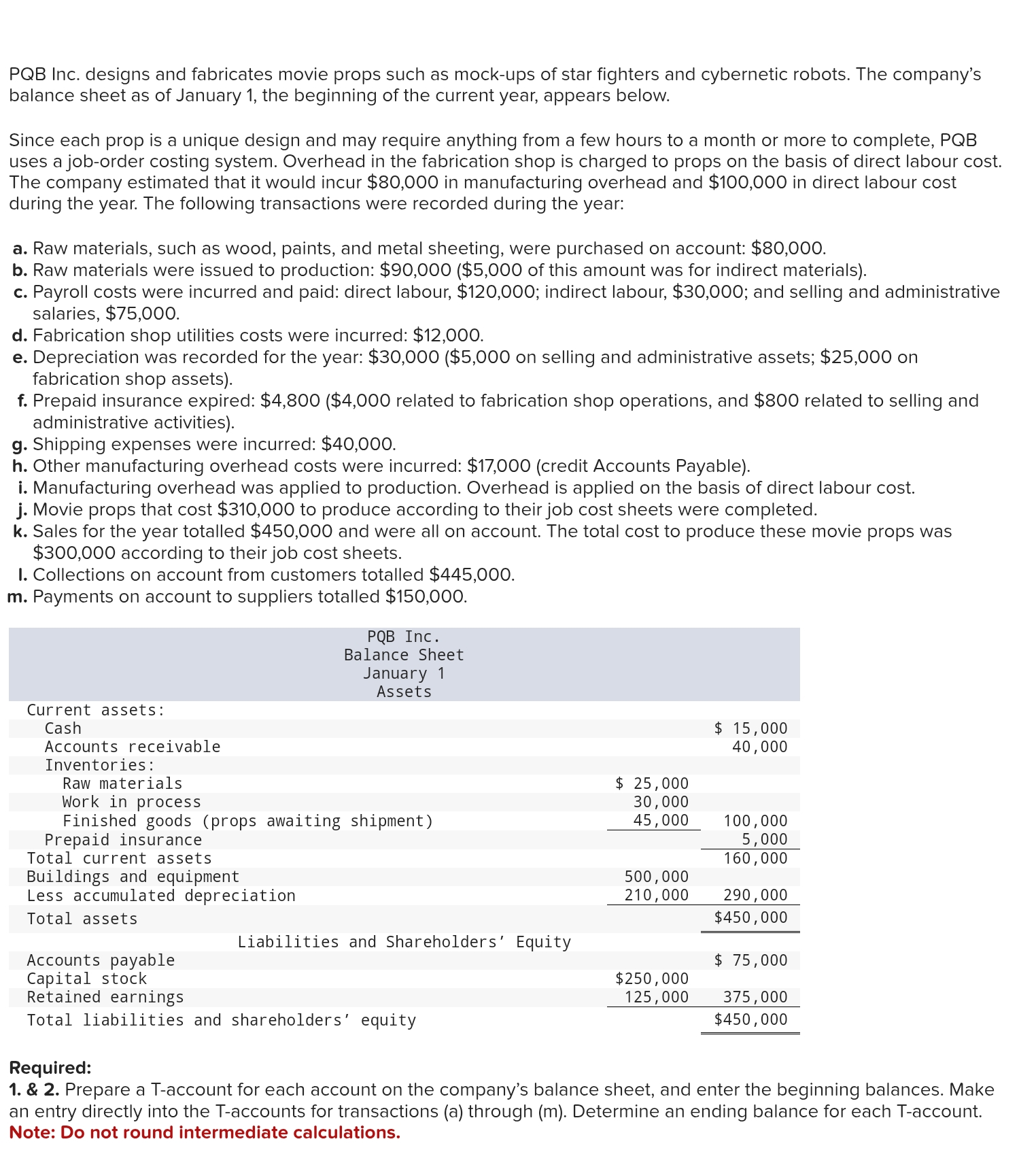

Question: Required: 1 . & 2 . Prepare a T - account for each account on the company's balance sheet, and enter the beginning balances.

Required:

& Prepare a Taccount for each account on the company's balance sheet, and enter the beginning balances. Make an entry directly into the T accounts for transactions a through m Determine an ending balance for each T account. Note: Do not round intermediate calculations. a Was manufacturing overhead underapplied or overapplied for the year?

b Assume that the company allocates any overhead balance among the Work in Process, Finished Goods, and Cost of Goods Sold accounts, using the overall balances in each account. Prepare a journal entry to show the allocation. Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Round allocation percentages to one decimal place.

Journal entry worksheet

Record the entry to allocation of over applied overhead to the other account on the bases of amount of overhead apply during the year in the ending balance each account.

Note: Enter debits before credits. Prepare an income statement for the year.

begintabularlll

hline multicolumnc PQB Inc.

multicolumnc For the Year Ended December

hline & &

hline & &

hline & &

hline Selling and administrative expenses: & &

hline & &

hline & & $

hline & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock