Question: require full notes or workings!!! Question 2 The summarised statements of profit or loss of P and S, for the year ended 31 October 2020

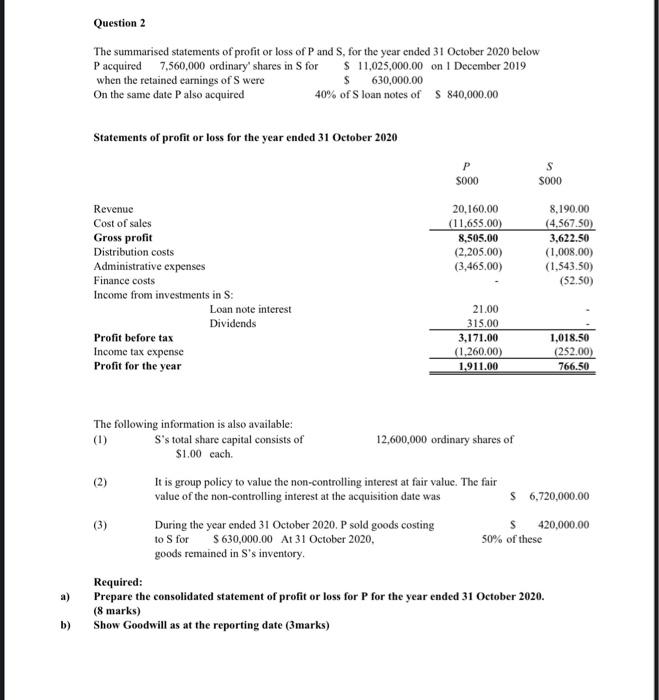

Question 2 The summarised statements of profit or loss of P and S, for the year ended 31 October 2020 below Pacquired 7,560,000 ordinary' shares in S for $ 11,025,000.00 on 1 December 2019 when the retained earnings of S were $ 630,000.00 On the same date Palso acquired 40% of Sloan notes of S 840,000.00 Statements of profit or loss for the year ended 31 October 2020 P S000 S S000 20,160.00 (11,655.00) 8,505.00 (2,205.00) (3,465.00) Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Income from investments in S. Loan note interest Dividends Profit before tax Income tax expense Profit for the year 8,190,00 (4,567.50) 3,622.50 (1,008.00) (1,543.50) (52.50) 21.00 315.00 3,171.00 (1.260.00) 1.911.00 1,018.50 (252.00) 766.50 (2) The following information is also available: (1) S's total share capital consists of 12,600,000 ordinary shares of $1,00 cach. ( It is group policy to value the non-controlling interest at fair value. The fair value of the non-controlling interest at the acquisition date was $ 6,720,000.00 (3) During the year ended 31 October 2020. P sold goods costing $ 420,000.00 to Sfor S 630,000.00 At 31 October 2020, 50% of these goods remained in S's inventory Required: Prepare the consolidated statement of profit or loss for P for the year ended 31 October 2020. (8 marks) Show Goodwill as at the reporting date (3marks) a) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts