Question: Required: 1. Complete the two final columns shown beside each item in Golden Corporation's comparative financial statements. TIP: Calculate the increase (decrease) by subtracting the

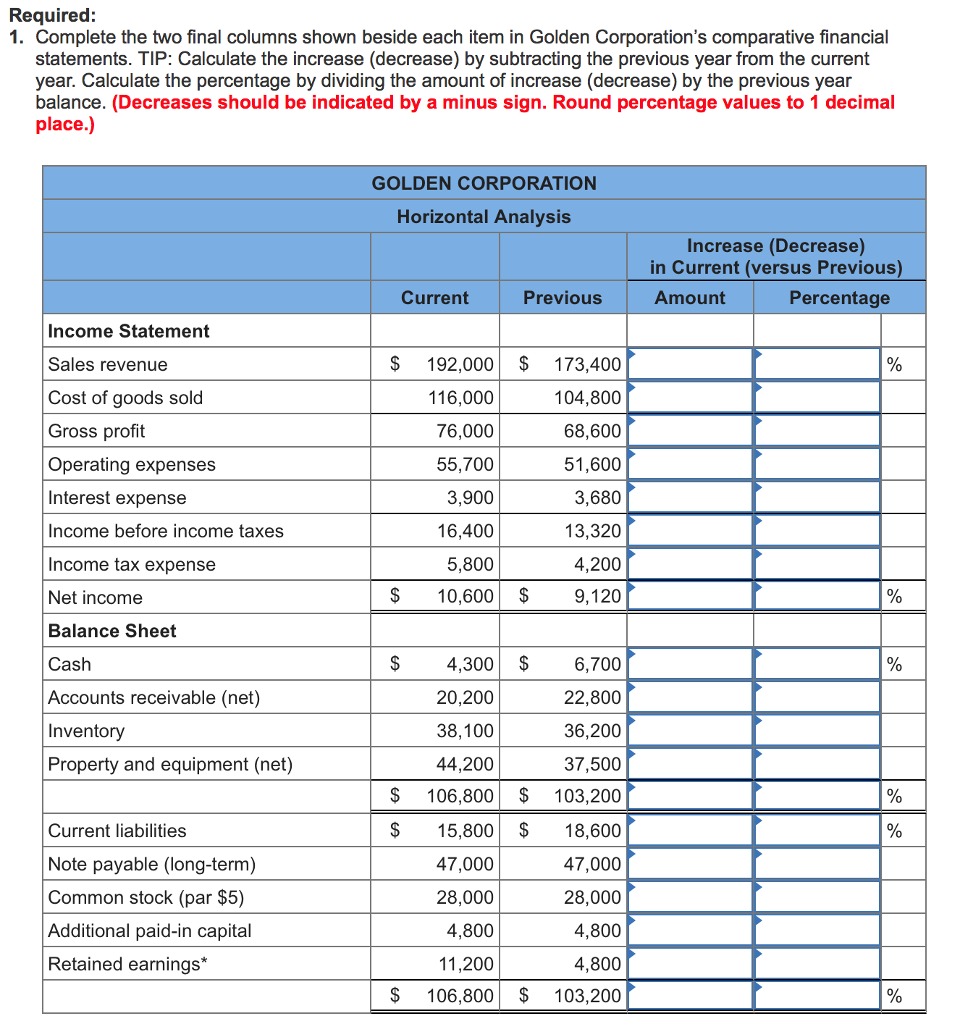

Required: 1. Complete the two final columns shown beside each item in Golden Corporation's comparative financial statements. TIP: Calculate the increase (decrease) by subtracting the previous year from the current year. Calculate the percentage by dividing the amount of increase (decrease) by the previous year balance. (Decreases should be indicated by a minus sign. Round percentage values to 1 decimal place.) GOLDEN CORPORATION Horizontal Analysis Increase (Decrease) in Current (versus Previous) Amount Percentage Current Income Statement Sales revenue Cost of goods sold Gross profit Operating expenses Interest expense $ 192,000 $ 173,400 116,000 104,800 76,000 68,600 55,700 51,600 3,900 3,680 16,400 13,320 5,800 4,200 10,600 $ 9,120|| Income before income taxes Income tax expense Net income Balance Sheet Cash Accounts receivable (net) Inventory Property and equipment (net) Current liabilities Note payable (long-term) Common stock (par $5) Additional paid-in capital 4,300 $ 6,700 20,200 22,800 38,100 36,200 44,200 37,500 $ 106,800 $ 103,200 15,800 $ 18,600 47,000 47,000 28,000 28,000 4,800 4,800 11,200 4,800 $ 106,800 $ 103,200 Retained earnings*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts