Question: Required: 1. Explain traditional absorption costing system' and 'activity-based costing system' and clarify how they differentiate from each other. Requirement C.1 = 10 marks 2.

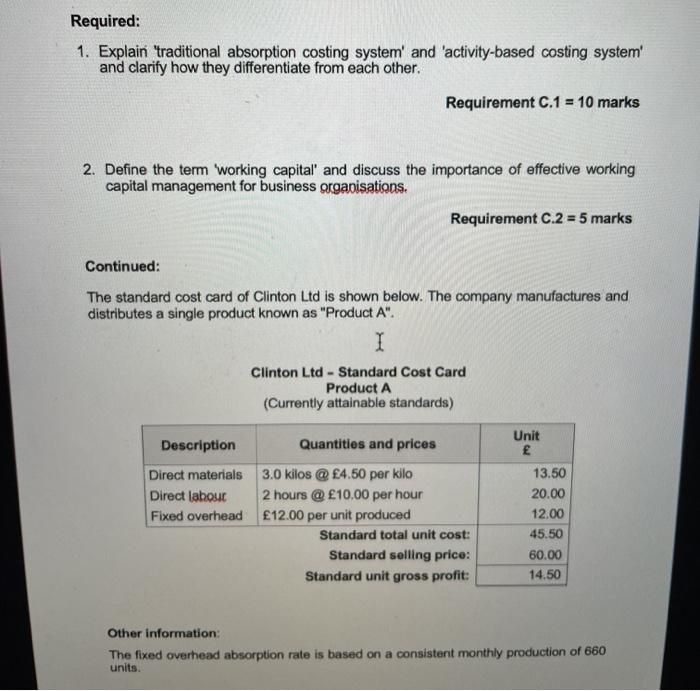

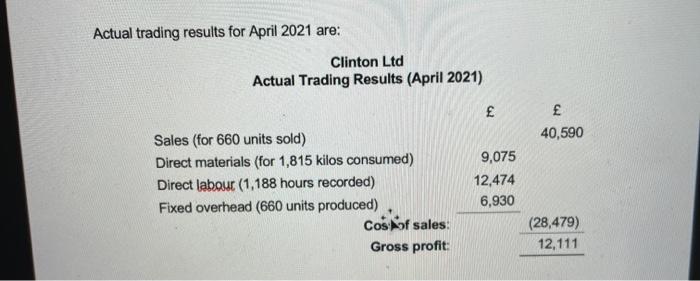

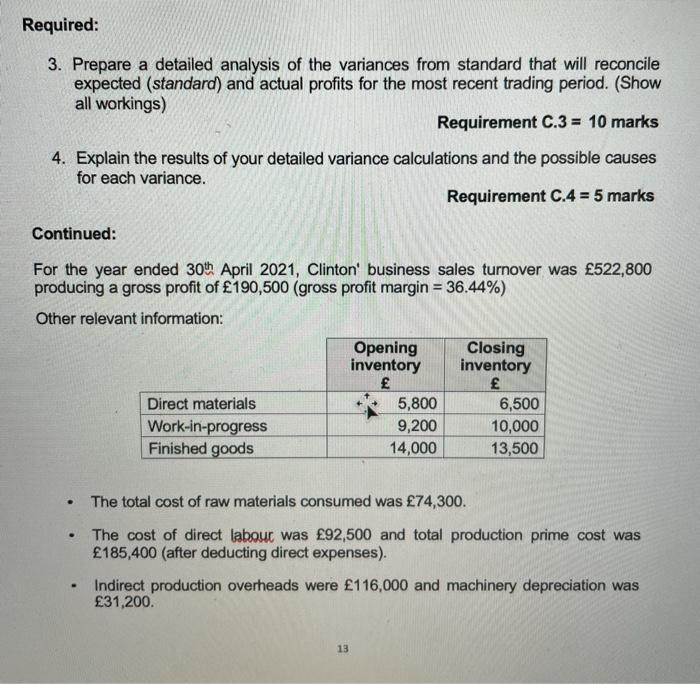

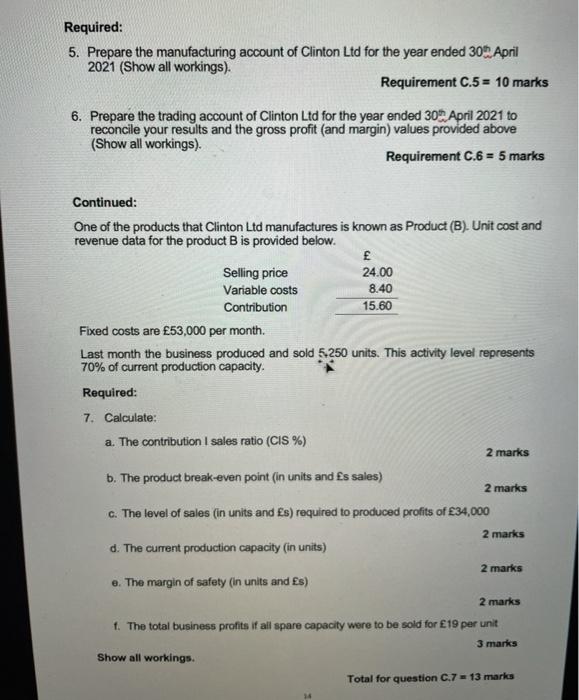

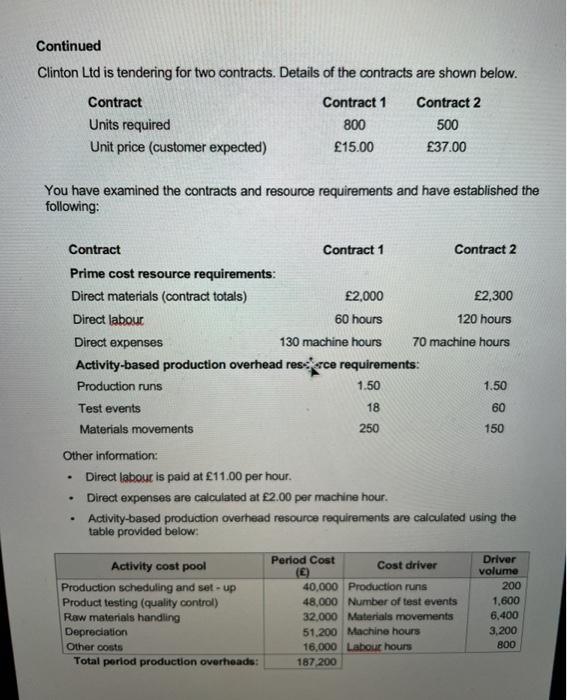

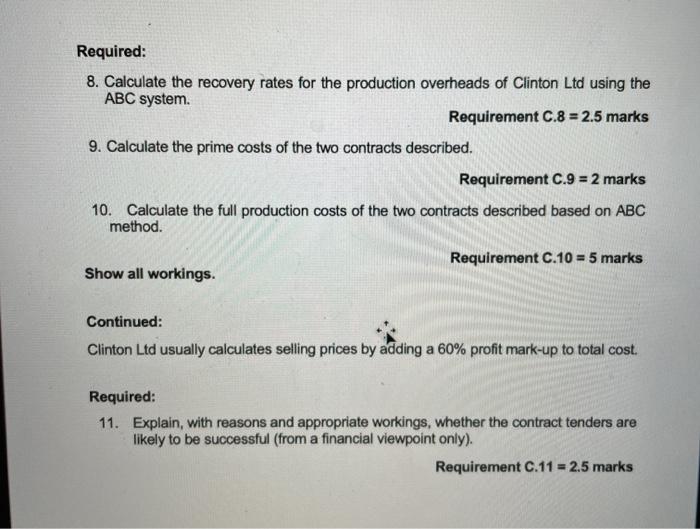

Required: 1. Explain traditional absorption costing system' and 'activity-based costing system' and clarify how they differentiate from each other. Requirement C.1 = 10 marks 2. Define the term 'working capital and discuss the importance of effective working capital management for business organisations. Requirement C.2 = 5 marks Continued: The standard cost card of Clinton Ltd is shown below. The company manufactures and distributes a single product known as "Product A". I Clinton Ltd - Standard Cost Card Product A (Currently attainable standards) Description Quantities and prices Direct materials 3.0 kilos @4.50 per kilo Direct labour 2 hours @10.00 per hour Fixed overhead 12.00 per unit produced Standard total unit cost: Standard selling price: Standard unit gross profit: Unit 13.50 20.00 12.00 45.50 60.00 14.50 Other information: The fixed overhead absorption rate is based on a consistent monthly production of 660 units. Actual trading results for April 2021 are: Clinton Ltd Actual Trading Results (April 2021) 40,590 Sales (for 660 units sold) Direct materials (for 1,815 kilos consumed) Direct labour (1,188 hours recorded) Fixed overhead (660 units produced) Cos of sales: Gross profit: 9,075 12,474 6,930 (28,479) 12,111 Required: 3. Prepare a detailed analysis of the variances from standard that will reconcile expected (standard) and actual profits for the most recent trading period. (Show all workings) Requirement C.3 = 10 marks 4. Explain the results of your detailed variance calculations and the possible causes for each variance. Requirement C.4 = 5 marks Continued: For the year ended 30th April 2021, Clinton' business sales turnover was 522,800 producing a gross profit of 190,500 (gross profit margin = 36.44%) Other relevant information: Opening Closing inventory inventory Direct materials 5,800 6,500 Work-in-progress 9,200 10,000 Finished goods 14,000 13,500 The total cost of raw materials consumed was 74,300. The cost of direct labour was 92,500 and total production prime cost was 185,400 (after deducting direct expenses). Indirect production overheads were 116,000 and machinery depreciation was 31,200. 13 Required: 5. Prepare the manufacturing account of Clinton Ltd for the year ended 30 April 2021 (Show all workings). Requirement C.5= 10 marks 6. Prepare the trading account of Clinton Ltd for the year ended 30 April 2021 to reconcile your results and the gross profit (and margin) values provided above (Show all workings) Requirement C.6 = 5 marks Continued: One of the products that Clinton Ltd manufactures is known as Product (B). Unit cost and revenue data for the product B is provided below. Selling price 24.00 Variable costs 8.40 Contribution 15.60 Fixed costs are 53,000 per month. Last month the business produced and sold 5250 units. This activity level represents 70% of current production capacity. Required: 7. Calculate: a. The contribution I sales ratio (CIS %) 2 marks b. The product break-even point (in units and s sales) 2 marks c. The level of sales (in units and Es) required to produced profits of 34,000 2 marks d. The current production capacity (in units) 2 marks . The margin of safety (in units and Es) 2 marks 1. The total business profits if all spare capacity were to be sold for 19 per unit 3 marks Show all workings. Total for question C.713 marks Continued Clinton Ltd is tendering for two contracts. Details of the contracts are shown below. Contract Contract 1 Contract 2 Units required 800 Unit price (customer expected) 15.00 37.00 500 You have examined the contracts and resource requirements and have established the following: Contract Contract 1 Contract 2 Prime cost resource requirements: Direct materials (contract totals) 2,000 2,300 Direct labour 60 hours 120 hours Direct expenses 130 machine hours 70 machine hours Activity-based production overhead resacce requirements: Production runs 1.50 1.50 Test events 18 60 Materials movements 250 150 Other information: Direct labour is paid at 11.00 per hour. Direct expenses are calculated at 2.00 per machine hour. Activity-based production overhead resource requirements are calculated using the table provided below: Activity cost pool Production scheduling and set-up Product testing (quality control) Raw materials handling Depreciation Other costs Total period production overheads: Period Cost Cost driver 40,000 Production runs 48,000 Number of test events 32.000 Materials movements 51.200 Machine hours 16.000 Labour hours 187 200 Driver volume 200 1,600 6,400 3,200 800 Required: 8. Calculate the recovery rates for the production overheads of Clinton Ltd using the ABC system Requirement C.8 = 2.5 marks 9. Calculate the prime costs of the two contracts described. Requirement C.9 = 2 marks 10. Calculate the full production costs of the two contracts described based on ABC method. Requirement C.10 = 5 marks Show all workings. Continued: Clinton Ltd usually calculates selling prices by adding a 60% profit mark-up to total cost. Required: 11. Explain, with reasons and appropriate workings, whether the contract tenders are likely to be successful (from a financial viewpoint only). Requirement C.11 = 2.5 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts