Question: Required: 1. Does Target use average cost, FIFO, or LIFO as its inventory cost flow assumption? 3. Calculate the gross profit ratio and the inventory

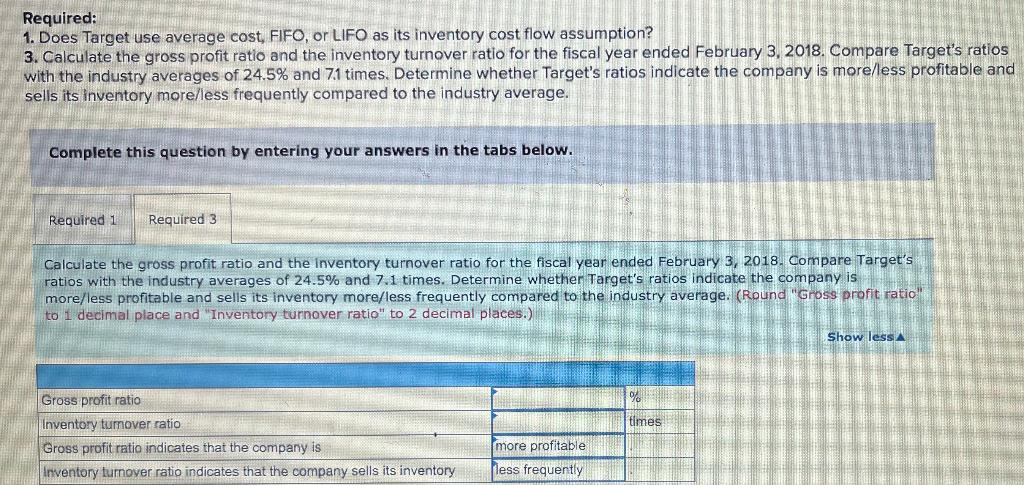

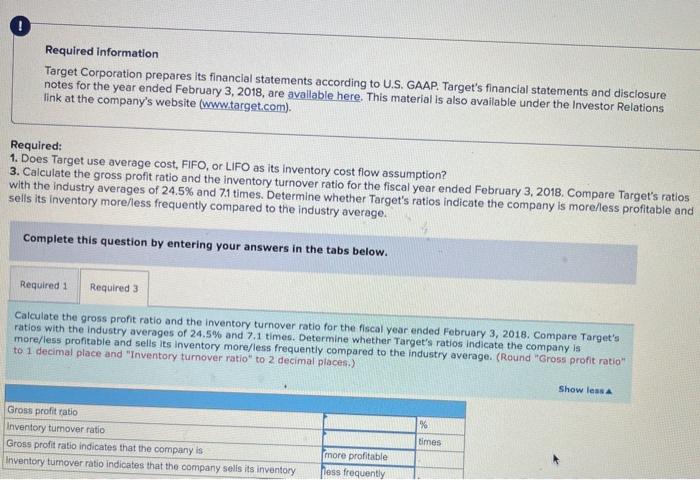

Required: 1. Does Target use average cost, FIFO, or LIFO as its inventory cost flow assumption? 3. Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 71 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. Complete this question by entering your answers in the tabs below. Required 1 Required 3 Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. (Round "Gross profit ratio" to 1 decimal place and Inventory turnover ratio" to 2 decimal places.) Show less times Gross profit ratio Inventory tumover ratio Gross profit ratio indicates that the company is Inventory turnover ratio indicates that the company sells its inventory more profitable less frequently ! Required information Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the company's website (www.target.com). Required: 1. Does Target use average cost, FIFO, or LIFO as its inventory cost flow assumption? 3. Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. Complete this question by entering your answers in the tabs below. Required 1 Required 3 Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. (Round "Gross profit ratio to 1 decimal place and "Inventory turnover ratio" to 2 decimal places) Show less Gross profit ratio Inventory tumover ratio Gross profit ratio indicates that the company is Inventory tumover ratio indicates that the company sells its inventory % times more profitable ness frequently Required: 1. Does Target use average cost, FIFO, or LIFO as its inventory cost flow assumption? 3. Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 71 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. Complete this question by entering your answers in the tabs below. Required 1 Required 3 Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. (Round "Gross profit ratio" to 1 decimal place and Inventory turnover ratio" to 2 decimal places.) Show less times Gross profit ratio Inventory tumover ratio Gross profit ratio indicates that the company is Inventory turnover ratio indicates that the company sells its inventory more profitable less frequently ! Required information Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the company's website (www.target.com). Required: 1. Does Target use average cost, FIFO, or LIFO as its inventory cost flow assumption? 3. Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. Complete this question by entering your answers in the tabs below. Required 1 Required 3 Calculate the gross profit ratio and the inventory turnover ratio for the fiscal year ended February 3, 2018. Compare Target's ratios with the industry averages of 24.5% and 7.1 times. Determine whether Target's ratios indicate the company is more/less profitable and sells its inventory more/less frequently compared to the industry average. (Round "Gross profit ratio to 1 decimal place and "Inventory turnover ratio" to 2 decimal places) Show less Gross profit ratio Inventory tumover ratio Gross profit ratio indicates that the company is Inventory tumover ratio indicates that the company sells its inventory % times more profitable ness frequently

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts