Question: Requied help for final Asap. submission in 2 days. PEG = P/E / Expected Growth Rate in Earnings (as this is often a percentage, it

Requied help for final Asap. submission in 2 days.

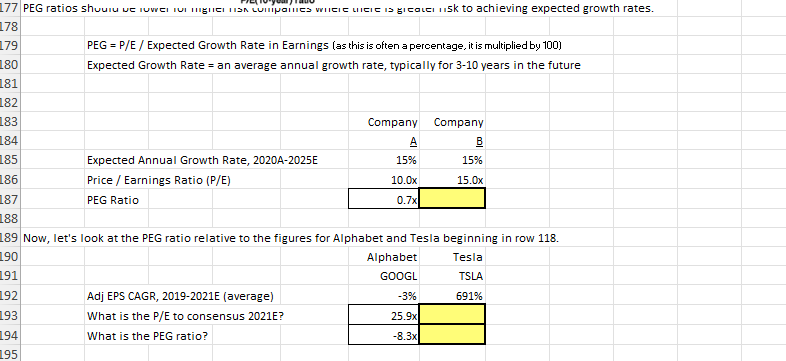

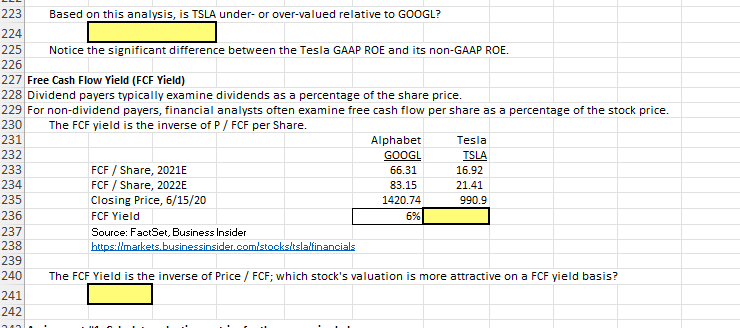

PEG = P/E / Expected Growth Rate in Earnings (as this is often a percentage, it is multiplied by 100) Expected Growth Rate = an average annual growth rate, typically for 3-10 years in the future 223 Based on this analysis, is TSLA under- or over-valued relative to GOOGL? Notice the significant difference between the Tesla GAAP ROE and its non-GAAP ROE. Free Cash Flow Yield (FCF Yield) Dividend payers typically examine dividends as a percentage of the share price. For non-dividend payers, financial analysts often examine free cash flow per share as a percentage of the stock price. The FCF yield is the inverse of P / FCF per Share. FCF / Share, 2021E FCF / Share, 2022E Closing Price, 6/15/20 FCF Yield Source: FactSet, Business Insider hetps:illmarkets,businessinsider.comistocksiltslaltinancials The FCF Yield is the inverse of Price / FCF; which stock's valuation is more attractive on a FCF yield basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts