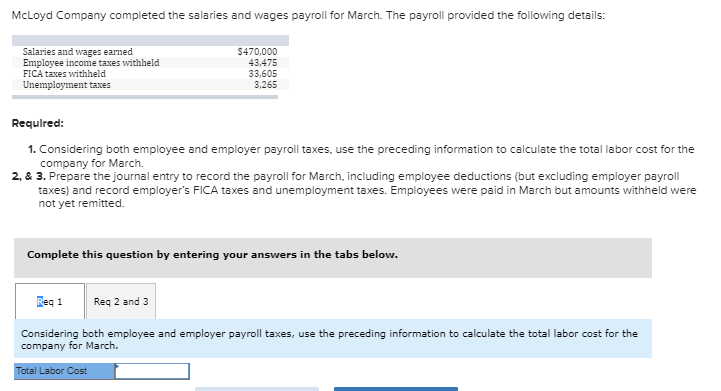

Question: Req1 Req 2 and 3 Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record

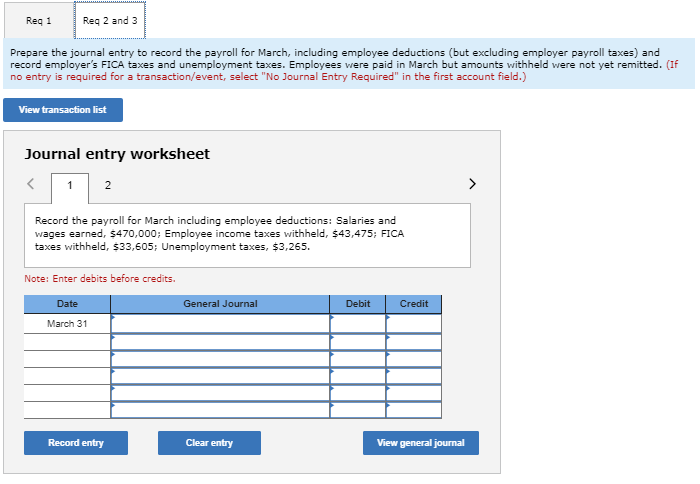

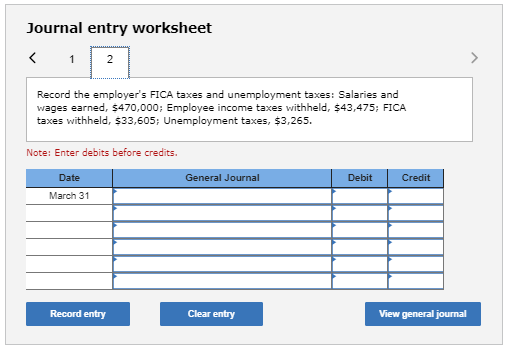

Req1 Req 2 and 3 Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer's FICA taxes and unemployment taxes. Employees were paid in March but amounts withheld were not yet remitted. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the payroll for March including employee deductions: Salaries and wages earned, $470,000; Employee income taxes withheld, $43,475; FICA taxes withheld, $33,605; Unemployment taxes, $3,265. Note: Enter debits before credits bit Credit Date General Journal March 31 Record entry Clear entry View general journal Journal entry worksheet Record the employer's FICA taxes and unemployment taxes: Salaries and wages earned, $470,000; Employee income taxes withheld, $43,475: FICA taxes withheld, $33,605; Unemployment taxes, $3,265 Note: Enter debits before credits Date General Journal Debit Credit March 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts