Question: require answer asap Design Layout References Mailings Review View Help imes New Rom 10 AA AA EEEEEE ALI BIU , * A-D-A- - - -

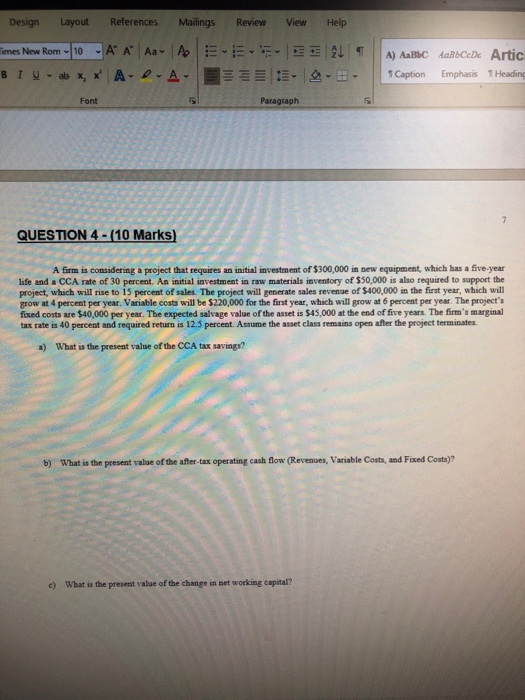

Design Layout References Mailings Review View Help imes New Rom 10 AA AA EEEEEE ALI BIU , * A-D-A- - - - A) ABC dakbCcDc Artic 1 Caption Emphasis T Heading Font Paragraph QUESTION 4 - (10 Marks) A firm is considering a project that requires an initial investment of $300,000 in new equipment, which has a five year life and a CCA rate of 30 percent. An initial investment in raw materials inventory of $50,000 is also required to support the project, which will rise to 15 percent of sales. The project will generate sales revenue of $400,000 in the first year, which will grow at 4 percent per year. Variable costs will be $220,000 for the first year, which will grow at 6 percent per year. The project's fixed costs are $40,000 per year. The expected salvage value of the asset is $45.000 at the end of five years. The firm's marginal tax rate is 40 percent and required return is 12.5 percent. Assume the asset class remains open after the project terminates a) What is the present value of the CCA tax savings? b) What is the presen of the after tax operating cash flow (Revenues, Variable costs and Fixed Costa) c) What is the present value of the change in net working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts