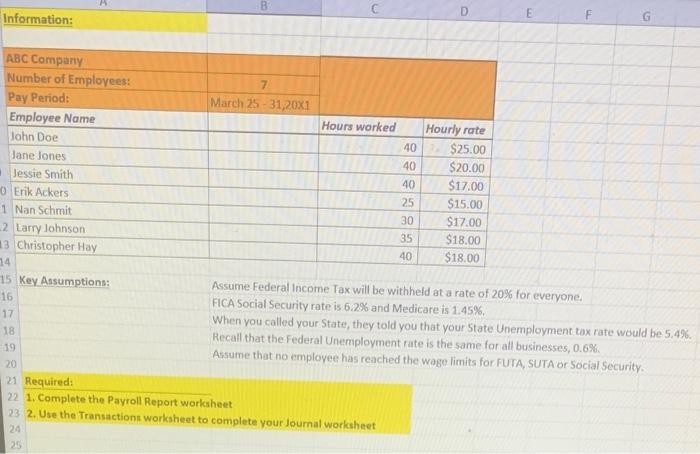

Question: REQUIRED: 1. Complete the Payroll worksheet 2. Use the transactions worksheet to complete your journal worksheet B D Information: F 40 ABC Company Number of

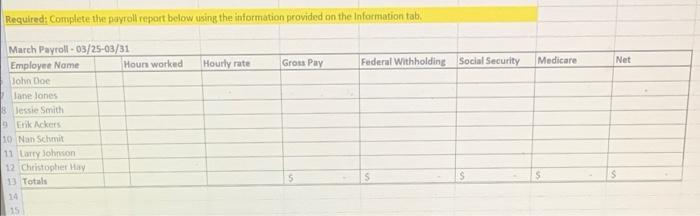

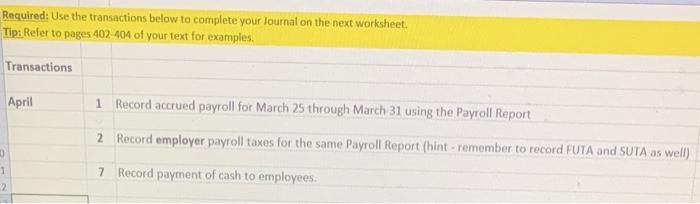

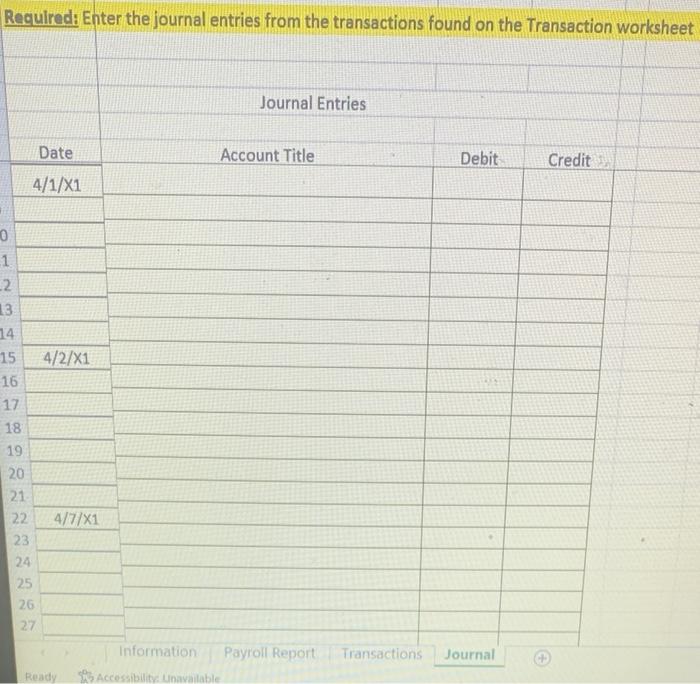

B D Information: F 40 ABC Company Number of Employees: 7 Pay Period: March 25 - 31,20X1 Employee Name Hours worked Hourly rate John Doe 40 $25.00 Jane Jones 40 $20.00 Jessie Smith $17.00 0 Erik Ackers 25 $15.00 1 Nan Schmit 30 $17.00 -2 Larry Johnson 35 $18.00 13 Christopher Hay 40 $18.00 14 15 key Assumptions: Assume Federal Income Tax will be withheld at a rate of 20% for everyone. 16 FICA Social Security rate is 6.2% and Medicare is 1.45% 17 When you called your State, they told you that your State Unemployment tax rate would be 5.4%. 18 Recall that the Federal Unemployment rate is the same for all businesses, 0.6% 19 Assume that no employee has reached the woge limits for FUTA, SUTA or Social Security 20 21 Required: 22 1. Complete the Payroll Report worksheet 23 2. Use the Transactions worksheet to complete your Journal worksheet 24 25 Required: Complete the payroll report below using the information provided on the Information tab Gross Pay Medicare Hourly rate Federal Withholding Social Security Net March Payroll - 03/25-03/31 Employee Name Hours worked John Doe Jane Jones Jessie Smith Erik Ackers 10 Nan Schmit 11 Larry Johnson 12. Christopher Hy 13 Totals 14 15 5 5 $ Required: Use the transactions below to complete your lournal on the next worksheet. Tip: Refer to pages 402-404 of your text for examples. Transactions April 1 Record accrued payroll for March 25 through March 31 using the Payroll Report 2 Record employer payroll taxes for the same Payroll Report (hint - remember to record FUTA and SUTA as well) 1 7 Record payment of cash to employees. Required: Enter the journal entries from the transactions found on the Transaction worksheet Journal Entries Date Account Title Debit Credit 4/1/X1 0 1 -2 13 14 15 4/27X1 16 17 18 19 20 21 22 4/7/X1 23 24 25 26 27 Information Payroll Report Ready Accessibility: unavailable Transactions Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts