Question: Required: 1. Prepare an answer sheet with the column headings shown below. Enter esch cost item on your answer sheet, placing the dollar amount under

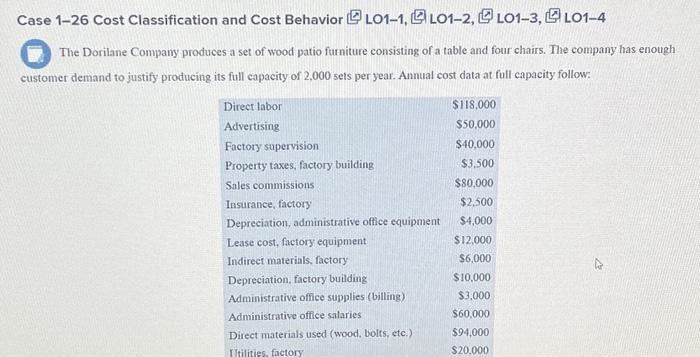

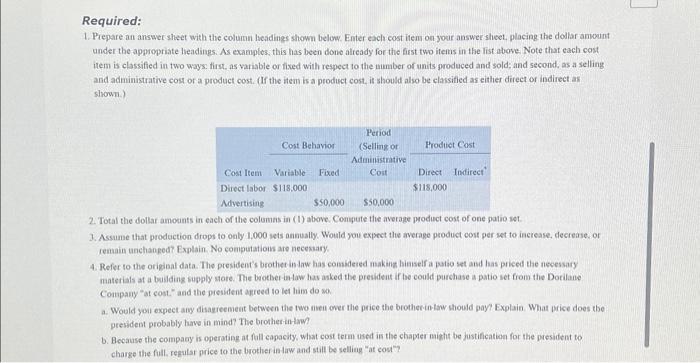

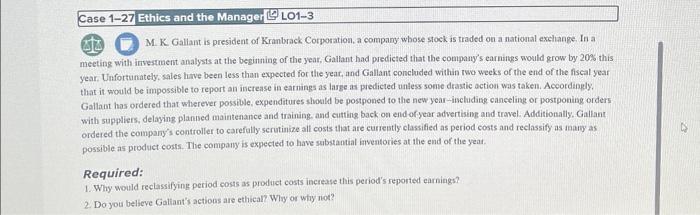

Required: 1. Prepare an answer sheet with the column headings shown below. Enter esch cost item on your answer sheet, placing the dollar amount under the appoptiate headings. As examples, this has been done already for the first two items in the list above. Note that each cost trem is classified in two ways: first, as variable or tixed with respect to the uumber of units produced and sold; and second, as a selling and administrative cost or a product cost. (If the item is a product cost. it should also be classitied as either direct or indirect as shown.) 2. Total the dollar amoants in each of the columas in (1) above. Compute the average product cost of one patio set. 3. Assume that production drops to only 1,000 iets annually. Would you expect tle average product cost per set to increase, decrease, or remain unchanged? Explain. No computations are necesaary. 4. Refer to the original data. The president's brothet in law has comidered making hiaself a patio set asd has priced the necessary inaterials at a busiding supply sare. The brotber in taw has asked the president if be could purchase a patio set from the Dotilane Company "at cost." and the president agreed to let him do so. a. Would you expect any disazieenent between the two neel over the price the brotherintow should pay? Explain. What price does the presidest probably have in mind? The brother in-law? b. Because the compacy is operating at fall capacity, what cost term used is the chapter might be justification for the president to charge the full. regular price to the brother in law and still be selling "at cos"? M. K. Gallant is president of Kranbrack Corporation, a company whose stock is traded on a national exchange. In a meeting with investment analysts at the beginning of the year, Gallant had predicted that the company's earnings would grow by 20% this year. Unfortunately, sales have been less than expected for the year, and Gallant concluded within rwo weeks of the end of the fiscal year that it would be impossible to report an increase in earnings as large as predicted unless some drastic action was taken. Accordingly. Gallant has ordered that wherever possible, expenditures shoald be postponed to the new year-including canceling or postponing orders with suppliers, delaying planned maintenance and training, and cutting back on end of year advertising and travel. Additionally. Gallant ordered the company's controller to carefally scrutinize all costs that are currestly classified as period costs and reclassify as inary as possible as product costs. The company is expected to have substantial imventories at the end of the year. Required: 1. Why would reclassifying period costs as product costs increase this period's reported earnings? 2. Do you believe Galiant's actions are ethical? Why or why not? Case 1-26 Cost Classification and Cost Behavior The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 2,000 sets per year. Annual cost data at full capacity follow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts