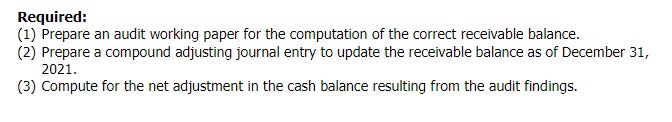

Question: Required: (1) Prepare an audit working paper for the computation of the correct receivable balance. (2) Prepare a compound adjusting journal entry to update the

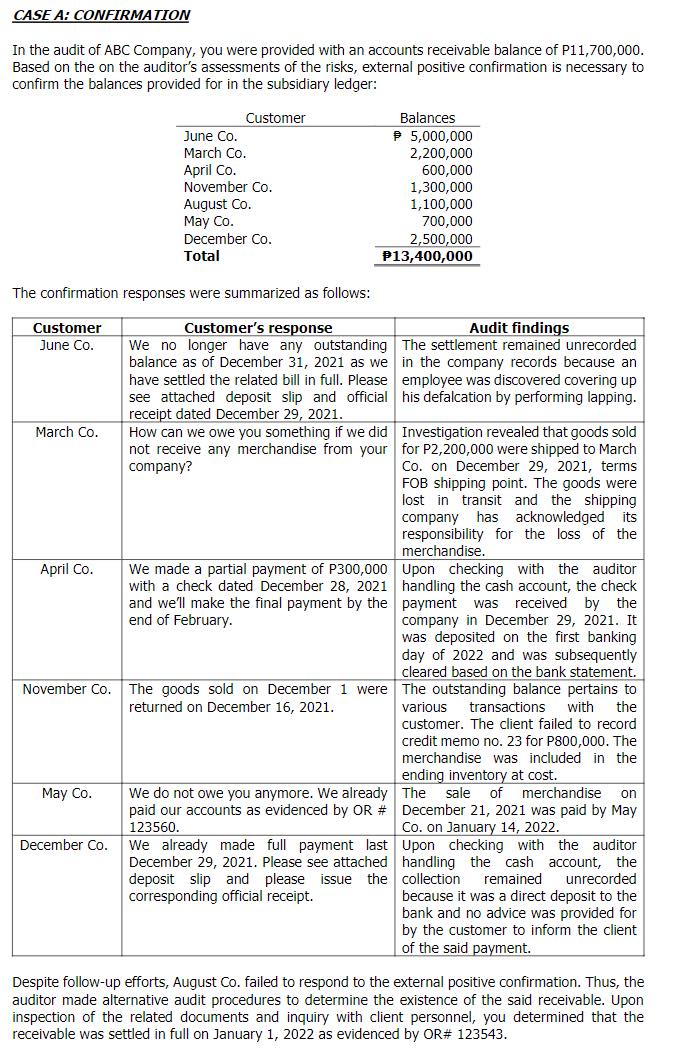

Required: (1) Prepare an audit working paper for the computation of the correct receivable balance. (2) Prepare a compound adjusting journal entry to update the receivable balance as of December 31, 2021. (3) Compute for the net adjustment in the cash balance resulting from the audit findings.CASE A: CONFIRMATION In the audit of ABC Company, you were provided with an accounts receivable balance of P11,700,000. Based on the on the auditor's assessments of the risks, external positive confirmation is necessary to confirm the balances provided for in the subsidiary ledger: Customer Balances June Co. P 5,000,000 March Co. 2,200,000 April Co. 600,000 November Co. 1,300,000 August Co. 1,100,000 May Co. 700,000 December Co. 2,500,000 Total P13,400,000 The confirmation responses were summarized as follows: Customer Customer's response Audit findings June Co. We no longer have any outstanding The settlement remained unrecorded balance as of December 31, 2021 as we in the company records because an have settled the related bill in full. Please employee was discovered covering up see attached deposit slip and official his defalcation by performing lapping. receipt dated December 29, 2021. March Co. How can we owe you something if we did |Investigation revealed that goods sold not receive any merchandise from your for P2,200,000 were shipped to March company? Co. on December 29, 2021, terms FOB shipping point. The goods were lost in transit and the shipping company has acknowledged its responsibility for the loss of the merchandise. April Co. We made a partial payment of P300,000 Upon checking with the auditor with a check dated December 28, 2021 handling the cash account, the check and we'll make the final payment by the payment was received by the end of February. company in December 29, 2021. It was deposited on the first banking day of 2022 and was subsequently cleared based on the bank statement. November Co. The goods sold on December 1 were The outstanding balance pertains to returned on December 16, 2021. various transactions with the customer. The client failed to record credit memo no. 23 for P800,000. The merchandise was included in the ending inventory at cost. May Co. We do not owe you anymore. We already The sale of merchandise on paid our accounts as evidenced by OR # December 21, 2021 was paid by May 123560. Co. on January 14, 2022. December Co. We already made full payment last Upon checking with the auditor December 29, 2021. Please see attached handling the cash account, the deposit slip and please issue the collection remained unrecorded corresponding official receipt. because it was a direct deposit to the bank and no advice was provided for by the customer to inform the client of the said payment. Despite follow-up efforts, August Co. failed to respond to the external positive confirmation. Thus, the auditor made alternative audit procedures to determine the existence of the said receivable. Upon inspection of the related documents and inquiry with client personnel, you determined that the receivable was settled in full on January 1, 2022 as evidenced by OR# 123543

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts