Question: REQUIRED: 1. Abbott allocates overhead based upon direct labor hours (DLH). Estimate the OVERALL predetermined overhead rate. Abbott estimates that

REQUIRED:

1. Abbott allocates overhead based upon direct labor hours (DLH). Estimate the OVERALL predetermined overhead rate. Abbott estimates that it will incur 400 dlh for year. (3 pts).

1. On 1/1/20, ALC obtains a lamp-making machine for $1000 - on account. It has a 0 salvage value and a useful life of 5 years. Please give the journal entry to describe this transaction (3 pts).

1. On 1/1/20, ALC purchased 500 lbs (pounds) of grease at $2/pound ON ACCOUNT. (Please give this journal entry. (3 pts).

1. On 1/1/20, ALC purchases - on account - 100 Mountain Dew Cans for $100. It also purchases - on account - 100 Coca-Cola Cans for $100. It also purchases - on account - 100 SPRITE cans for $100. Please give the journal entry to record this transaction (3 pts).

1. On 1/1/20, ALC purchases - on account - 100 pieces of paper for $100. Please give the journal entry to describe this transaction (3 pts).

1. During the year, ALC Mountain Dew Lamp workers, requisitioned out 10 Mountain Dew Cans and 5 pieces of paper. Give the journal entry to describe this transaction (3 pts).

1. During the year, ALC Coca-Cola Lamp workers requisitioned out 10 Coca-Cola cans and 10 pieces of paper. Give the journal entry (3 pts).

1. During the year, ALC Sprite Lamp workers requisitioned out 10 Sprite cans and 5 pieces of paper. Give the journal entry (3 pts).

1. During the year, ALC Coca-Cola lamp workers requisitioned out 200 pounds of grease to helps make lamps. Please give the journal entry (3 pts

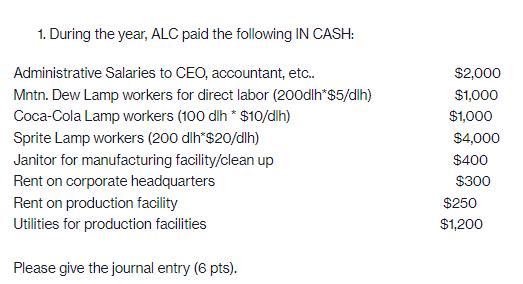

1. Give the journal entry to APPLY overhead (6 pts).

1. During the year, ALC MADE 10 MOUNTAIN DEW LAMPS and SOLD 5 Mountain Dew Lamps ON ACCOUNT for $1,000/lamp. Give the journal entry to describe the SALES transaction (5 pts).

1. During the year, ALC MADE 10 COCA-COLA LAMPS and SOLD 8 Coca-Cola Lamps for $500/lamp (or $4,000 total) in CASH. Give the journal entry to describe the SALES transaction (5 pts).

1. During the year, ALC MADE 10 SPRITE LAMPS and SOLD 5 Sprite Lamps for $800/lamp (or $4,000 total) in CASH. Give the journal entry to describe the SALES transaction (5 pts).

1. Give any adjusting journal entries needed on 12/31 (AND YOU DO NOT NEED TO DO THE INCOME STATEMENT CLOSING ENTRY). You may assume that all of the over/under applied overhead is closed to cost of goods sold (COGS) (6 pts).

1. Based upon 1-15 above, PREPARE THE INCOME STATEMENT FOR THE YEAR (4 pts).

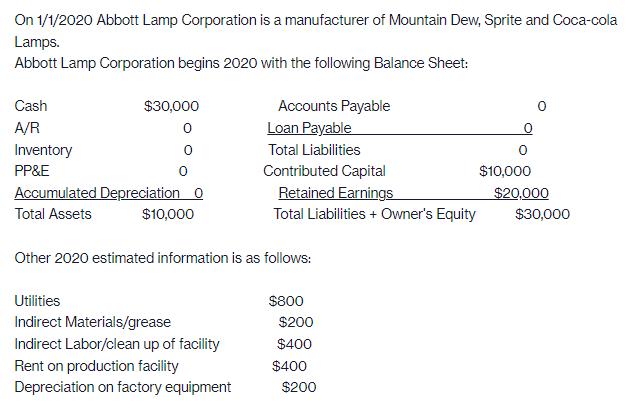

On 1/1/2020 Abbott Lamp Corporation is a manufacturer of Mountain Dew, Sprite and Coca-cola Lamps. Abbott Lamp Corporation begins 2020 with the following Balance Sheet: Cash A/R Inventory PP&E $30,000 0 0 0 Accumulated Depreciation O Total Assets $10,000 Accounts Payable Loan Payable Total Liabilities Utilities Indirect Materials/grease Indirect Labor/clean up of facility Rent on production facility Depreciation on factory equipment Contributed Capital Retained Earnings Total Liabilities + Owner's Equity Other 2020 estimated information is as follows: $800 $200 $400 $400 $200 0 $10,000 $20,000 $30,000

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Okay here are the answers in a stepbystep manner 1 Abbott allocates overhead based upon direct labor hours DLH Estimate the OVERALL predetermined overhead rate Abbott estimates that it will incur 400 ... View full answer

Get step-by-step solutions from verified subject matter experts