Question: Required 1. Complete the six-column table by entering adjustments that reflect the following information: a. As of December 31, 2005, employees had earned $900 of

Required

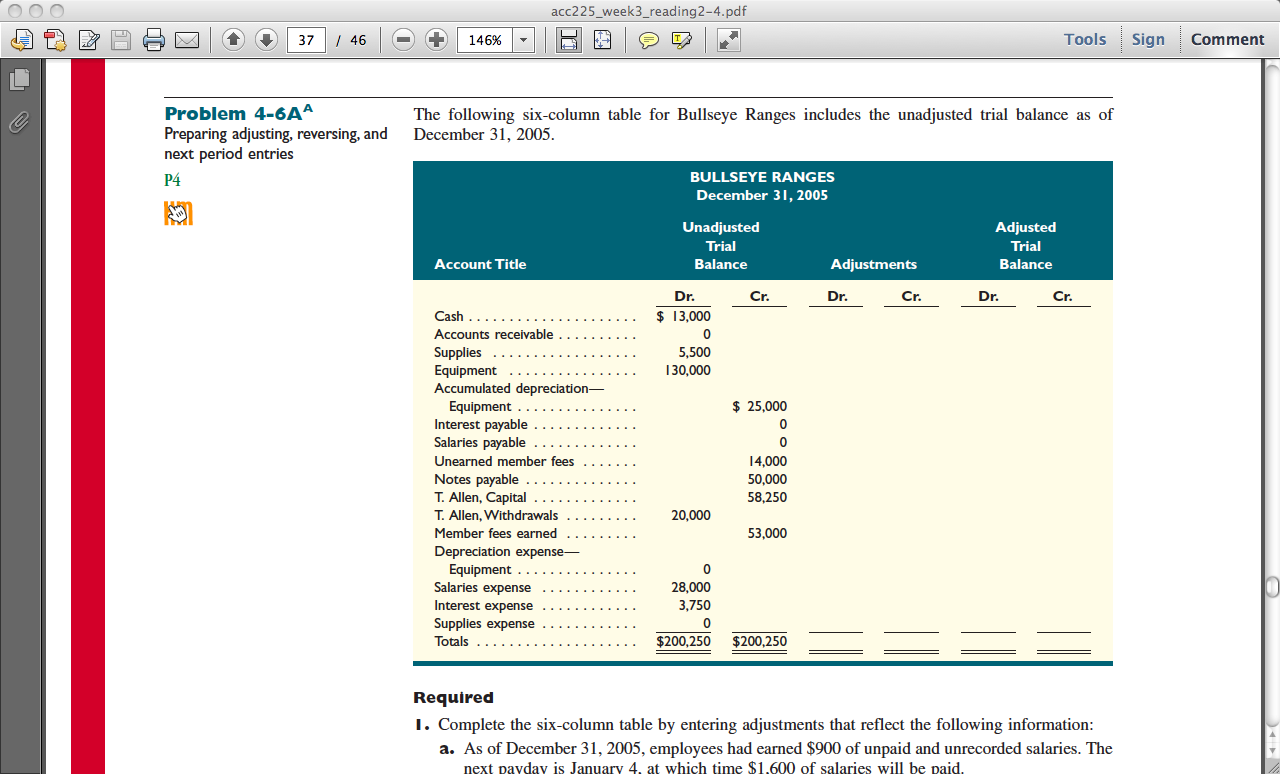

1. Complete the six-column table by entering adjustments that reflect the following information:

a. As of December 31, 2005, employees had earned $900 of unpaid and unrecorded salaries. The

next payday is January 4, at which time $1,600 of salaries will be paid.

b. The cost of supplies still available at December 31, 2005, is $2,700.

c. The notes payable requires an interest payment to be made every three months. The amount

of unrecorded accrued interest at December 31, 2005, is $1,250. The next interest payment,

at an amount of $1,500, is due on January 15, 2006.

d. Analysis of the unearned member fees account shows $5,600 remaining unearned at December

31, 2005.

e. In addition to the member fees included in the revenue account balance, the company has earned

another $9,100 in unrecorded fees that will be collected on January 31, 2006. The company

is also expected to collect $8,000 on that same day for new fees earned in January 2006.

f. Depreciation expense for the year is $12,500.

2. Prepare journal entries for the adjustments entered in the six-column table for part 1.

3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals.

4. Prepare journal entries to record the cash payments and cash collections described for January.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts