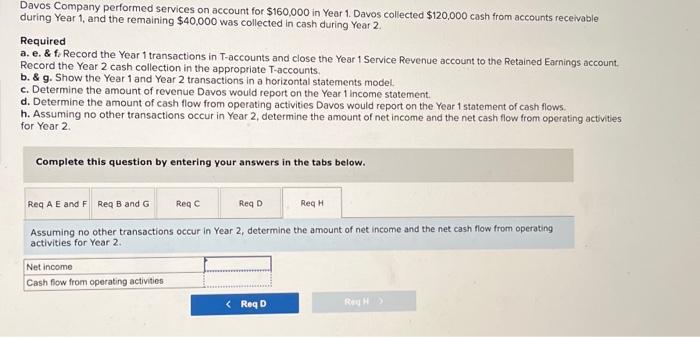

Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts. (Select " 1,2 , or 3 for the transactions in the order they take place. Select "cl" for closing entries.) Davos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1 , and the remaining $40,000 was collected in cash during Year 2 . Required a. e. \& f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts. b. \& g. Show the Year 1 and Year 2 transactions in a horizontal statements model. c. Determine the amount of revenue Davos would report on the Year 1 income statement. d. Determine the amount of cash flow from operating activities Davos would report on the Year 1 statement of cash flows. h. Assuming no other transactions occur in Year 2, determine the amount of net income and the net cash flow from operating activities for Year 2. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Show the Year 1 and Year 2 transactions in a horizontal statements model. (Enter any decreases to account balances and cash outflows with a minus sign. In the State the initials OA to designate operating activity, FA to designate finance activity, 1 A to designate investing activity and NC for net change in cash. Not aif cells require inpi Davos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1 , and the remaining $40,000 was collected in cash during Year 2. Required a. e. \& f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts. b. \& g. Show the Year 1 and Year 2 transactions in a horizontal statements model. c. Determine the amount of revenue Davos would report on the Year 1 income statement. d. Determine the amount of cash flow from operating activities Davos would report on the Year 1 statement of cash flows. h. Assuming no other transactions occur in Year 2, determine the amount of net income and the net cash flow from operating activities for Year 2. Complete this question by entering your answers in the tabs below. Determine the amount of revenue Davos would report on the Year 1 income statement. Davos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1 , and the remaining $40,000 was collected in cash during Year 2 . Required a. e. \& f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts. b. \& g. Show the Year 1 and Year 2 transactions in a horizontal statements model. c. Determine the amount of revenue Davos would report on the Year 1 income statement. d. Determine the amount of cash flow from operating activities Davos would report on the Year 1 statement of cash flows. h. Assuming no other transactions occur in Year 2 , determine the amount of net income and the net cash flow from operating activities for Year 2. Complete this question by entering your answers in the tabs below. Determine the amount of cash flow from operating activities Davos would report on the Year 1 statement of cash flows. Davos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1 , and the remaining $40,000 was collected in cash during Year 2 . Required a. e. \& f Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts. b. \& g. Show the Year 1 and Year 2 transactions in a horizontal statements model. c. Determine the amount of revenue Davos would report on the Year 1 income statement. d. Determine the amount of cash flow from operating activities Davos would report on the Year 1 statement of cash flows. h. Assuming no other transactions occur in Year 2, determine the amount of net income and the net cash flow from operating activities for Year 2. Complete this question by entering your answers in the tabs below. Assuming no other transactions occur in Year 2, determine the amount of net income and the net cash flow from operating activities for Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts