Question: Requesting assistance with this assignment. Please include the formulas in the cells to help with better understanding. The spreadsheet is under this link: https://docs.google.com/spreadsheets/d/1X13j4pXgR4P_SP-kPKtqdkcgSbnITdYv/edit?usp=sharing&ouid=104188387970967450917&rtpof=true&sd=true Question

Requesting assistance with this assignment. Please include the formulas in the cells to help with better understanding. The spreadsheet is under this link: https://docs.google.com/spreadsheets/d/1X13j4pXgR4P_SP-kPKtqdkcgSbnITdYv/edit?usp=sharing&ouid=104188387970967450917&rtpof=true&sd=true

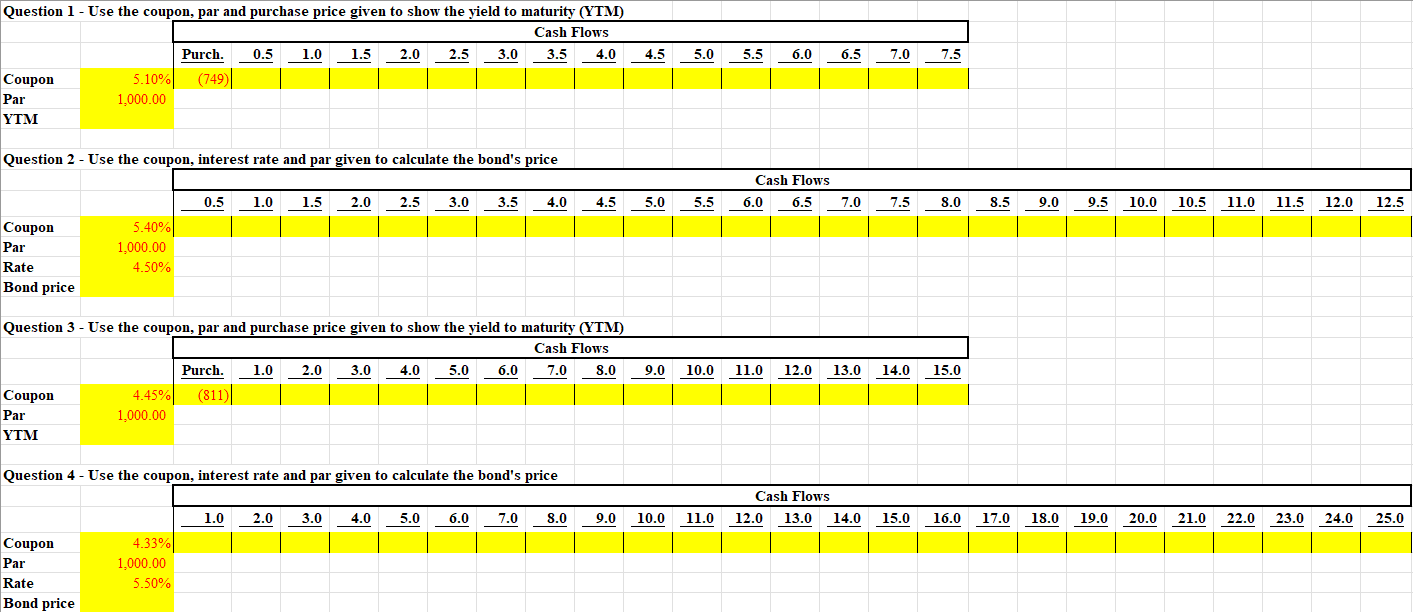

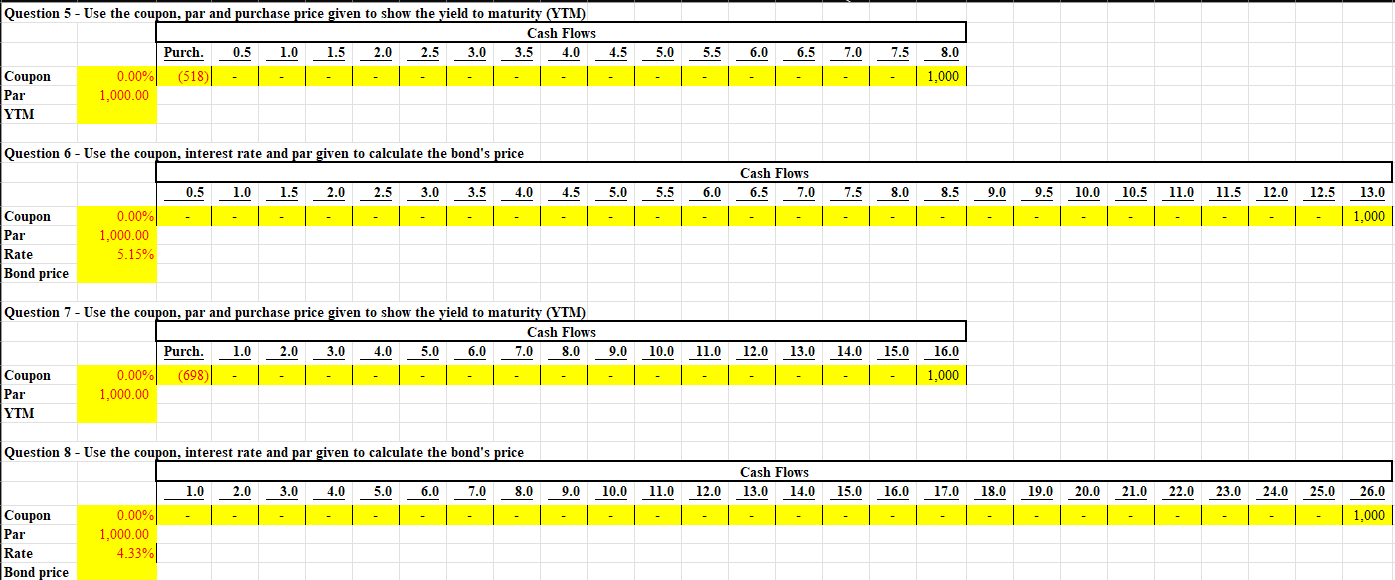

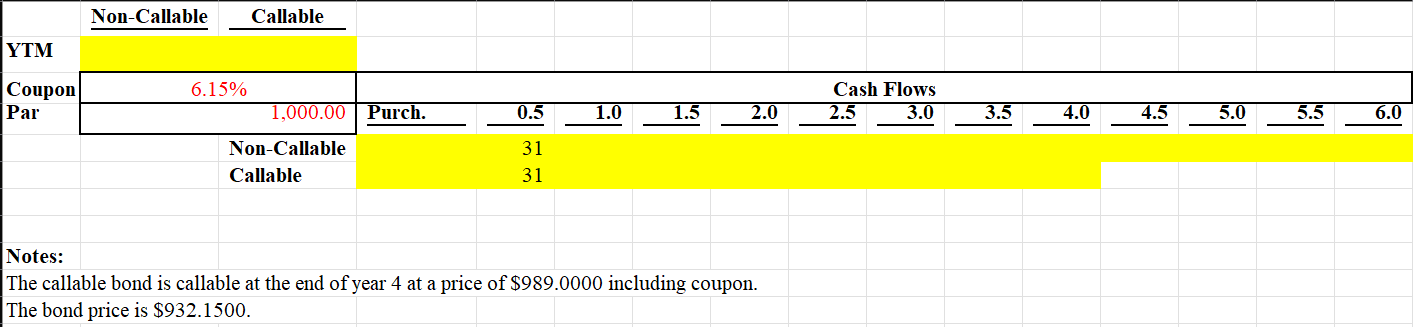

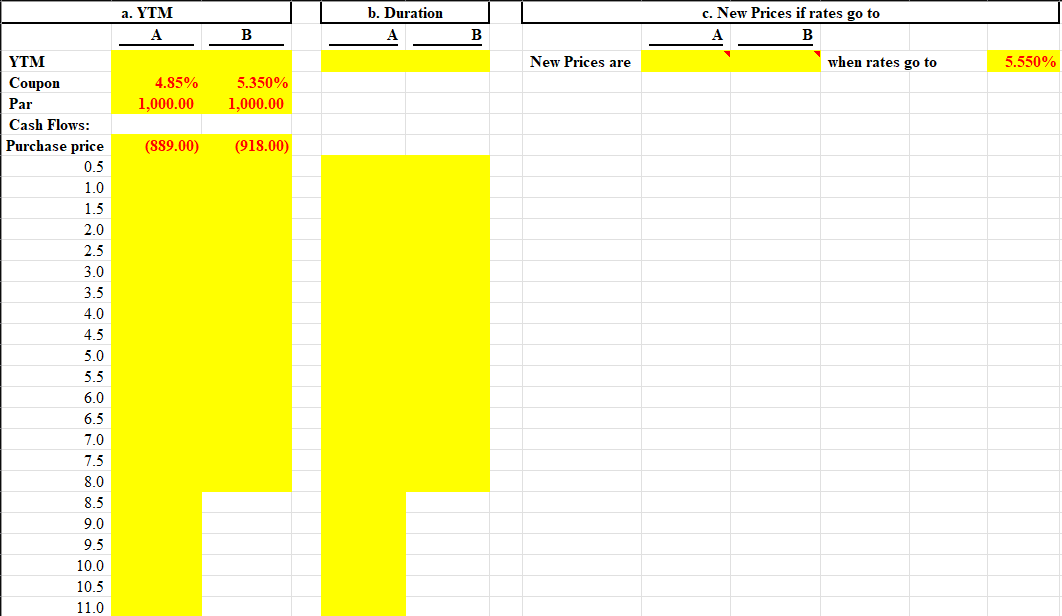

Question 1 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) Cash Flows Purch 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 Coupon 5.10% (749) Par 1,000.00 YTM Question 2 - Use the coupon, interest rate and par given to calculate the bond's price Cash Flows 9.0 9.5 10.0 10.5 11.0 11.5 12.0 12.5 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 3.0 8.5 Coupon 5.40% Par 1,000.00 Rate 4.50% Bond price Question 3 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) Cash Flows Purch 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 Coupon 4.45% (811) Par 1,000.00 YTM Question 4 - Use the coupon, interest rate and par given to calculate the bond's price Cash Flows 2.0 3.0 5.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0 1.0 4.0 6.0 Coupon 4.33% Par 1,000.00 Rate 5.50% Bond priceQuestion 5 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) Cash Flows Purch 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Coupon 0.00% (518) 1,000 Par 1,000.00 YTM Question 6 - Use the coupon, interest rate and par given to calculate the bond's price Cash Flows 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 11.0 11.5 12.0 12.5 13.0 Coupon 0.00% 1,000 Par 1,000.00 Rate 5.15% Bond price Question 7 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) Cash Flows Purch 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 .0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 Coupon 0.00% 698 1,000 Par 1,000.00 YTM Question 8 - Use the coupon, interest rate and par given to calculate the bond's price Cash Flows 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0 26. 1,000 Coupon 0.00% Par 1,000.00 Rate 4.33% Bond priceNon-Callable Callable YTM Cash Flows Coupon 6.15% 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 Par 1,000.00 Purch 0.5 1.0 Non-Callable 31 Callable 31 Notes: The callable bond is callable at the end of year 4 at a price of $989.0000 including coupon. The bond price is $932.1500.a. YTM b. Duration c. New Prices if rates go to A B A B A B YTM New Prices are when rates go to 5.550% Coupon 4.85% 5.350% Par 1,000.00 1,000.00 Cash Flows: Purchase price (889.00) (918.00) 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 11.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts